Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

CICC Alpha is a subsidiary of China International Capital Corporation Limited (CICC), managing a RMB 2 billion fund focusing on internet and financial innovation.

CICC Alpha is a subsidiary of China International Capital Corporation Limited (CICC), managing a RMB 2 billion fund focusing on internet and financial innovation.

The SBI-Xueda Education Fund is an education investment fund jointly set up by Japan-based SBI Holdings and China-based Xueda Education Group in 2018.

The SBI-Xueda Education Fund is an education investment fund jointly set up by Japan-based SBI Holdings and China-based Xueda Education Group in 2018.

Co-founder and President of Chinapex

Co-founder and President of Chinapex. Tiger Yang attended high school in Singapore and graduated from the University of California, Berkeley with a Bachelor of Science in Political Economy. Before co-founding Chinapex, Yang managed multiple internal data analytics projects for clients such as Microsoft. He was nominated for the “Innovative Leader of the Year Award” by China Internet Weekly in 2017.

Co-founder and President of Chinapex. Tiger Yang attended high school in Singapore and graduated from the University of California, Berkeley with a Bachelor of Science in Political Economy. Before co-founding Chinapex, Yang managed multiple internal data analytics projects for clients such as Microsoft. He was nominated for the “Innovative Leader of the Year Award” by China Internet Weekly in 2017.

Founder and CEO of UBTECH

Zhou graduated from Nanjing Forestry University with a bachelor’s degree in Automation in 1998. Upon graduation, he worked for Michael Weinig, a German woodworking manufacturing company. After four years at Michael Weinig, he became its youngest ever manager for the Greater China Area. Zhou and his team have been working in robotics R&D since 2008 and founded UBTECH in 2012.

Zhou graduated from Nanjing Forestry University with a bachelor’s degree in Automation in 1998. Upon graduation, he worked for Michael Weinig, a German woodworking manufacturing company. After four years at Michael Weinig, he became its youngest ever manager for the Greater China Area. Zhou and his team have been working in robotics R&D since 2008 and founded UBTECH in 2012.

Co-founder of Dingdang Medicine Express

Xu Huansheng was born in 1979 and obtained an MBA from the National School of Development, Peking University. He founded Baidu’s smart hardware unit and Baidu Cloud during his four years at Baidu in the early 2010s. He co-founded Dingdang Medicine Express in 2014. He is now a senior partner at Feihe Dairy (Firmus), one of the biggest infant and toddler formula producers in China.

Xu Huansheng was born in 1979 and obtained an MBA from the National School of Development, Peking University. He founded Baidu’s smart hardware unit and Baidu Cloud during his four years at Baidu in the early 2010s. He co-founded Dingdang Medicine Express in 2014. He is now a senior partner at Feihe Dairy (Firmus), one of the biggest infant and toddler formula producers in China.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

Hai Quan Fund is founded by Hu Haiquan (a famous singer in China). It now manages over 1.3bn RMB and has invested in more than 40 startups in 3 years.

Hai Quan Fund is founded by Hu Haiquan (a famous singer in China). It now manages over 1.3bn RMB and has invested in more than 40 startups in 3 years.

Sinopharm-CICC Capital was co-founded by Sinopharm and China International Capital Corporation (CICC) in October 2016. It focuses on investments in the healthcare industry.

Sinopharm-CICC Capital was co-founded by Sinopharm and China International Capital Corporation (CICC) in October 2016. It focuses on investments in the healthcare industry.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

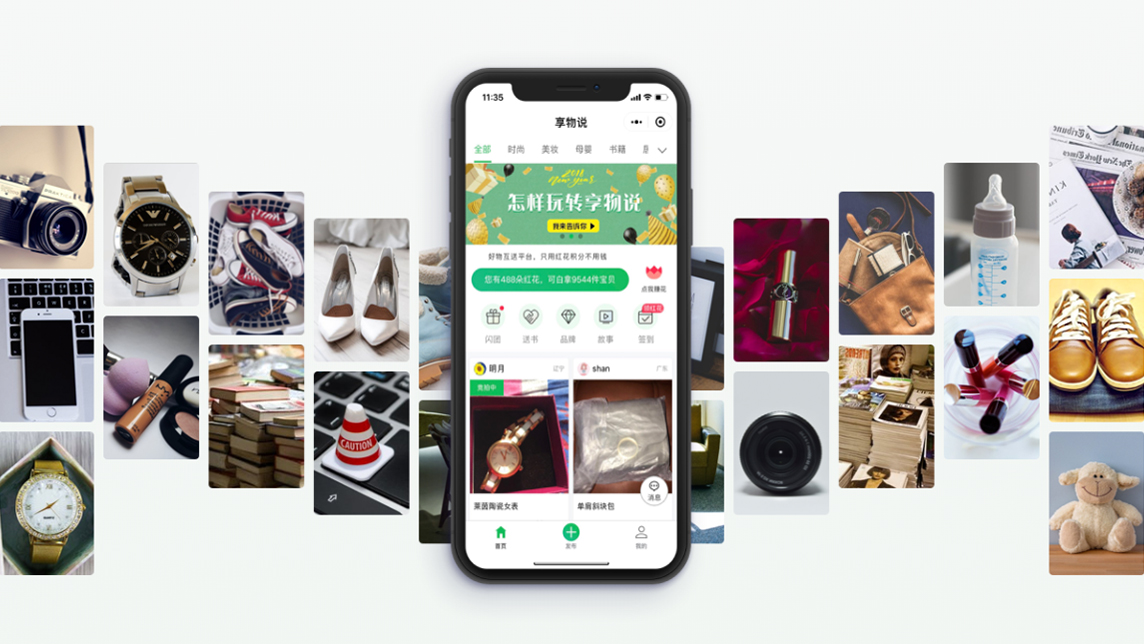

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Matrix Partners China”.