MUFG Innovation Partners

-

DATABASE (365)

-

ARTICLES (473)

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Zhongjia Yitai Private Equity Partners

Zhongjia Yitai Private Equity Partners was founded in 2016 and funded by Mingtai Capital.

Zhongjia Yitai Private Equity Partners was founded in 2016 and funded by Mingtai Capital.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Acton Capital Partners is a Munich-based VC that focuses on late-stage investments. The firm invests primarily in the sectors of fintech, marketing and e-commerce and has invested over €350m across the three industries. It has backed prominent companies such as Toronto-based Chef’s Plate and online homemade crafts marketplace Etsy.

Acton Capital Partners is a Munich-based VC that focuses on late-stage investments. The firm invests primarily in the sectors of fintech, marketing and e-commerce and has invested over €350m across the three industries. It has backed prominent companies such as Toronto-based Chef’s Plate and online homemade crafts marketplace Etsy.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Axon Partners Group is an international investment, corporate development, alternative asset management and consulting firm. It was formed in 2012 as the result of bringing together two companies founded by Francisco Velázquez six years earlier: Axon Capital, a Spanish venture capital firm and SVP Advisors, a boutique consulting outfit that specialized in media and telecommunications. Axon Partners Group manages five funds across Southern Europe, Latin America and India and is in the midst of launching a multi-sectoral pan-European fund.

Axon Partners Group is an international investment, corporate development, alternative asset management and consulting firm. It was formed in 2012 as the result of bringing together two companies founded by Francisco Velázquez six years earlier: Axon Capital, a Spanish venture capital firm and SVP Advisors, a boutique consulting outfit that specialized in media and telecommunications. Axon Partners Group manages five funds across Southern Europe, Latin America and India and is in the midst of launching a multi-sectoral pan-European fund.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

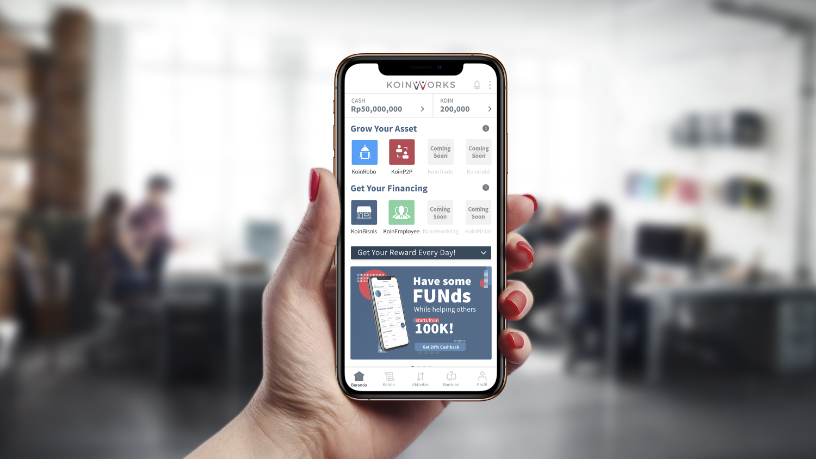

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Sorry, we couldn’t find any matches for“MUFG Innovation Partners”.