Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Forebright Capital originates from the PE investment team established in 2001 under the state-owned China Everbright which is listed in Hong Kong. Everbright was spun off in May 2014 as an independent company. With money raised from institutional investors and family offices at home and abroad, Forebright Capital currently manages four US-dollar funds. It mainly invests in sectors of clean energy, healthcare and fintech.

Forebright Capital originates from the PE investment team established in 2001 under the state-owned China Everbright which is listed in Hong Kong. Everbright was spun off in May 2014 as an independent company. With money raised from institutional investors and family offices at home and abroad, Forebright Capital currently manages four US-dollar funds. It mainly invests in sectors of clean energy, healthcare and fintech.

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

Abac Nest was founded in Barcelona in 2017 by the team behind Abac Capital, and supported by a network of industry experts and investors. Abac Nest mainly invests in early-stage investments.

Abac Nest was founded in Barcelona in 2017 by the team behind Abac Capital, and supported by a network of industry experts and investors. Abac Nest mainly invests in early-stage investments.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Danhe Capital is the investment fund established by Chen Yidan, a Chinese internet entrepreneur and philanthropist. He is a co-founder of Tencent.

Danhe Capital is the investment fund established by Chen Yidan, a Chinese internet entrepreneur and philanthropist. He is a co-founder of Tencent.

Chenshan Asset Management was founded in 2016 by Jiang Jian, Edward Tian (Tian Suning) and Chen Haofei. Jiang is also the partner of China Broadband Capital and has led its investments in Dianping, Tujia, Babytree, etc. Tian is the board chairman of China Broadband Capital, founder of Nasdaq-listed AsiaInfo and former CEO of China Netcom Corporation. Chen is the managing director of China International Capital Corp (CICC).

Chenshan Asset Management was founded in 2016 by Jiang Jian, Edward Tian (Tian Suning) and Chen Haofei. Jiang is also the partner of China Broadband Capital and has led its investments in Dianping, Tujia, Babytree, etc. Tian is the board chairman of China Broadband Capital, founder of Nasdaq-listed AsiaInfo and former CEO of China Netcom Corporation. Chen is the managing director of China International Capital Corp (CICC).

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Zhengxuan Capital was established in June 2003. Xia Zuoquan, the company's majority shareholder and chairman of the board, is also one of the founders of BYD, an EV maker. Zhengxuan Capital has invested in over 40 companies, primarily in the AI, robotics, semiconductor and aerospace industries. Five of Zhengxuan Capital’s companies have been listed publicly, and its average ROI is greater than 10. It has AUM of more than RMB 10 billion.

Zhengxuan Capital was established in June 2003. Xia Zuoquan, the company's majority shareholder and chairman of the board, is also one of the founders of BYD, an EV maker. Zhengxuan Capital has invested in over 40 companies, primarily in the AI, robotics, semiconductor and aerospace industries. Five of Zhengxuan Capital’s companies have been listed publicly, and its average ROI is greater than 10. It has AUM of more than RMB 10 billion.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2014 by China’s No.1 high-end human resource and online social platform for entrepreneurs, Zhisland Capital is an investment platform.

Founded in 2014 by China’s No.1 high-end human resource and online social platform for entrepreneurs, Zhisland Capital is an investment platform.

HuaGai Capital was founded in 2012. Its asset volume is in the tens of billions of RMB. It now manages multiple private equity funds.

HuaGai Capital was founded in 2012. Its asset volume is in the tens of billions of RMB. It now manages multiple private equity funds.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

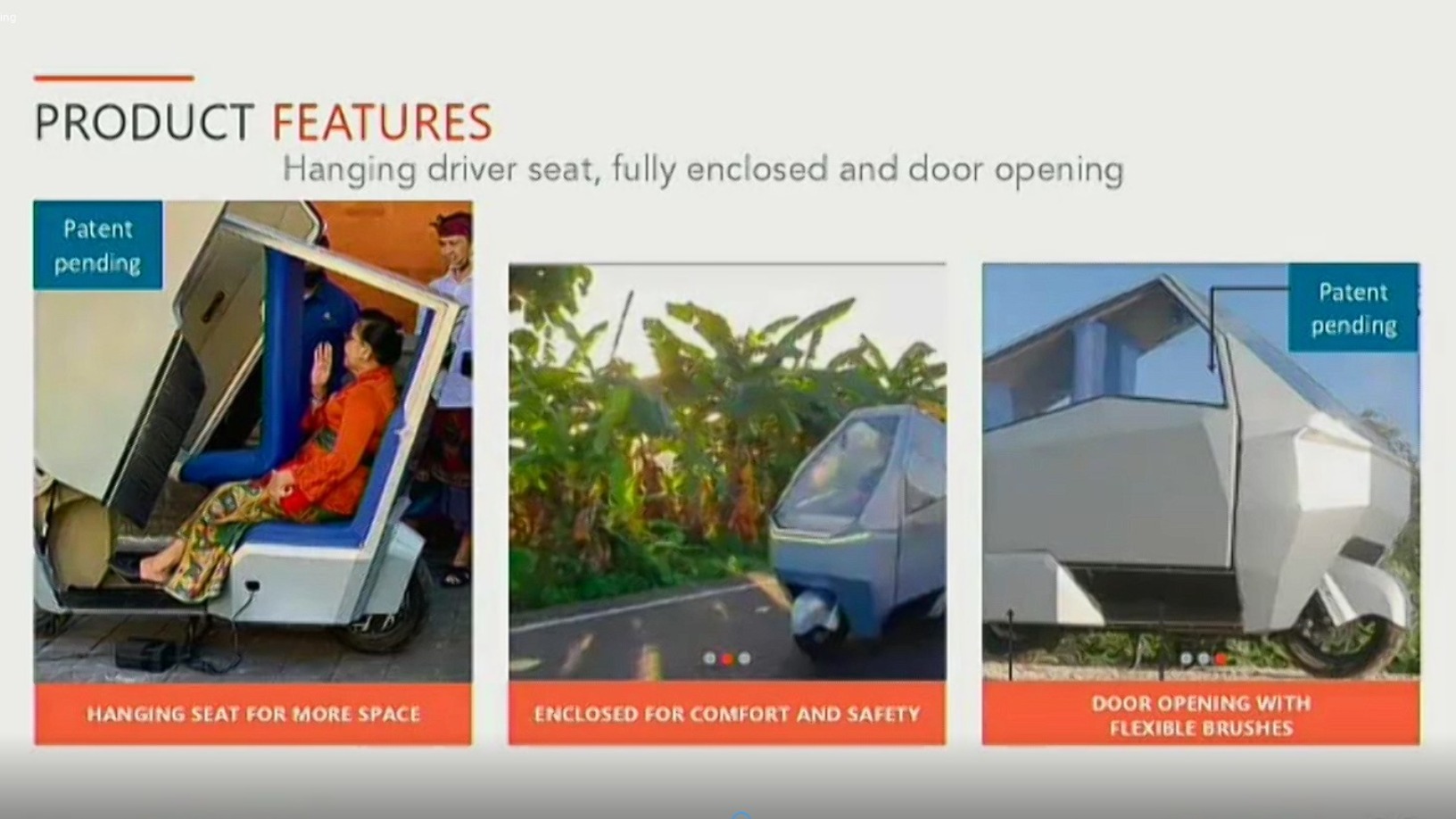

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.