Li Bin

-

DATABASE (83)

-

ARTICLES (59)

Founder and CEO of Worktile

From 1999 to 2006, Wang attended Shaanxi University of Science & Technology, where he earned his bachelor’s and master’s degrees in Mechatronic Engineering. He worked as a senior software engineer for Great Wall Computer Software & Systems Inc., from September 2006 to May 2008 and as a senior systems architect at Ethos Technologies from May 2008 to July 2011. Wang has won the Microsoft Most Valuable Professional award three times. In 2012, he founded Worktile with Li Huijun.

From 1999 to 2006, Wang attended Shaanxi University of Science & Technology, where he earned his bachelor’s and master’s degrees in Mechatronic Engineering. He worked as a senior software engineer for Great Wall Computer Software & Systems Inc., from September 2006 to May 2008 and as a senior systems architect at Ethos Technologies from May 2008 to July 2011. Wang has won the Microsoft Most Valuable Professional award three times. In 2012, he founded Worktile with Li Huijun.

Co-founder of Ximalaya

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Founder and CEO of CarBlock

Founder and CEO of CarBlock. A successful serial entrepreneur. Lee received his bachelor’s degree in Electronics and Communications Engineering from the East China University of Science and Technology and his MBA from Columbia Business School. Lee is the founder and CEO of nonda, a leading connected car company in the United States. He also helped co-found Baixing.com, China’s second-largest online classifieds platform, and formerly served as the Head of New Business Development at eBay and Microsoft.

Founder and CEO of CarBlock. A successful serial entrepreneur. Lee received his bachelor’s degree in Electronics and Communications Engineering from the East China University of Science and Technology and his MBA from Columbia Business School. Lee is the founder and CEO of nonda, a leading connected car company in the United States. He also helped co-found Baixing.com, China’s second-largest online classifieds platform, and formerly served as the Head of New Business Development at eBay and Microsoft.

CEO and and co-founder of Bluepha

Zhang Haoqian completed a doctorate degree in systems and synthetic biology at Peking University in 2016. He has published more than 20 papers in international academic journals. In 2019, he was honored as one of China's 100 Most Creative People in Business. He is also a member of the Synthetic Biology Committee under China Society of Biotechnology.Peking University has participated in the International Genetically Engineered Machine (iGEM) competitions, with Zhang as a team member or leader between 2008 and 2010. The team has won gold medals twice at the iGEM competitions supported by MIT. He was also coaching the university’s iGEM team from 2011 until 2017. Zhang also founded the committee of China iGEMer Community.In 2010, Zhang met fellow iGEMer and Bluepha co-founder Li Teng at the iGEM giant jamboree event. They co-founded SynBio startup Bluepha in 2016, a spin-off from Tsinghua University.

Zhang Haoqian completed a doctorate degree in systems and synthetic biology at Peking University in 2016. He has published more than 20 papers in international academic journals. In 2019, he was honored as one of China's 100 Most Creative People in Business. He is also a member of the Synthetic Biology Committee under China Society of Biotechnology.Peking University has participated in the International Genetically Engineered Machine (iGEM) competitions, with Zhang as a team member or leader between 2008 and 2010. The team has won gold medals twice at the iGEM competitions supported by MIT. He was also coaching the university’s iGEM team from 2011 until 2017. Zhang also founded the committee of China iGEMer Community.In 2010, Zhang met fellow iGEMer and Bluepha co-founder Li Teng at the iGEM giant jamboree event. They co-founded SynBio startup Bluepha in 2016, a spin-off from Tsinghua University.

