Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Co-CEO and co-founder of Elio

Waldo Hartanto graduated with a BSc in Accounting and Finance in 2012 at Boston College, Wallace E Carroll Graduate School of Management. After graduation, he worked as an equity research analyst at Mandiri Sekuritas for seven months and later joined Rothschild's global financial advisory team in Jakarta.In January 2014, he moved to Singapore to work for one year at Heritas Capital Management as healthcare investment analyst. In 2015, he became the managing director of Wahyu Abadi, an Indonesian business process outsourcing company. His younger brother Walton is also at Wahyu based in Jakarta. In April 2018, both brothers co-founded Elio to focus online healthcare for men.

Waldo Hartanto graduated with a BSc in Accounting and Finance in 2012 at Boston College, Wallace E Carroll Graduate School of Management. After graduation, he worked as an equity research analyst at Mandiri Sekuritas for seven months and later joined Rothschild's global financial advisory team in Jakarta.In January 2014, he moved to Singapore to work for one year at Heritas Capital Management as healthcare investment analyst. In 2015, he became the managing director of Wahyu Abadi, an Indonesian business process outsourcing company. His younger brother Walton is also at Wahyu based in Jakarta. In April 2018, both brothers co-founded Elio to focus online healthcare for men.

Co-founder and Commissioner of IDCloudHost

Although Depi Rusnandar holds a bachelor’s in Geophysics and Seismology from Indonesia’s Institut Teknologi Bandung, he spent most of his career at Bank Syariah Mandiri (the sharia arm of Bank Mandiri). He joined the bank as an Account Officer in 2002 and became a data analyst for its commercial banking vertical in 2015. Depi obtained a master’s in Syariah banking at Indonesia Banking School in 2015 and eventually left the bank to establish IDCloudHost as a co-founder and commissioner. He also joined PT BPRS Artha Fisabilillah as a director in 2017.

Although Depi Rusnandar holds a bachelor’s in Geophysics and Seismology from Indonesia’s Institut Teknologi Bandung, he spent most of his career at Bank Syariah Mandiri (the sharia arm of Bank Mandiri). He joined the bank as an Account Officer in 2002 and became a data analyst for its commercial banking vertical in 2015. Depi obtained a master’s in Syariah banking at Indonesia Banking School in 2015 and eventually left the bank to establish IDCloudHost as a co-founder and commissioner. He also joined PT BPRS Artha Fisabilillah as a director in 2017.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Co-founder and COO of Manpro

Ranny Anita is an experienced project manager in the construction and energy industries who has worked at Contromation Energy Services, construction firm PT Grahaputra Mandiri Kharisma and the Siloam Hospitals Group. She left Contromation in October 2017 to join former colleague Zaki Muliawan to establish Manpro.Ranny holds a bachelor’s degree in Civil Engineering and a master’s in Project Management from Universitas Pelita Harapan, Indonesia.

Ranny Anita is an experienced project manager in the construction and energy industries who has worked at Contromation Energy Services, construction firm PT Grahaputra Mandiri Kharisma and the Siloam Hospitals Group. She left Contromation in October 2017 to join former colleague Zaki Muliawan to establish Manpro.Ranny holds a bachelor’s degree in Civil Engineering and a master’s in Project Management from Universitas Pelita Harapan, Indonesia.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Director and Founder of Mayordomo

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Edpuzzle waives fees for video learning platform during coronavirus pandemic

Spanish edtech startup Edpuzzle lets teachers create engaging remote-learning tools from easily accessible online videos

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Farm Friend: World’s first agri-drone sharing platform wins over users, investors

Gone are the days of the lone Chinese farmer toiling under the sun. Now drones are here to help – and there’s even a drone sharing platform too

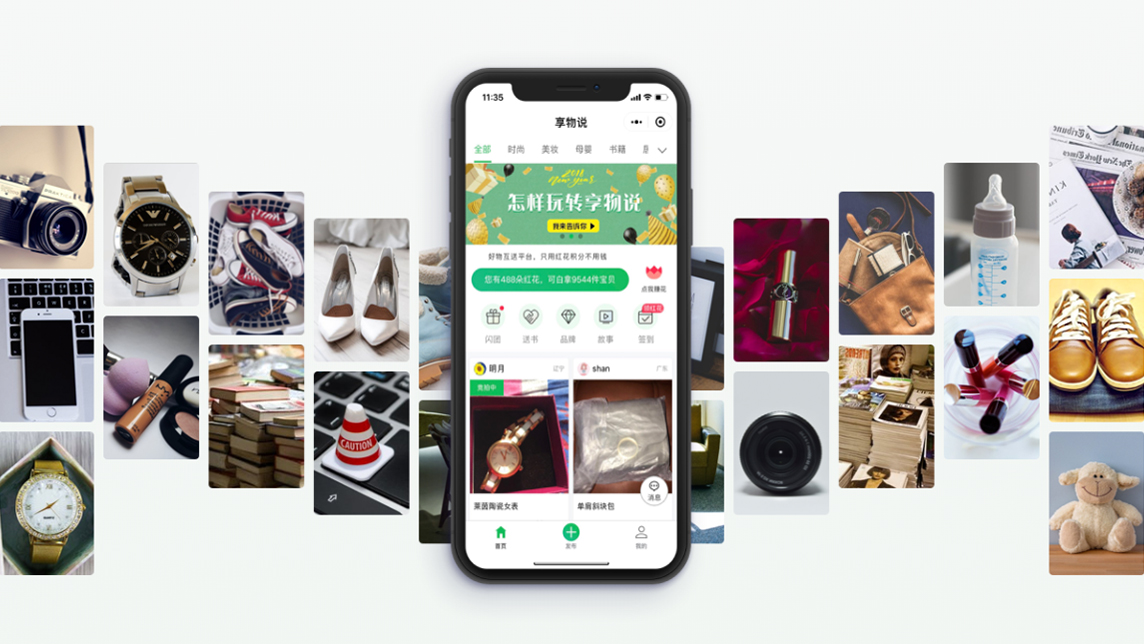

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

eFishery poised to benefit from Indonesia's growing aquaculture sector

eFishery's IoT automatic feeding system is delivering efficiencies and boosting output for small fish farmers, driving strong growth for the aquaculture startup.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Xuebacoming: Promising edtech had compliance issues from day one

Other hefty mistakes also contributed to Xuebacoming's demise – proof that investor and media support, and a booming market, won't guarantee success

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.