Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Co-founder of Babytree

One of the first in China to go to Harvard on a full scholarship since 1949, Bo Shao, who also holds an MBA from the university, worked at Boston Consulting Group before starting EachNet in China in 1999. EachNet was acquired by eBay in 2003 for US$225 million. Today he is a founding partner of Matrix Partners China.

One of the first in China to go to Harvard on a full scholarship since 1949, Bo Shao, who also holds an MBA from the university, worked at Boston Consulting Group before starting EachNet in China in 1999. EachNet was acquired by eBay in 2003 for US$225 million. Today he is a founding partner of Matrix Partners China.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Toutoushidao Capital (Datou Capital)

Toutoushidao Capital was co-founded in 2015 by Cao Guoxiong, partner of Matrix Partners China, and Wu Xiaobo, a well-known financial writer. Mainly targeting the culture and entertainment sectors, it had planned to invest RMB 2bn–RMB 3bn in the next three years.

Toutoushidao Capital was co-founded in 2015 by Cao Guoxiong, partner of Matrix Partners China, and Wu Xiaobo, a well-known financial writer. Mainly targeting the culture and entertainment sectors, it had planned to invest RMB 2bn–RMB 3bn in the next three years.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

AngelClub is a capital management platform co-invested by co-founder of Tencent, Zeng Liqing, founder of Matrix Partners, Zhang Ying, and management at TsingVentures, Chuangfuzhi Capital and Panda VC.

AngelClub is a capital management platform co-invested by co-founder of Tencent, Zeng Liqing, founder of Matrix Partners, Zhang Ying, and management at TsingVentures, Chuangfuzhi Capital and Panda VC.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Gobi Partners is a venture capital firm with seven offices across China, Hong Kong, Singapore and Kuala Lumpur. Since it was founded in 2002, the firm has raised seven funds and has invested in over 100 portfolio companies across China, Hong Kong and Southeast Asia.

Gobi Partners is a venture capital firm with seven offices across China, Hong Kong, Singapore and Kuala Lumpur. Since it was founded in 2002, the firm has raised seven funds and has invested in over 100 portfolio companies across China, Hong Kong and Southeast Asia.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Bringing Indonesia's research to the world: Interview with Anton Lucanus, Neliti CEO

The former biologist talks about online repositories and his vision for improving Indonesia's research culture

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Santara: Sharia-inspired equity crowdfunding for Indonesia's MSMEs

With strong links to local business communities, Santara has big ambitions to become a household name in equity crowdfunding

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

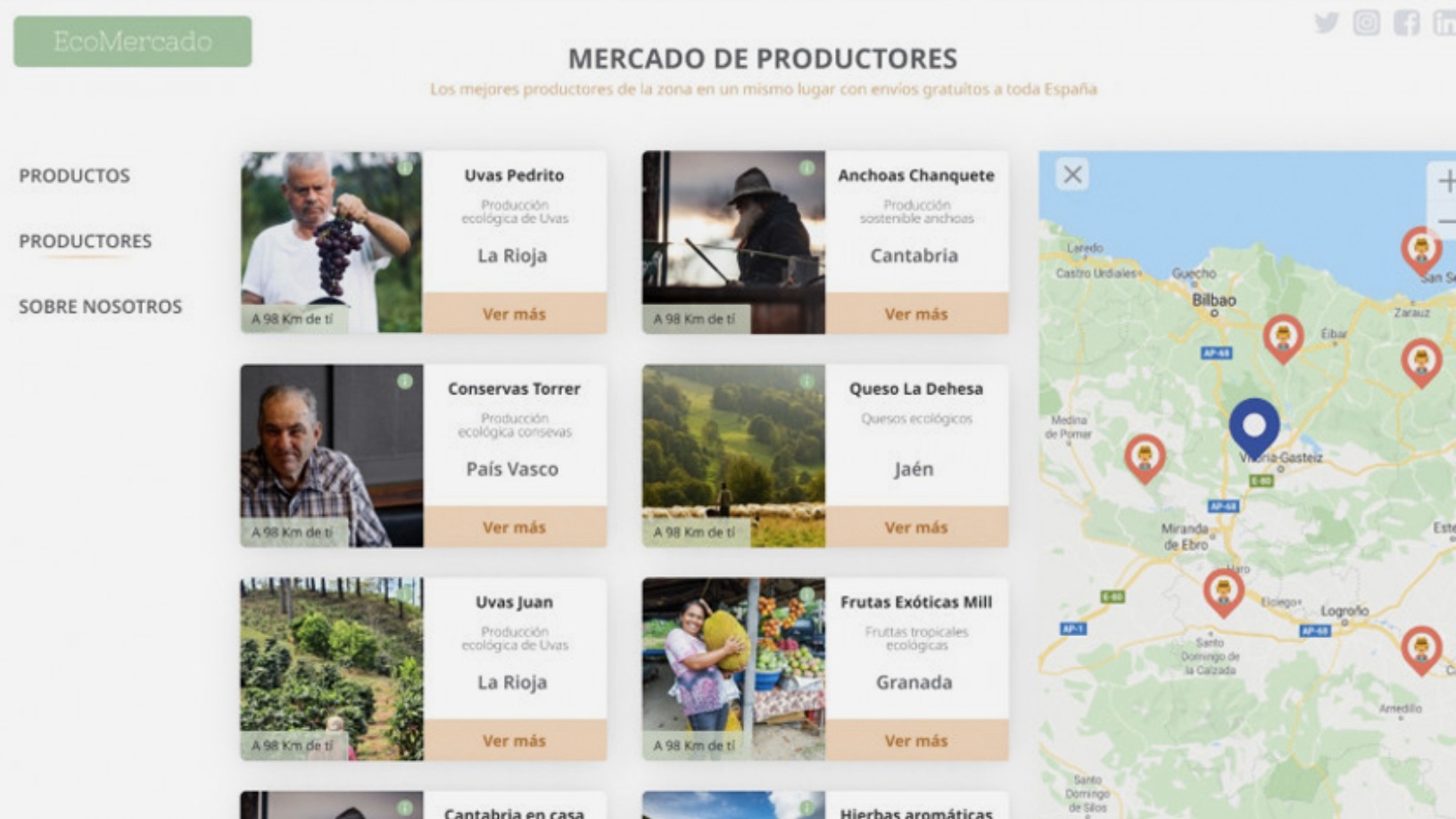

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

eCooltra CEO: Offline-to-online leader in two-wheel sharing economy

Timo Buetefisch, the CEO and co-founder of Europe's largest scooter rental firm Cooltra, discusses the successful offline-to-online shift to scooter-sharing app eCooltra

8villages is one of the first agritech startups in Indonesia, and the social media for farmers has since expanded into e-commerce and agriculture data collection

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Sorry, we couldn’t find any matches for“Matrix Partners China”.