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Mobike founder Hu Weiwei: A crazy idea that touched millions of lives

In just three years, Hu Weiwei has changed the way over 150 million people travel in the city with her company’s dockless bikes

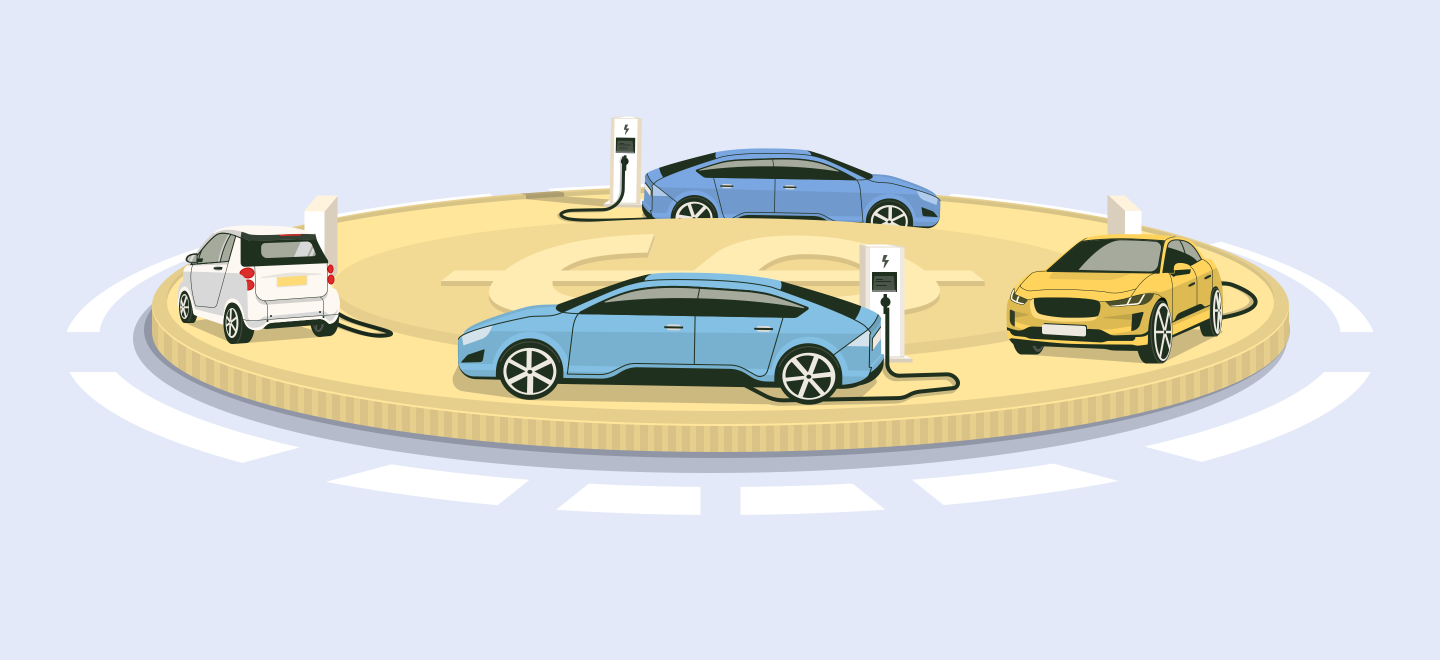

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Smart Bees wants to capitalize on China's two-children policy

High property prices fuel demand for Smart Bees' bespoke smart tech-equipped furniture that maximizes living spaces for families and young homeowners

