Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Founder and CEO of YH Global

Founder and CEO of YH Global. Serial innovator in supply chain businesses. He received his EMBA at the Cheung Kong Graduate School of Business, started a fledgling logistics service in 1997, and won the 2017 EY Entrepreneur of the Year Award for China.

Founder and CEO of YH Global. Serial innovator in supply chain businesses. He received his EMBA at the Cheung Kong Graduate School of Business, started a fledgling logistics service in 1997, and won the 2017 EY Entrepreneur of the Year Award for China.

CEO and Founder of AISpeech

After receiving his MPhil from Cambridge Judge Business School, Gao founded AISpeech in the UK in 2007. In 2008, he returned to China and settled down in Suzhou, where AISpeech is now headquartered.

After receiving his MPhil from Cambridge Judge Business School, Gao founded AISpeech in the UK in 2007. In 2008, he returned to China and settled down in Suzhou, where AISpeech is now headquartered.

Alejandro Artacho Amichis of Spotahome

Alejandro Artacho Amichis has degrees in Business Administration and Law from Spanish universities and the University of International Business and Economics (UIBE).He studied in China on an exchange program and got a grant from the Chinese government to learn Mandarin at UIBE in Beijing in 2010. He returned to Spain and started Abendium in 2011, an import and export business between Spain and China. He also established travel agency Aledasia in 2012 to market luxury trips to rich Chinese tourists. The Spotahome idea was resurrected by Artacho in 2014 after working in a property company in London.

Alejandro Artacho Amichis has degrees in Business Administration and Law from Spanish universities and the University of International Business and Economics (UIBE).He studied in China on an exchange program and got a grant from the Chinese government to learn Mandarin at UIBE in Beijing in 2010. He returned to Spain and started Abendium in 2011, an import and export business between Spain and China. He also established travel agency Aledasia in 2012 to market luxury trips to rich Chinese tourists. The Spotahome idea was resurrected by Artacho in 2014 after working in a property company in London.

CEO and Co-founder of 4D ShoeTech

Antonio Lin was admitted as a freshman of College of Mathematics and Informatics in South China Agricultural University in 2015. He also founded a 3D printing company in 2015. The business encountered financial problems and was later shut down.But in March 2016, the global entrepreneur incubator Blackbox picked Lin’s company as one of the ten teams with potential to be trained in Silicon Valley for a week. It was during this training program that Lin met Qiu Chen from Tsinghua University and Zhou Zhiheng, the general manager of Michael Antonio Footwear Group’s business in China.Lin quickly pivoted the focus of his company to 3D printing of footwear and became the CEO of 4D ShoeTech.

Antonio Lin was admitted as a freshman of College of Mathematics and Informatics in South China Agricultural University in 2015. He also founded a 3D printing company in 2015. The business encountered financial problems and was later shut down.But in March 2016, the global entrepreneur incubator Blackbox picked Lin’s company as one of the ten teams with potential to be trained in Silicon Valley for a week. It was during this training program that Lin met Qiu Chen from Tsinghua University and Zhou Zhiheng, the general manager of Michael Antonio Footwear Group’s business in China.Lin quickly pivoted the focus of his company to 3D printing of footwear and became the CEO of 4D ShoeTech.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

Co-founder of Zaihui

Li worked as a regional sales manager at Dianping, the largest restaurant review website in China, from 2008 to 2015, where he successfully built and led a team of more than 300 sales experts, helping the company achieve considerable sales revenue.

Li worked as a regional sales manager at Dianping, the largest restaurant review website in China, from 2008 to 2015, where he successfully built and led a team of more than 300 sales experts, helping the company achieve considerable sales revenue.

CMS Zhiyuan Capital Co Ltd was founded in August 2009. It is a wholly-owned subsidiary of China Merchants Securities, with a registered capital of RMB 2.1 billion. Operating as a private equity firm, it is ranked amongst the top private funds in China with assets under management exceeding RMB 20 billion.

CMS Zhiyuan Capital Co Ltd was founded in August 2009. It is a wholly-owned subsidiary of China Merchants Securities, with a registered capital of RMB 2.1 billion. Operating as a private equity firm, it is ranked amongst the top private funds in China with assets under management exceeding RMB 20 billion.

CICC Capital was established in March 2017 as a wholly-owned subsidiary of CICC (China International Capital Corporation). It was registered as a private equity fund manager with the Asset Management Association of China in December 2017. By the end of 2017, CICC Capital had assets under management of RMB 200 billion.

