Meat-Tech 3D

-

DATABASE (494)

-

ARTICLES (468)

XY Capital was co-founded in Hangzhou in April 2018 by former Alibaba CEO Lu Zhaoxi and Tang Yun, a former government official in Hangzhou with a PhD in Computer Science from Tsinghua University. The company set up an RMB investment fund in June 2018 and invests mainly in early-stage tech startups.

XY Capital was co-founded in Hangzhou in April 2018 by former Alibaba CEO Lu Zhaoxi and Tang Yun, a former government official in Hangzhou with a PhD in Computer Science from Tsinghua University. The company set up an RMB investment fund in June 2018 and invests mainly in early-stage tech startups.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

The Gassó family is a Spanish entreprenurial family known for its GAES auditive solutions and centers for the hearing-impaired, in existence since 1949. Though the family has many charitable interests, it had not disclosed any investments in tech startups until leading the 2019 seed round of biotech startup VEnvirotech, which produces bioplastics from corporates’ organic waste.

The Gassó family is a Spanish entreprenurial family known for its GAES auditive solutions and centers for the hearing-impaired, in existence since 1949. Though the family has many charitable interests, it had not disclosed any investments in tech startups until leading the 2019 seed round of biotech startup VEnvirotech, which produces bioplastics from corporates’ organic waste.

CEO of Shenzhourong

Data services veteran Huang Haijia was the director of the Chinese government’s first online project in 1998; and the co-founder and former COO of ID5, set up in cooperation with the national police, for online identification checks and involving the digitization of ID data of the 1.3 billion population. In 2001, Huang founded Guozhengtong, an IT consultancy supporting local governments in their digitization and, subsequently, banks and telcos. He later founded financial data and credit risk management SaaS company Shenzhourong, which he heads as CEO. Huang holds an EMBA from the Central European International Business School. He is also a member of the fifth batch of entrepreneurs from the incubation program of AAMA (Asia America Multi-Technology Association), Silicon Valley's largest non-profit organization dedicated to the Asian American high-tech community.

Data services veteran Huang Haijia was the director of the Chinese government’s first online project in 1998; and the co-founder and former COO of ID5, set up in cooperation with the national police, for online identification checks and involving the digitization of ID data of the 1.3 billion population. In 2001, Huang founded Guozhengtong, an IT consultancy supporting local governments in their digitization and, subsequently, banks and telcos. He later founded financial data and credit risk management SaaS company Shenzhourong, which he heads as CEO. Huang holds an EMBA from the Central European International Business School. He is also a member of the fifth batch of entrepreneurs from the incubation program of AAMA (Asia America Multi-Technology Association), Silicon Valley's largest non-profit organization dedicated to the Asian American high-tech community.

Co-founder of AllRead MLT

Dimosthenis Karatzas is Senior Research Fellow and Associate Director at the Computer Vision Centre (CVC) of the Autonomous University of Barcelona (UAB). He specializes in computer vision, document image analysis and color science. In 2007, he co-founded TruColour in the UK, where he currently is a member of the board of directors. In 2013, he was awarded the IAPR/ICDAR Young Investigator Award “for outstanding service and innovative research in human perception-based document analysis.” Karatzas also worked as a Research Fellow at the University of Liverpool and University of Southampton in the UK. Since 2019, he has been part of the co-founding team of Allread MLT, a deep-tech startup that converts text, symbols and codes to Big Data using computer vision technology, character recognition and machine learning.

Dimosthenis Karatzas is Senior Research Fellow and Associate Director at the Computer Vision Centre (CVC) of the Autonomous University of Barcelona (UAB). He specializes in computer vision, document image analysis and color science. In 2007, he co-founded TruColour in the UK, where he currently is a member of the board of directors. In 2013, he was awarded the IAPR/ICDAR Young Investigator Award “for outstanding service and innovative research in human perception-based document analysis.” Karatzas also worked as a Research Fellow at the University of Liverpool and University of Southampton in the UK. Since 2019, he has been part of the co-founding team of Allread MLT, a deep-tech startup that converts text, symbols and codes to Big Data using computer vision technology, character recognition and machine learning.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Paris-based micro VC Kima Ventures was founded in 2010 by French tech billionaire Xavier Niel and French-Israeli angel investor/entrepreneur Jeremie Berrebi. They invest in early-stage companies in any sector, regardless of geography, and invest in 2–3 companies on a weekly basis. As of end-2016, Kima had a portfolio of more than 450 companies in 30 countries worldwide.

Paris-based micro VC Kima Ventures was founded in 2010 by French tech billionaire Xavier Niel and French-Israeli angel investor/entrepreneur Jeremie Berrebi. They invest in early-stage companies in any sector, regardless of geography, and invest in 2–3 companies on a weekly basis. As of end-2016, Kima had a portfolio of more than 450 companies in 30 countries worldwide.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Founded in 2017, Shenzhen Yueke Xintai is a VC firm under the state-owned Technology Financial Group. Founded in 1992, Technology Financial Group began currently manages nine FOFs and 78 other funds, worth RMB 50bn in total. It has provided funding service to over 2,000 tech companies and helped more than 60 businesses go public.

