Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Yamaha Motor Ventures & Laboratory Silicon Valley

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Making Ideas Business was founded in 2012 by a group of 51 students and professors after the end of the 2011-2012 Master in Internet Business at ISDI, an international institution that offers training and degree programs in digital business management.Along with mentoring and industry expertise, the fund provides tech startups in the Spanish ecosystem with seed investments. It has invested €260,000 in five companies to date.The group today includes more than 78 partners and angel investors that, in total, have more than 1,000 years of professional experience and 50,000 hours of training in the internet sector.

Making Ideas Business was founded in 2012 by a group of 51 students and professors after the end of the 2011-2012 Master in Internet Business at ISDI, an international institution that offers training and degree programs in digital business management.Along with mentoring and industry expertise, the fund provides tech startups in the Spanish ecosystem with seed investments. It has invested €260,000 in five companies to date.The group today includes more than 78 partners and angel investors that, in total, have more than 1,000 years of professional experience and 50,000 hours of training in the internet sector.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

Founded in 2009 by ex-banker Yan Li (currently its managing director), Eastern Bell focuses on logistics & supply chain and O2O e-commerce companies.

Founded in 2009 by ex-banker Yan Li (currently its managing director), Eastern Bell focuses on logistics & supply chain and O2O e-commerce companies.

Northern Light Venture Capital

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

Taihecap (formerly TH Capital)

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2011 by Wang Xiao, a member of the Baidu founding team, Unity Ventures is a venture capital firm in China that focuses on early-stage companies in the internet and mobile internet sectors.

Founded in 2011 by Wang Xiao, a member of the Baidu founding team, Unity Ventures is a venture capital firm in China that focuses on early-stage companies in the internet and mobile internet sectors.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

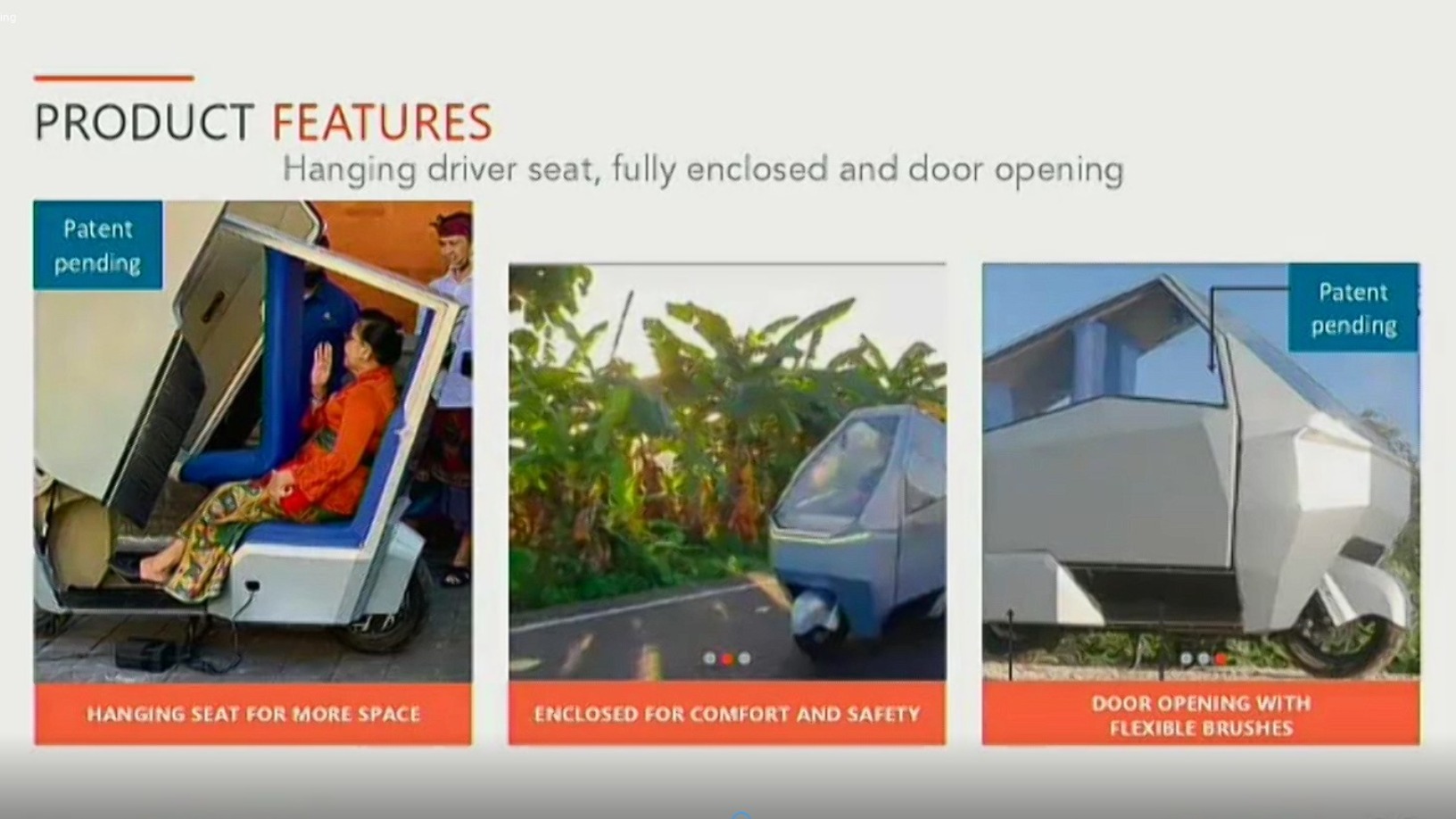

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.