Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Experienced DIY travelers turn travel planners to customize your trip for the most authentic experiences. Zhinanmao claims its one-stop service saves 20% cost, 70% time.

Experienced DIY travelers turn travel planners to customize your trip for the most authentic experiences. Zhinanmao claims its one-stop service saves 20% cost, 70% time.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

Spiral Ventures (IMJ Investment Partners)

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Citizen journalism is hot, but where’s the money? Panda iMedia helps talented “we media” creators to market and monetize their content, even investing in them.

Citizen journalism is hot, but where’s the money? Panda iMedia helps talented “we media” creators to market and monetize their content, even investing in them.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Co-founder of BlackGarlic

Angelo Syailendra is a veteran in business analysis and investment. After earning a bachelor’s in Industrial Engineering with summa cum laude from the University of Michigan in USA, he went to Stanford University to read a master’s in Economics and Finance. He worked as an analyst and associate in companies such as Morgan Stanley and Affinity Equity Partners. He also helped to establish foodtech startups Klik-Eat and BlackGarlic. Angelo is currently a director at a data centre company DCI Indonesia.

Angelo Syailendra is a veteran in business analysis and investment. After earning a bachelor’s in Industrial Engineering with summa cum laude from the University of Michigan in USA, he went to Stanford University to read a master’s in Economics and Finance. He worked as an analyst and associate in companies such as Morgan Stanley and Affinity Equity Partners. He also helped to establish foodtech startups Klik-Eat and BlackGarlic. Angelo is currently a director at a data centre company DCI Indonesia.

Co-founder and CTO of Factorial

Pau Ramon is a co-founder and the CTO of Spanish human resource startup Factorial. For five years, he was the CTO of Redbooth (formerly Teambox), a cloud-based SaaS project management tool that facilitates collaboration and communication within teams. Ramon had fortuitously met the Redbooth team when trying to secure funding and partners for zspeakers.com, a social media influencer monetizing platform he had earlier established. Ramon has a BSc in Multimedia and another in Software Engineering.

Pau Ramon is a co-founder and the CTO of Spanish human resource startup Factorial. For five years, he was the CTO of Redbooth (formerly Teambox), a cloud-based SaaS project management tool that facilitates collaboration and communication within teams. Ramon had fortuitously met the Redbooth team when trying to secure funding and partners for zspeakers.com, a social media influencer monetizing platform he had earlier established. Ramon has a BSc in Multimedia and another in Software Engineering.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Co-founder and Chief Learning Officer of Arkademi

Prior to joining high school friend Hilman Fajrian to develop Arkademi, a new Massive Online Open Course (MOOC) platform, Resi Dwi Erveny was a learning manager at PLN Corporate University, the corporate training division of the state-owned electricity company. She resigned in early 2018 and worked as an HR consultant for Indonesia Power, PLN's commercial subsidiary. Later in 2018, she joined Hilman as Arkademi's Chief Learning Officer, responsible for helping course partners design curricula and develop content tailored for online learning.

Prior to joining high school friend Hilman Fajrian to develop Arkademi, a new Massive Online Open Course (MOOC) platform, Resi Dwi Erveny was a learning manager at PLN Corporate University, the corporate training division of the state-owned electricity company. She resigned in early 2018 and worked as an HR consultant for Indonesia Power, PLN's commercial subsidiary. Later in 2018, she joined Hilman as Arkademi's Chief Learning Officer, responsible for helping course partners design curricula and develop content tailored for online learning.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

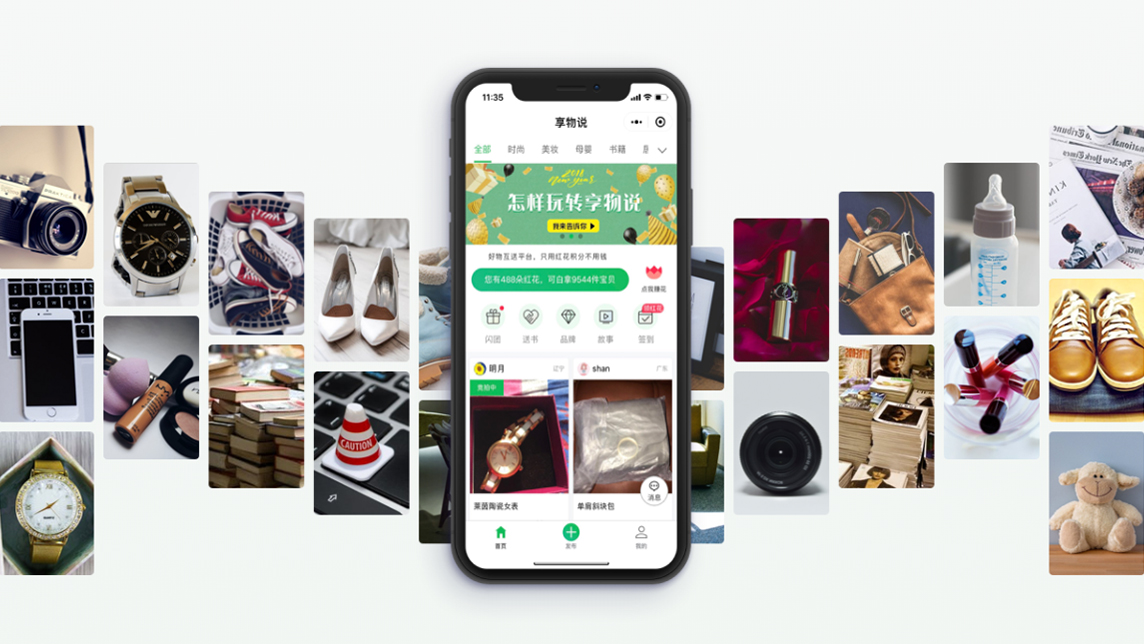

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Matrix Partners China”.