Founded in 2017, Shenzhen Yueke Xintai is a VC firm under the state-owned Technology Financial Group. Founded in 1992, Technology Financial Group began currently manages nine FOFs and 78 other funds, worth RMB 50bn in total. It has provided funding service to over 2,000 tech companies and helped more than 60 businesses go public.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

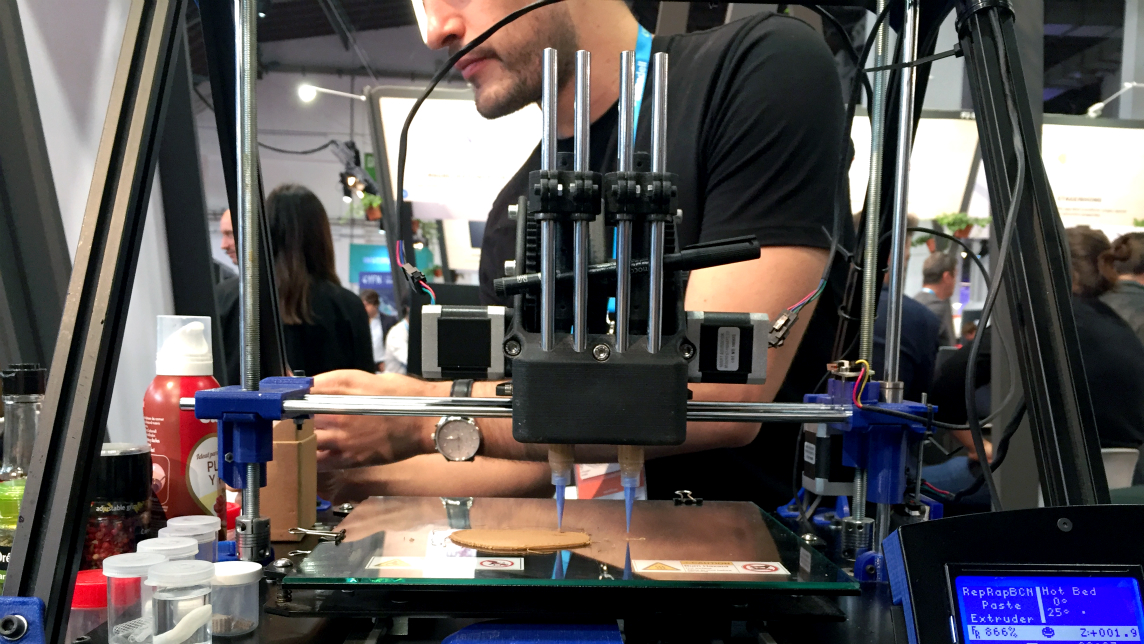

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Shiyin Tech's self-service 3D food printers let you create your own desserts

Anyone with a smartphone can use one of 200 Shiyin Tech 3D printers to produce a chocolate dessert in under five minutes

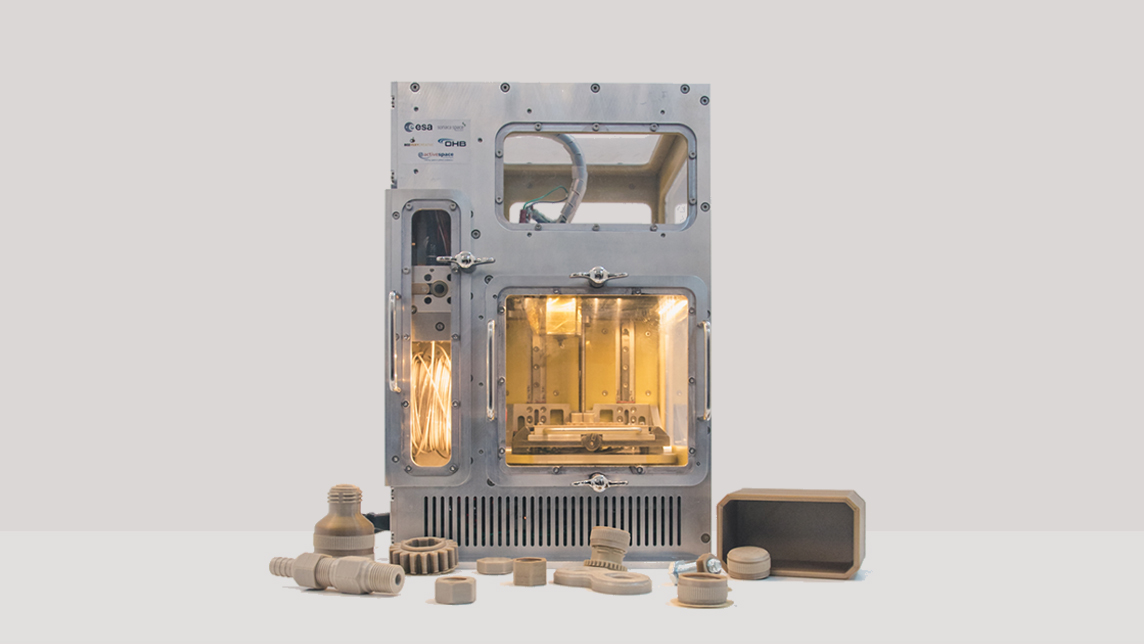

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

3D printing foodtech Natural Machines joins Euronext's pre-IPO training program

With its 3D printed vegan candies and snowflake pizzas, Natural Machines already has more than 300 companies using its Foodini food printer, which it’s upgrading with laser tech for simultaneous cooking too

Sorry, we couldn’t find any matches for“Meat-Tech 3D”.