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

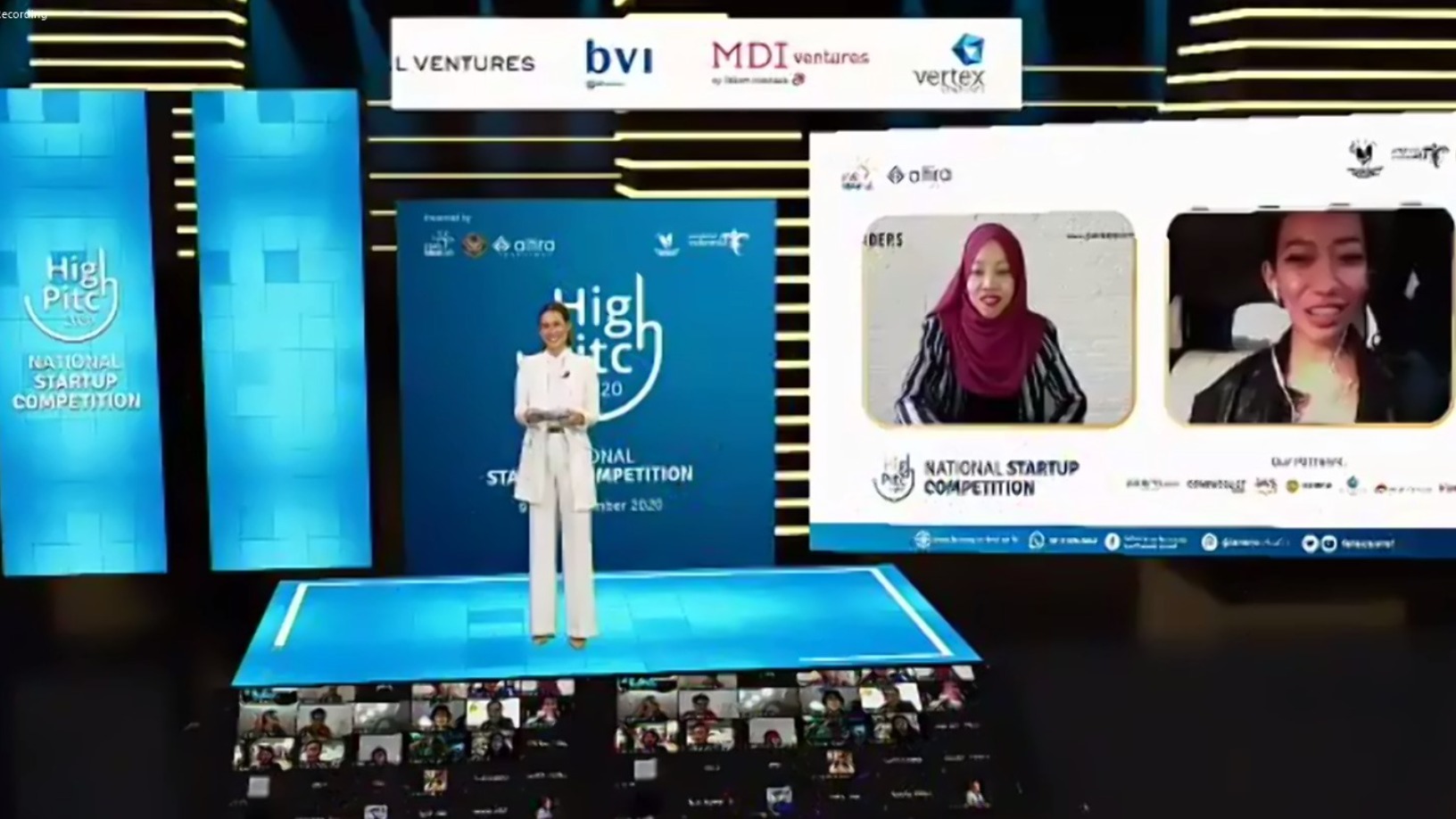

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

Squirrel AI: Edtech's AI-based personalized tutoring eases load for students and teachers

Used by more than 3m students, unicorn Squirrel AI tracks learning outcomes in real time and adapts teaching, proving more effective than traditional methods

Codemao, China's pioneer in online coding lessons for kids, targets IPO

Codemao has taught over 30m children in China how to code with its proprietary online tools, including cartoons, mobile apps and curriculum, even its own coding language

Shiyin Tech's self-service 3D food printers let you create your own desserts

Anyone with a smartphone can use one of 200 Shiyin Tech 3D printers to produce a chocolate dessert in under five minutes

Sorry, we couldn’t find any matches for“Li Bin”.