Lightspeed China Partners

-

DATABASE (847)

-

ARTICLES (523)

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Co-founder of Babytree

One of the first in China to go to Harvard on a full scholarship since 1949, Bo Shao, who also holds an MBA from the university, worked at Boston Consulting Group before starting EachNet in China in 1999. EachNet was acquired by eBay in 2003 for US$225 million. Today he is a founding partner of Matrix Partners China.

One of the first in China to go to Harvard on a full scholarship since 1949, Bo Shao, who also holds an MBA from the university, worked at Boston Consulting Group before starting EachNet in China in 1999. EachNet was acquired by eBay in 2003 for US$225 million. Today he is a founding partner of Matrix Partners China.

Gobi Partners is a venture capital firm with seven offices across China, Hong Kong, Singapore and Kuala Lumpur. Since it was founded in 2002, the firm has raised seven funds and has invested in over 100 portfolio companies across China, Hong Kong and Southeast Asia.

Gobi Partners is a venture capital firm with seven offices across China, Hong Kong, Singapore and Kuala Lumpur. Since it was founded in 2002, the firm has raised seven funds and has invested in over 100 portfolio companies across China, Hong Kong and Southeast Asia.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Zhang Yiming: The man who said no to Baidu, Alibaba and Tencent

Rejecting offers from BAT to grow ByteDance, Zhang Yiming has quickly built up a social media content empire that includes TikTok and Toutiao, challenging the incumbents

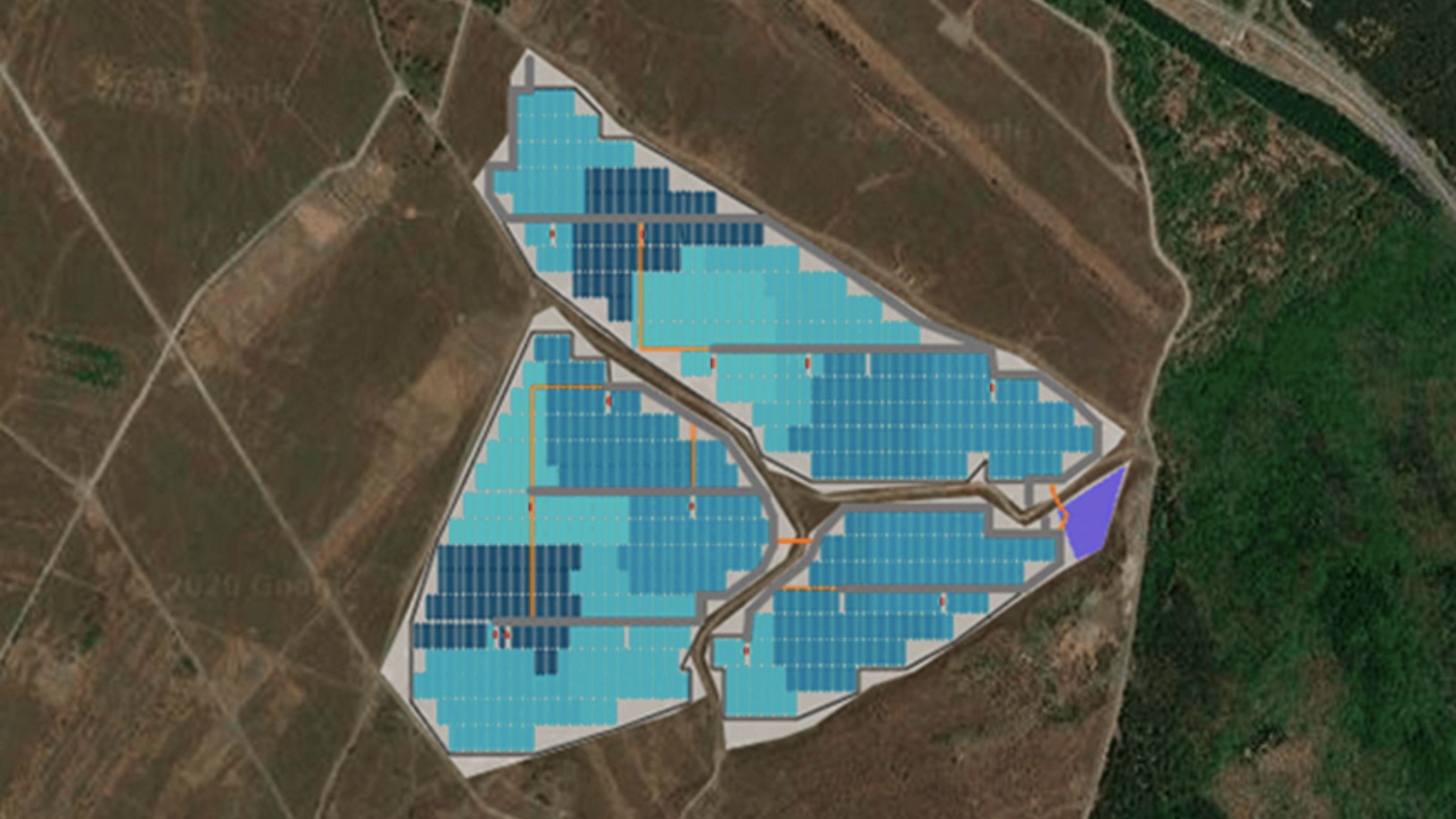

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Lota Digital: Disrupting fishing in Portugal for a sustainable future

