Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Set up in 2012 by Jackie Chen (Chen Liang) and Sebastian Kübler, who together with Raymond Lei (Lei Yang) founded Taishan Invest AG, one of China's first angel funds. TXD Ventures is an early-stage investor focusing on Chinese consumer startups, particularly online- and/or mobile-based. Its investments range from RMB 1 million to RMB 6 million.

Set up in 2012 by Jackie Chen (Chen Liang) and Sebastian Kübler, who together with Raymond Lei (Lei Yang) founded Taishan Invest AG, one of China's first angel funds. TXD Ventures is an early-stage investor focusing on Chinese consumer startups, particularly online- and/or mobile-based. Its investments range from RMB 1 million to RMB 6 million.

Founded in 1940 by Juan Soler Güell, Quadis is one of the biggest car wholesalers in Spain. Quadis is managed by grandsons Pol and Lluís Soler who have been reinventing and diversifying the family business through investments in emerging automotive technology for electric and hybrid vehicles. The privately owned company has recently backed Wallbox Chargers which designs and manufactures EV chargers that can be remotely managed through mobile apps.

Founded in 1940 by Juan Soler Güell, Quadis is one of the biggest car wholesalers in Spain. Quadis is managed by grandsons Pol and Lluís Soler who have been reinventing and diversifying the family business through investments in emerging automotive technology for electric and hybrid vehicles. The privately owned company has recently backed Wallbox Chargers which designs and manufactures EV chargers that can be remotely managed through mobile apps.

NUMA is a Paris-based innovation hub with offices in New York, Berlin, Moscow, Barcelona, Mexico City, Casablanca in Morocco and Bengalaru, India. Supported by its 130 staff members, the company runs training and startup acceleration programs globally. To date, 300 startups have participated in NUMA's acceleration program, which was developed in partnership with the City of Paris. To date, NUMA has seen 17 exits from its investments.

NUMA is a Paris-based innovation hub with offices in New York, Berlin, Moscow, Barcelona, Mexico City, Casablanca in Morocco and Bengalaru, India. Supported by its 130 staff members, the company runs training and startup acceleration programs globally. To date, 300 startups have participated in NUMA's acceleration program, which was developed in partnership with the City of Paris. To date, NUMA has seen 17 exits from its investments.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Stanley Ventures / Stanley Black & Decker

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Asia Africa Investment & Consulting

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Western Technology Investment (WTI)

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

N.A.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

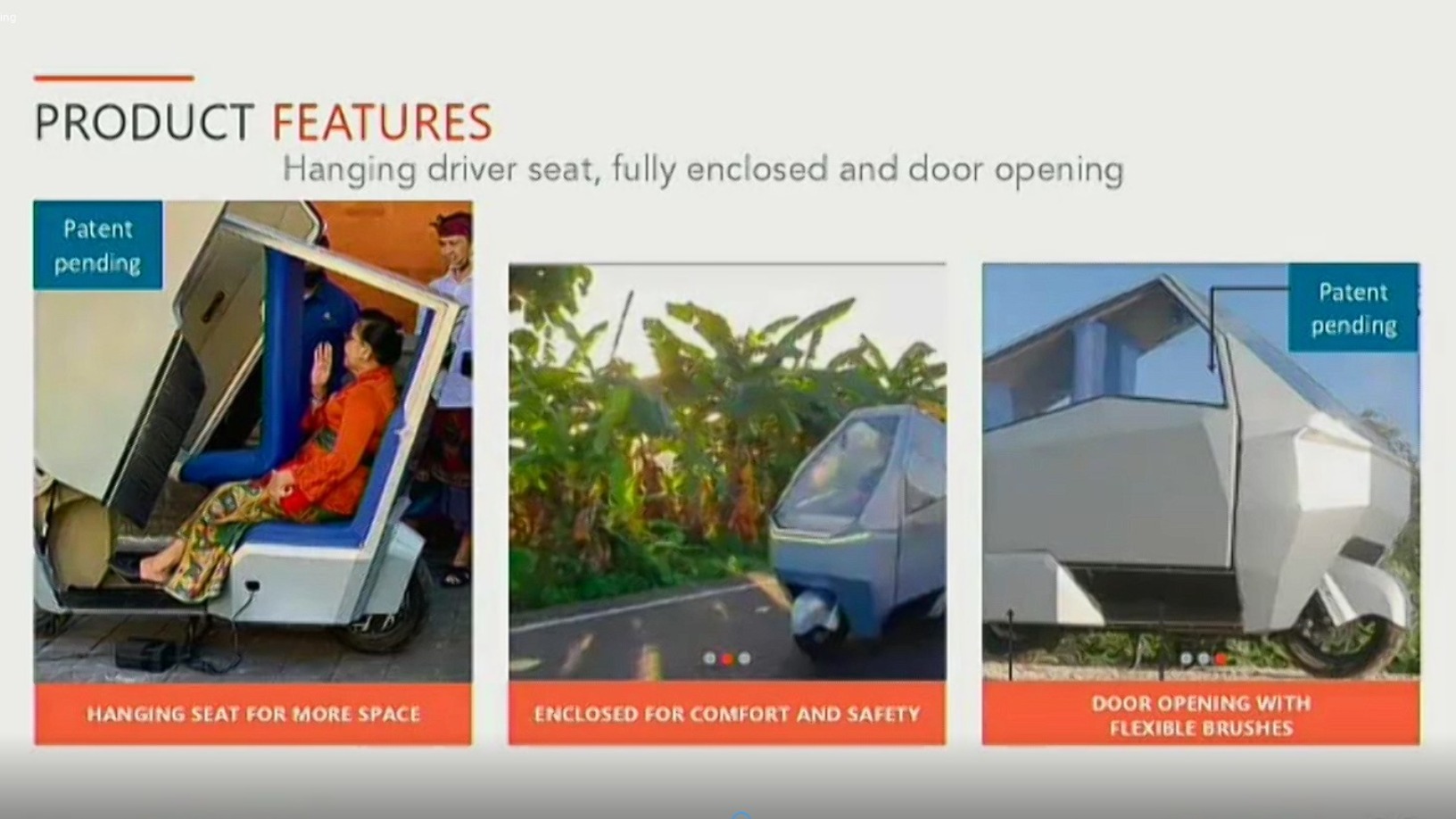

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.