Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Founder and CEO of UrbanIndo

Silicon Valley highflier Arip Tirta left a top job in 2011 to develop a big data and analytics property platform in Indonesia. He was based in Palo Alto, California for more than seven years and was a director of Investment Analysis and Strategy at a leading venture debt provider Hercules Technology Growth Capital.Armed with a bachelor’s in Mathematics of Computation from UCLA in 2002 and a master’s in Scientific Computing and Computational Mathematics from Stanford University in 2004, Arip found it frustrating to find a property in Indonesia, so he started UrbanIndo.

Silicon Valley highflier Arip Tirta left a top job in 2011 to develop a big data and analytics property platform in Indonesia. He was based in Palo Alto, California for more than seven years and was a director of Investment Analysis and Strategy at a leading venture debt provider Hercules Technology Growth Capital.Armed with a bachelor’s in Mathematics of Computation from UCLA in 2002 and a master’s in Scientific Computing and Computational Mathematics from Stanford University in 2004, Arip found it frustrating to find a property in Indonesia, so he started UrbanIndo.

Co-founder and Group CFO of Orami, Co-founder and Managing Director of Xurya

Gusmantara Ekamukti Himawan, known as Eka, holds a degree in Electrical Engineering from Purdue University, USA. However, he chose a career in finance instead, beginning as a research associate at Independence Capital Asset Partners. After becoming an analyst there, he moved on to become an investment banker at Barclays for two years. He left Barclays in 2012 to co-found Bilna with fellow Purdue alumni Ferry Tenka and Jason Lamuda. He was the CFO of Bilna that merged with Moxy to become Orami. Eka is now the CFO and executive vice chairman of Orami.

Gusmantara Ekamukti Himawan, known as Eka, holds a degree in Electrical Engineering from Purdue University, USA. However, he chose a career in finance instead, beginning as a research associate at Independence Capital Asset Partners. After becoming an analyst there, he moved on to become an investment banker at Barclays for two years. He left Barclays in 2012 to co-found Bilna with fellow Purdue alumni Ferry Tenka and Jason Lamuda. He was the CFO of Bilna that merged with Moxy to become Orami. Eka is now the CFO and executive vice chairman of Orami.

Founder and CEO of Fresh Market (Shihang Shengxian)

With the innovative C2B2F (Customer to Business to Farm) business model he came up with, Fresh Market survived the winter for venture capital funding in China in 2016, and is today the leading fresh food e-commerce platform in East China.Zhang Hongliang (b. 1975) embarked on his journey as a serial entrepreneur after five years in the financial management sector and six years in the automobile industry. The persistent Suzhou native founded Fresh Market (Shihang Shengxian) in 2011 at aged 36, after several tries in three years.

With the innovative C2B2F (Customer to Business to Farm) business model he came up with, Fresh Market survived the winter for venture capital funding in China in 2016, and is today the leading fresh food e-commerce platform in East China.Zhang Hongliang (b. 1975) embarked on his journey as a serial entrepreneur after five years in the financial management sector and six years in the automobile industry. The persistent Suzhou native founded Fresh Market (Shihang Shengxian) in 2011 at aged 36, after several tries in three years.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

Ex-CFO and Co-founder of Bioo / Arkyne Technologies

Alexandre Díaz Codina is a Business Administration graduate from Universitat Pompeu Fabra (UPF). He joined Arkyne Technologies as co-founder and CFO in November 2015. He left Arkyne and the Bioo project in May 2017.While working on the Bioo project, Díaz and fellow co-founders were named as promising young entrepreneurs in Forbes 30u30 Europe. He also co-founded youth forum Impact.Barcelona in February 2016 with UPF alumni to give youths a “voice” in society. In January 2018 he joined AZ Capital as an investment banking intern.

