Leaguer Venture Capital

-

DATABASE (831)

-

ARTICLES (427)

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Founded in Shenzhen in 2011, Leaguer Finance is a fund management company with branches in Hong Kong and Jilin. It invests mainly in the intelligent device manufacturing, tourism, new energy and robotics fields.

Founded in Shenzhen in 2011, Leaguer Finance is a fund management company with branches in Hong Kong and Jilin. It invests mainly in the intelligent device manufacturing, tourism, new energy and robotics fields.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Founder and CEO of Zhinanmao

Former partner, Mount Venture Capital; vice president, Power Capital. The economics graduate from Jiangsu University is an avid backpacker and certified tour guide. A serial entrepreneur too (with previous startups in bicycle rental, education and training, e-commerce, F&B).

Former partner, Mount Venture Capital; vice president, Power Capital. The economics graduate from Jiangsu University is an avid backpacker and certified tour guide. A serial entrepreneur too (with previous startups in bicycle rental, education and training, e-commerce, F&B).

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Co-founder and Co-CEO of Dianrong

Former private equity partner and intellectual property lawyer with over a decade of experience, whose clients included Google, Microsoft, and venture capital funds. A councilor of the Shanghai branch of the All-China Youth Federation, Guo holds an EMBA from PBC School of Finance, Tsinghua University.

Former private equity partner and intellectual property lawyer with over a decade of experience, whose clients included Google, Microsoft, and venture capital funds. A councilor of the Shanghai branch of the All-China Youth Federation, Guo holds an EMBA from PBC School of Finance, Tsinghua University.

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Zhangjiang Torch Venture Capital

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Established in 1985, venture capital firm DFJ has invested in more than 300 companies throughout the world. Its core funds have raised US$4 billion to date.

Established in 1985, venture capital firm DFJ has invested in more than 300 companies throughout the world. Its core funds have raised US$4 billion to date.

Founder of GirlUp

New media and branding pro Wu Jing is a graduate of Beijing University of Aeronautics and Astronautics (now named BeiHang University), and a former staff of ELLE magazine and leading advertising agency BBDO. The founder of GirlUp is also a co-founder of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects.

New media and branding pro Wu Jing is a graduate of Beijing University of Aeronautics and Astronautics (now named BeiHang University), and a former staff of ELLE magazine and leading advertising agency BBDO. The founder of GirlUp is also a co-founder of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

This AI startup helps Tencent, Xiaomi chatbots “think” and “talk” like humans

Trio.AI makes communicating with machines easier and more effective – even fun

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Exovite: Revolutionary treatment for broken bones and assisted surgery

Medtech startup Exovite combines 3D printing technology and remote treatment to improve rehabilitation of broken bones, and employs mixed reality to assist surgery

Feedect provides nutritional insect protein to feed the future

Feedect farms insects to produce high-quality protein alternatives for animal and human food

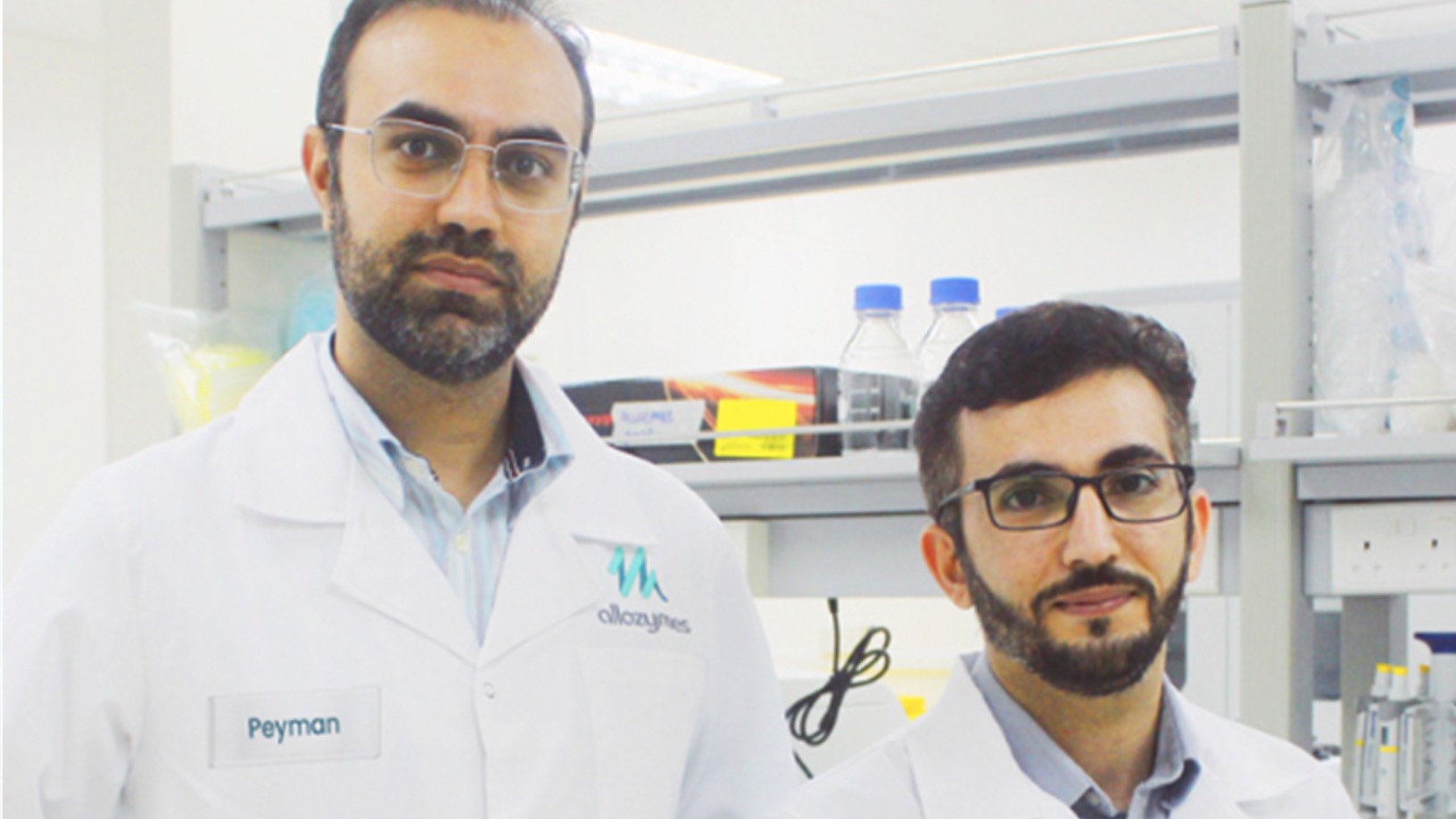

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Sorry, we couldn’t find any matches for“Leaguer Venture Capital”.