Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

ONES Ventures is a venture capital firm run primarily by people in their 30s with overseas experience. It invests mainly in early-stage startups aimed at young people. ONES Ventures cooperates extensively with the Thiel Fellowship.

ONES Ventures is a venture capital firm run primarily by people in their 30s with overseas experience. It invests mainly in early-stage startups aimed at young people. ONES Ventures cooperates extensively with the Thiel Fellowship.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Founded in 1998, Asiaec Partnership is one of the earliest venture capital firms in China, with about 20 funds under management. It has invested in 100+ companies, of which about one-third have gone public, with an IRR of over 35%.

Founded in 1998, Asiaec Partnership is one of the earliest venture capital firms in China, with about 20 funds under management. It has invested in 100+ companies, of which about one-third have gone public, with an IRR of over 35%.

RMKB Ventures is a hands-on venture firm investing in seed stage digital companies in Indonesia. Managing partner Kevin Sutantyo is a veteran entrepreneur in the US and in Indonesia. He recently became a venture partner at Sovereign’s Capital, also an investor in Printerous.

RMKB Ventures is a hands-on venture firm investing in seed stage digital companies in Indonesia. Managing partner Kevin Sutantyo is a veteran entrepreneur in the US and in Indonesia. He recently became a venture partner at Sovereign’s Capital, also an investor in Printerous.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

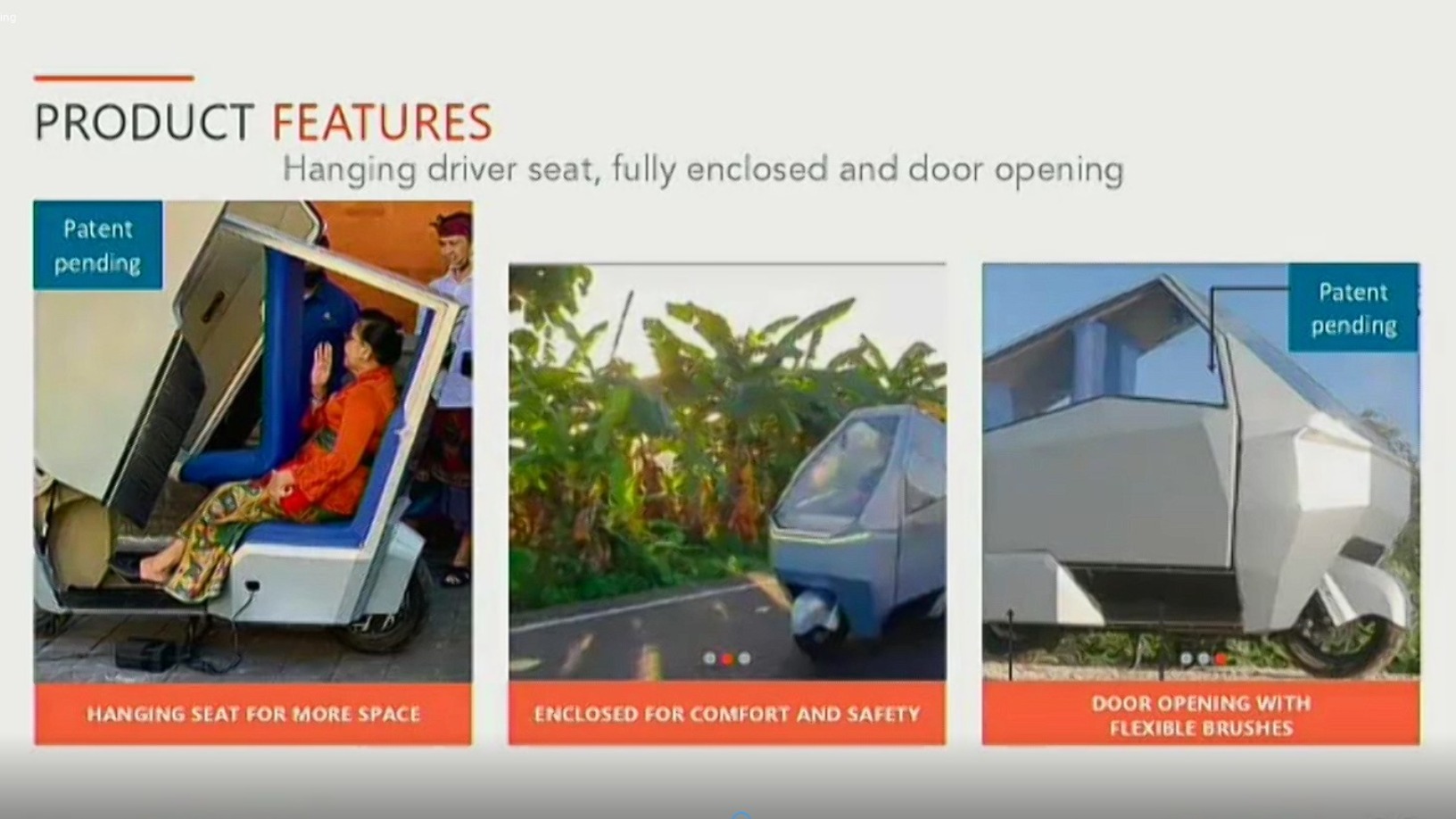

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.