Alexandre Díaz Codina is a Business Administration graduate from Universitat Pompeu Fabra (UPF). He joined Arkyne Technologies as co-founder and CFO in November 2015. He left Arkyne and the Bioo project in May 2017.While working on the Bioo project, Díaz and fellow co-founders were named as promising young entrepreneurs in Forbes 30u30 Europe. He also co-founded youth forum Impact.Barcelona in February 2016 with UPF alumni to give youths a “voice” in society. In January 2018 he joined AZ Capital as an investment banking intern.

CEO and Founder of Smile Formula

Sam Xu (Xu Yinglin) holds a bachelor's in Petroleum Engineering from Texas A&M University. After graduation, he joined British Petroleum in 2010 as a petroleum engineer and worked for three years in Houston before moving to energy investment from 2013 to 2017, working for KLR Group and CohnReznick Capital. He made it to the Forbes 30 Under 30 list in 2017 for his work in the energy field. In 2017, Xu enrolled in the Harvard Business School and obtained his MBA in 2019. In July 2019, he founded Smile Formula and has since served as its CEO.

Sam Xu (Xu Yinglin) holds a bachelor's in Petroleum Engineering from Texas A&M University. After graduation, he joined British Petroleum in 2010 as a petroleum engineer and worked for three years in Houston before moving to energy investment from 2013 to 2017, working for KLR Group and CohnReznick Capital. He made it to the Forbes 30 Under 30 list in 2017 for his work in the energy field. In 2017, Xu enrolled in the Harvard Business School and obtained his MBA in 2019. In July 2019, he founded Smile Formula and has since served as its CEO.

Co-founder, CEO of Meatable

Krijn De Nood is the Dutch co-founder and CEO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology with the use of pluripotent stem cells, where he has worked since 2018. He previously worked at McKinsey for six-and-a-half years in Amsterdam, New York and in Kenya. Prior to that, he worked as an equity derivatives trader at derivative trading company All Options after a short stint at Barclays Capital.De Nood holds two first degrees from the University of Amsterdam, in philosophy and in economics and finance.

Krijn De Nood is the Dutch co-founder and CEO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology with the use of pluripotent stem cells, where he has worked since 2018. He previously worked at McKinsey for six-and-a-half years in Amsterdam, New York and in Kenya. Prior to that, he worked as an equity derivatives trader at derivative trading company All Options after a short stint at Barclays Capital.De Nood holds two first degrees from the University of Amsterdam, in philosophy and in economics and finance.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Suzhou Wujiang Orient State-Owned Capital Investment Management

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Established in 2013, ZP Capital is a venture capital fund. It invests mainly in companies in the internet and consumer technology sectors.

Established in 2013, ZP Capital is a venture capital fund. It invests mainly in companies in the internet and consumer technology sectors.

CICC Capital was established in March 2017 as a wholly-owned subsidiary of CICC (China International Capital Corporation). It was registered as a private equity fund manager with the Asset Management Association of China in December 2017. By the end of 2017, CICC Capital had assets under management of RMB 200 billion.

CICC Capital was established in March 2017 as a wholly-owned subsidiary of CICC (China International Capital Corporation). It was registered as a private equity fund manager with the Asset Management Association of China in December 2017. By the end of 2017, CICC Capital had assets under management of RMB 200 billion.

GenBridge Capital is a private equity fund started by former executives from e-retailer JD.com and TPG Capital in 2016. It raised $500m from JD.com, international corporations, sovereign wealth funds and family funds. GenBridge Capital mainly invests in the consumer goods sector, including new-generation brands and offline stores.

GenBridge Capital is a private equity fund started by former executives from e-retailer JD.com and TPG Capital in 2016. It raised $500m from JD.com, international corporations, sovereign wealth funds and family funds. GenBridge Capital mainly invests in the consumer goods sector, including new-generation brands and offline stores.

Macquarie Capital is part of the Macquarie Group, comprising its corporate advisory, equity, debt and private capital markets businesses, and undertakes principal investing.

