Material Impact

-

DATABASE (81)

-

ARTICLES (261)

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Haitong Kaiyuan Investment is the wholly owned private equity investment firm by Haiting Securities in 2008. It focuses on new energy, new material, biotechnology, IT, communication and advanced manufacturing sectors.

Haitong Kaiyuan Investment is the wholly owned private equity investment firm by Haiting Securities in 2008. It focuses on new energy, new material, biotechnology, IT, communication and advanced manufacturing sectors.

Based in Shanghai, Sharewin Investment was founded in 2005. In 2010, the company changed its focus from PE to VC. It invests mainly in the healthcare, TMT, new material, advanced manufacturing, arts and entertainment and consumer products sectors.

Based in Shanghai, Sharewin Investment was founded in 2005. In 2010, the company changed its focus from PE to VC. It invests mainly in the healthcare, TMT, new material, advanced manufacturing, arts and entertainment and consumer products sectors.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Founder and CEO of Geometry Healthcare

Chen Liangcheng completed his undergraduate and postgraduate study at Tsinghua University and earned a master's degree in Hydrology and Water Resources Engineering in 2003. In January 2005, he founded Beijing Landi Gelin Technology Co., Ltd., a building material company, and was its General Manager till July 2015, when he left to start up Geometry Healthcare and has since been its CEO.

Chen Liangcheng completed his undergraduate and postgraduate study at Tsinghua University and earned a master's degree in Hydrology and Water Resources Engineering in 2003. In January 2005, he founded Beijing Landi Gelin Technology Co., Ltd., a building material company, and was its General Manager till July 2015, when he left to start up Geometry Healthcare and has since been its CEO.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

Co-founder and CEO of Allozymes

Peyman Salehian is an Iranian-born entrepreneur trained in chemical and biomolecular engineering. He founded his first company in 2010 after developing a custom material, and sold his stake in the company in 2013 before pursuing a PhD in Chemical and Biomolecular engineering at the National University of Singapore (NUS).Salehian graduated from the PhD program in 2017 and worked as a research fellow before embarking on one-year stints at two Singapore companies. In late 2019, he and fellow NUS researcher Akbar Vahidi established Allozymes, a startup offering enzyme engineering services using NUS-developed technology under license, with Salehian as CEO and Vahidi as CTO.

Peyman Salehian is an Iranian-born entrepreneur trained in chemical and biomolecular engineering. He founded his first company in 2010 after developing a custom material, and sold his stake in the company in 2013 before pursuing a PhD in Chemical and Biomolecular engineering at the National University of Singapore (NUS).Salehian graduated from the PhD program in 2017 and worked as a research fellow before embarking on one-year stints at two Singapore companies. In late 2019, he and fellow NUS researcher Akbar Vahidi established Allozymes, a startup offering enzyme engineering services using NUS-developed technology under license, with Salehian as CEO and Vahidi as CTO.

Focusing on sustainability and the education sector, BEEVERYCREATIVE is leading the way to revolutionize 3D printing.

Focusing on sustainability and the education sector, BEEVERYCREATIVE is leading the way to revolutionize 3D printing.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

After emulating Chinese business models, Indonesian startups seek success abroad

Indonesia adapted and furthered the successful business models that created unicorns in China. Now, it's exporting its own to the rest of Southeast Asia, even beyond

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

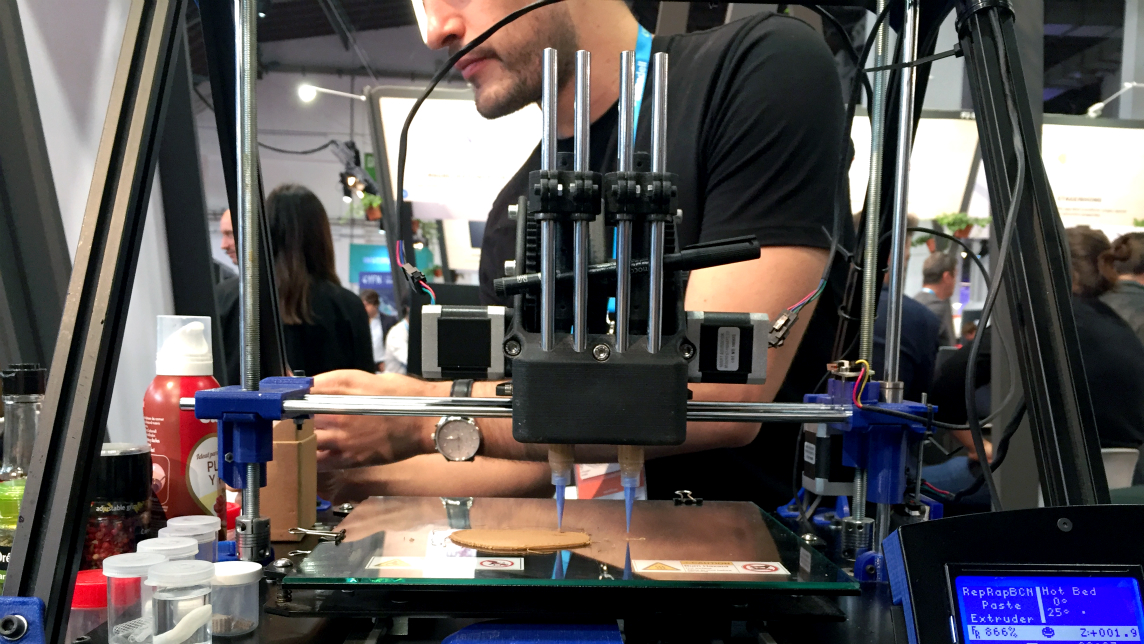

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

Sorry, we couldn’t find any matches for“Material Impact”.