CICC Capital was established in March 2017 as a wholly-owned subsidiary of CICC (China International Capital Corporation). It was registered as a private equity fund manager with the Asset Management Association of China in December 2017. By the end of 2017, CICC Capital had assets under management of RMB 200 billion.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

A famous angel investor in the healthcare sector, Shao Hui founded Youxiang, the first cross-border medical tourism player in China in 2006, targeting the Chinese upper class. In 2001, he participated in the venture-stage funding of Beijing Nanshan Ski Village, now the most popular ski village in China.

A famous angel investor in the healthcare sector, Shao Hui founded Youxiang, the first cross-border medical tourism player in China in 2006, targeting the Chinese upper class. In 2001, he participated in the venture-stage funding of Beijing Nanshan Ski Village, now the most popular ski village in China.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

Minsheng Securities Co., Ltd. was established in Beijing in 1986 with registered capital of RMB 9.619 billion. China Securities Regulatory Commission has authorized Minsheng Securities to engage in securities trading and securities underwriting and serve as a sponsor. It is one of the first securities companies in China.

Minsheng Securities Co., Ltd. was established in Beijing in 1986 with registered capital of RMB 9.619 billion. China Securities Regulatory Commission has authorized Minsheng Securities to engage in securities trading and securities underwriting and serve as a sponsor. It is one of the first securities companies in China.

Alta Life Sciences (Alta LS) was established in 2016. Based in Barcelona, the management team is led by the co-founder of Alta Partners Guy Paul Nohra, a leading pioneer VC in life sciences. Alta Partners has funded over 150 companies since 1996. Alta LS specializes in the life sciences sector in Spain and abroad, targeting biotech, genomics, medical devices, diagnostics and digital health. It also acts as a bridge fund, connecting the Spanish life sciences ecosystem to VC experts in Silicon Valley. Investment is available for all stages of development, with focus mainly on seed and Series A funding.

Alta Life Sciences (Alta LS) was established in 2016. Based in Barcelona, the management team is led by the co-founder of Alta Partners Guy Paul Nohra, a leading pioneer VC in life sciences. Alta Partners has funded over 150 companies since 1996. Alta LS specializes in the life sciences sector in Spain and abroad, targeting biotech, genomics, medical devices, diagnostics and digital health. It also acts as a bridge fund, connecting the Spanish life sciences ecosystem to VC experts in Silicon Valley. Investment is available for all stages of development, with focus mainly on seed and Series A funding.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

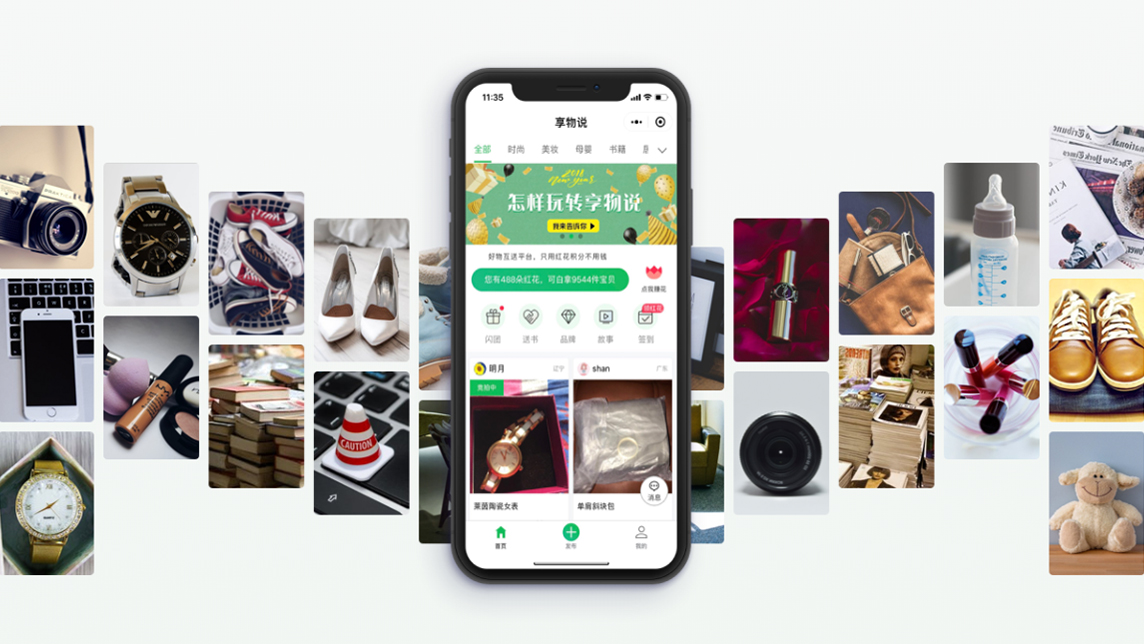

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Matrix Partners China”.