Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

Foxconn- and Tencent-backed Mobike is leading the fierce fight for dominance in the global dockless bike-sharing market, with ambitions for more – including logistics services.

Foxconn- and Tencent-backed Mobike is leading the fierce fight for dominance in the global dockless bike-sharing market, with ambitions for more – including logistics services.

The first online HR services platform to help China SMEs meet their complex social security processing needs –so they save time and money, minimize errors.

The first online HR services platform to help China SMEs meet their complex social security processing needs –so they save time and money, minimize errors.

Redpoint China Ventures focuses on early-stage TMT startups in the consumer services, transaction platforms, social networking, video entertainment, digital advertisement, big data, cloud technology, SaaS, information security and artificial intelligence sectors, among others. It has invested in more than 50 domestic consumer internet and enterprise IT companies. It has been the first institutional investor or founding investor in 80% of its investments.

Redpoint China Ventures focuses on early-stage TMT startups in the consumer services, transaction platforms, social networking, video entertainment, digital advertisement, big data, cloud technology, SaaS, information security and artificial intelligence sectors, among others. It has invested in more than 50 domestic consumer internet and enterprise IT companies. It has been the first institutional investor or founding investor in 80% of its investments.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Thanks to Beile’s integrated online-offline education system, Chinese children can get an American education and perfect their English from young, without having to go abroad.

Thanks to Beile’s integrated online-offline education system, Chinese children can get an American education and perfect their English from young, without having to go abroad.

The TMT-focused VC manages about RMB 10 billion, in three USD-denominated funds and the Tianjin Chengbai RMB-denominated fund. Founded in 2006 by Tian Suning (Edward), the former CEO of China Netcom Group and co-founder and CEO of AsiaInfo (China's first Internet technology provider) is widely regarded as a founder of China's Internet industry. CBC's key investments include Uber, LinkedIn, Evernote, AirBnB, Dianping and Qihoo 360.

The TMT-focused VC manages about RMB 10 billion, in three USD-denominated funds and the Tianjin Chengbai RMB-denominated fund. Founded in 2006 by Tian Suning (Edward), the former CEO of China Netcom Group and co-founder and CEO of AsiaInfo (China's first Internet technology provider) is widely regarded as a founder of China's Internet industry. CBC's key investments include Uber, LinkedIn, Evernote, AirBnB, Dianping and Qihoo 360.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Headquartered in Zhengzhou, China Reform TUS Fund is China's first capital management fund. Jointly backed by state-level venture capital funds, top Chinese universities and the provincial government, it invests primarily in new energy, healthcare and information technology.

Headquartered in Zhengzhou, China Reform TUS Fund is China's first capital management fund. Jointly backed by state-level venture capital funds, top Chinese universities and the provincial government, it invests primarily in new energy, healthcare and information technology.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

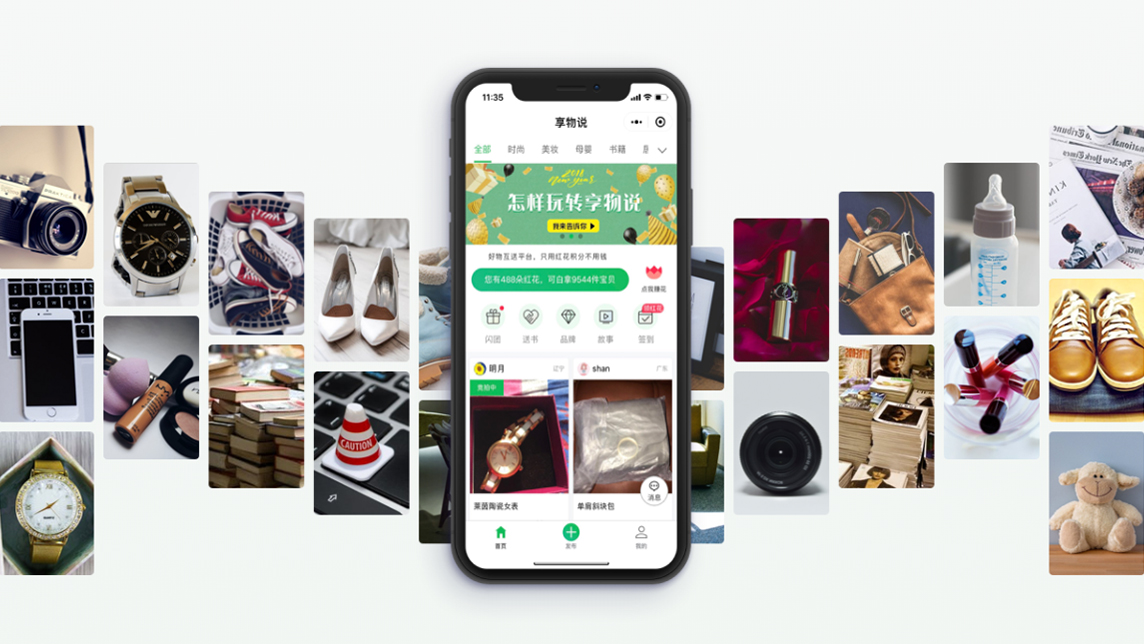

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Matrix Partners China”.