The “digital fish market” app helps fishermen compete in a market dominated by large players

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

E-wallet unicorn OVO’s future in question amid Lippo's divestment, talk of DANA merger

As even the conglomerate giant feels the pain of OVO's aggressive cash-burning, should digital payments players rethink their strategy to gain market share, beyond the usual discounts and subsidies?

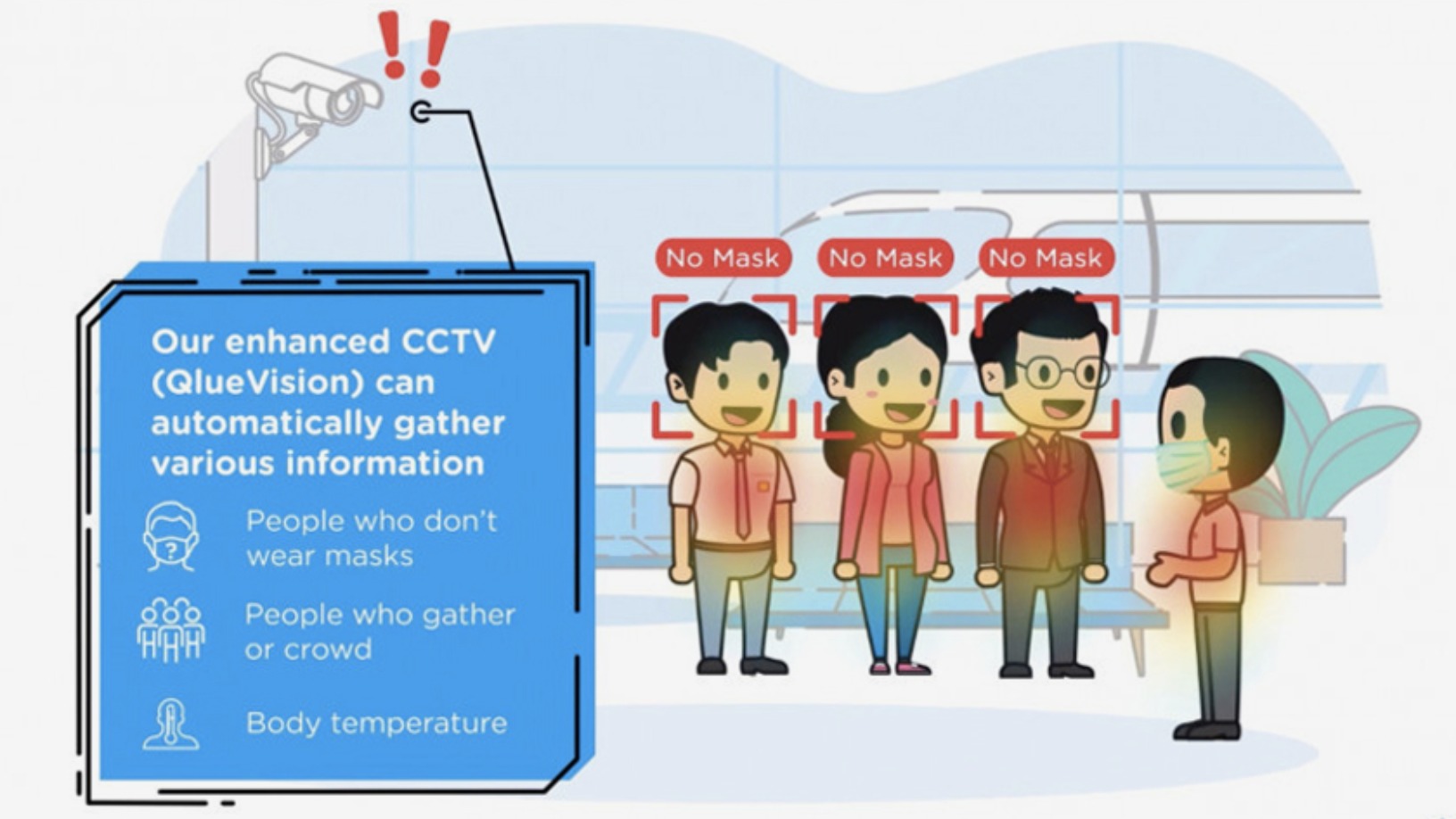

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Rainier: Decade-long dedication to VR research bears fruit in edtech market

Beijing-based Rainier is using VR technology to improve safety in lab experiments at universities and high schools, even primary schools

Sorry, we couldn’t find any matches for“Lightspeed China Partners”.