Macquarie Capital is part of the Macquarie Group, comprising its corporate advisory, equity, debt and private capital markets businesses, and undertakes principal investing.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

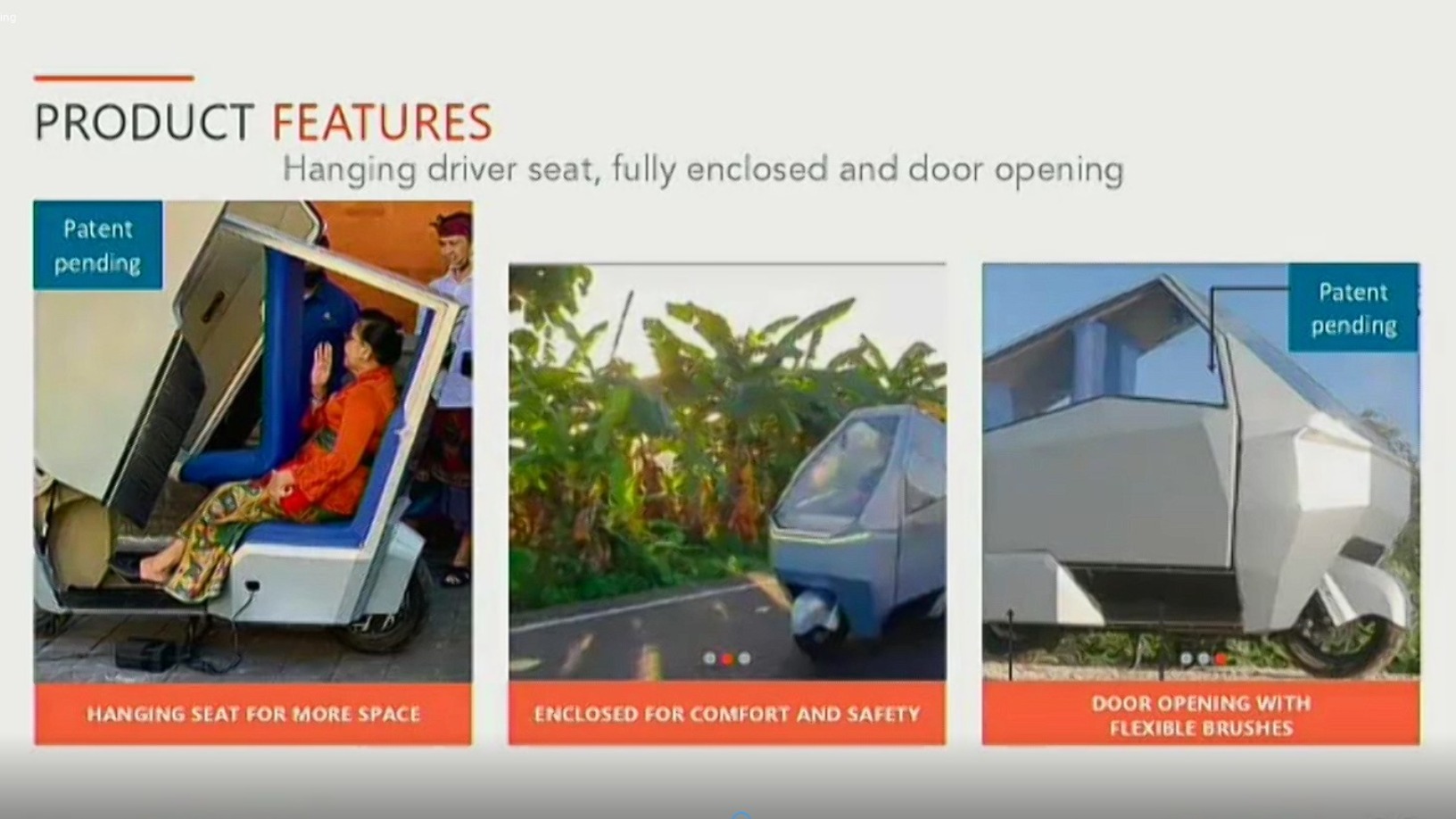

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.