Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

As the private equity arm of Hanfor Holdings Ltd., it makes buyout, venture and co-investment within China.

As the private equity arm of Hanfor Holdings Ltd., it makes buyout, venture and co-investment within China.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Founded in 2018, Allwiseinfo (Kuaidai Huizhi) is a Beijing-based venture capital firm.

Founded in 2018, Allwiseinfo (Kuaidai Huizhi) is a Beijing-based venture capital firm.

iFLYTEK is a Chinese software company that specializes in speech technology such as speech synthesis and speech recognition. Established in 1999, iFLYTEK was listed on the Shenzhen Stock Exchange in 2008. With products like iFLYTEK Voice Input and iFLYTEK ViaFly, it has cornered more than 70% of the Chinese speech technology market. iFLYTEK has made investments in over 60 AI companies in the education, healthcare, loT, connected car and robotics sectors, where its products can be widely applied.

iFLYTEK is a Chinese software company that specializes in speech technology such as speech synthesis and speech recognition. Established in 1999, iFLYTEK was listed on the Shenzhen Stock Exchange in 2008. With products like iFLYTEK Voice Input and iFLYTEK ViaFly, it has cornered more than 70% of the Chinese speech technology market. iFLYTEK has made investments in over 60 AI companies in the education, healthcare, loT, connected car and robotics sectors, where its products can be widely applied.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

Zhongjia Yitai Private Equity Partners

Zhongjia Yitai Private Equity Partners was founded in 2016 and funded by Mingtai Capital.

Zhongjia Yitai Private Equity Partners was founded in 2016 and funded by Mingtai Capital.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Tunas Nusantara Kapital, also known as TNKapital, is an Indonesian early stage venture capital firm founded in 2017. TNKapital has invested in payroll software startup Gadjian, logistics and fulfilment firm Pakde, as well as employee attendance and management software Hadirr. Like many early stage venture capital firms, TNKapital also provides mentorship and networking support to its portfolio companies.

Tunas Nusantara Kapital, also known as TNKapital, is an Indonesian early stage venture capital firm founded in 2017. TNKapital has invested in payroll software startup Gadjian, logistics and fulfilment firm Pakde, as well as employee attendance and management software Hadirr. Like many early stage venture capital firms, TNKapital also provides mentorship and networking support to its portfolio companies.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

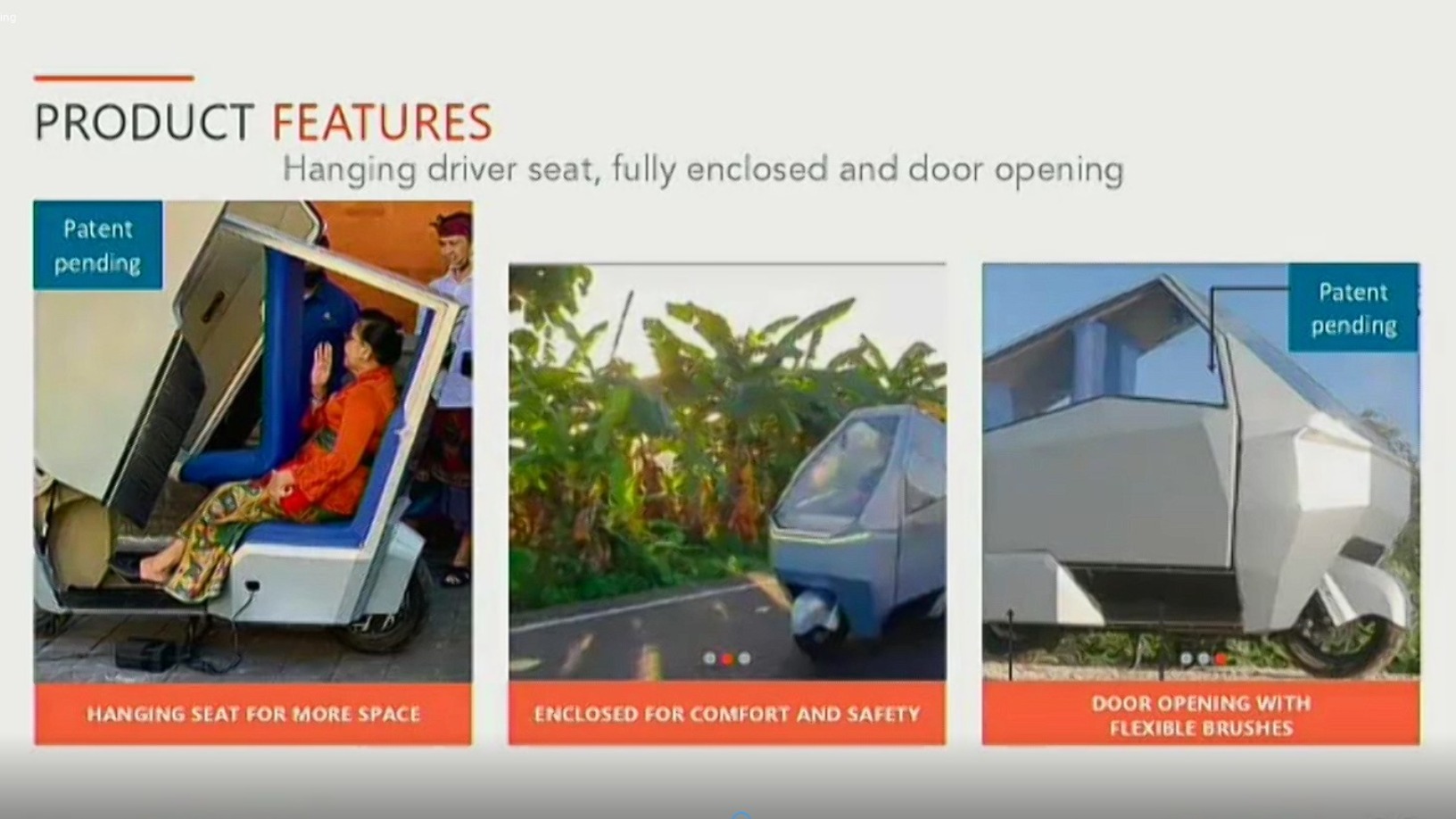

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.