Meat-Tech 3D

-

DATABASE (494)

-

ARTICLES (468)

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

D Moonshots is an investment fund created by Romanian entrepreneur Sacha Dragic, founder of the Superbets online sports betting group. The Cyprus-based investor was founded in 2019 and typically invests €100,000-500,000. To date, the firm has invested in Romanian medtech Medicai’s €500,000 seed round and UK-based soft-skills VR software Bodyswaps’ £470,000 seed funding.

D Moonshots is an investment fund created by Romanian entrepreneur Sacha Dragic, founder of the Superbets online sports betting group. The Cyprus-based investor was founded in 2019 and typically invests €100,000-500,000. To date, the firm has invested in Romanian medtech Medicai’s €500,000 seed round and UK-based soft-skills VR software Bodyswaps’ £470,000 seed funding.

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

DCVC (formerly Data Collective)

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

CEO and founder of SOURCE Global (formerly Zero Mass Water)

Cody Frieson is the US founder and CEO of SOURCE Global (formerly Zero Mass Water), the first off-grid drinking water production tech based on solar-powered panels. The Arizona State University Fulton Engineering School professor of innovation invented the Hydropanel, the key to SOURCE’s technology, and continues to teach part-time at the university. He is also a fellow at both the NGO Aspen Institute, which is committed to realizing a free, just and equitable society, and also at Unreasonable – an entity composed of entrepreneurs, institutions and investors dedicated to “discover profit in solving global problems.”Frieson was also previously founder, president and CTO of rechargeable zinc battery startup Fluidic Energy, another of his inventions, where he worked from 2007 to 2013, when it was acquired and became NantEnergy. In 2019, Freison won the Lemelson-MIT Student Prize for innovations to benefit the world – the US’ most prestigious student innovation award with a $500,000 prize. Frieson holds a PhD in Materials Science and Engineering from The Massachusetts Institute of Technology (MIT).

Cody Frieson is the US founder and CEO of SOURCE Global (formerly Zero Mass Water), the first off-grid drinking water production tech based on solar-powered panels. The Arizona State University Fulton Engineering School professor of innovation invented the Hydropanel, the key to SOURCE’s technology, and continues to teach part-time at the university. He is also a fellow at both the NGO Aspen Institute, which is committed to realizing a free, just and equitable society, and also at Unreasonable – an entity composed of entrepreneurs, institutions and investors dedicated to “discover profit in solving global problems.”Frieson was also previously founder, president and CTO of rechargeable zinc battery startup Fluidic Energy, another of his inventions, where he worked from 2007 to 2013, when it was acquired and became NantEnergy. In 2019, Freison won the Lemelson-MIT Student Prize for innovations to benefit the world – the US’ most prestigious student innovation award with a $500,000 prize. Frieson holds a PhD in Materials Science and Engineering from The Massachusetts Institute of Technology (MIT).

CEO and co-founder of Carbo Culture

Finnish native Pia Henrietta Moon, has been a scout leader since 2003. Her first job was in event management and tourism operations in India for Sunset Getaways & Insta tourism in 2007. While studying at the University of Economics and Business in Vienna, she met American engineer Christopher Carstens in 2013 at a global solutions innovation program organized by Singularity University in California. She left university in 2014 and co-founded Carbo Culture as CEO in 2016 with Carstens as CTO.In 2016, Moon also joined the electronics company Yleiselektroniikka as a board member, the youngest person in Finland to hold such a position in a listed company. Moon also founded edtech startup Mehackit in 2013 and became its chairwoman for four years. She exited both companies in 2018 to focus on running Carbo Culture.While at university, Moon also worked for over two years at Rails Girls, a not-for-profit for women in tech. In Finland, she joined the student entrepreneurship society in 2011 and completed an internship in 2010 at the Ministry for Foreign Affairs of Finland. In 2015, she joined the World Economic Forum’s Global Shapers youth community initiative in Helsinki.

Finnish native Pia Henrietta Moon, has been a scout leader since 2003. Her first job was in event management and tourism operations in India for Sunset Getaways & Insta tourism in 2007. While studying at the University of Economics and Business in Vienna, she met American engineer Christopher Carstens in 2013 at a global solutions innovation program organized by Singularity University in California. She left university in 2014 and co-founded Carbo Culture as CEO in 2016 with Carstens as CTO.In 2016, Moon also joined the electronics company Yleiselektroniikka as a board member, the youngest person in Finland to hold such a position in a listed company. Moon also founded edtech startup Mehackit in 2013 and became its chairwoman for four years. She exited both companies in 2018 to focus on running Carbo Culture.While at university, Moon also worked for over two years at Rails Girls, a not-for-profit for women in tech. In Finland, she joined the student entrepreneurship society in 2011 and completed an internship in 2010 at the Ministry for Foreign Affairs of Finland. In 2015, she joined the World Economic Forum’s Global Shapers youth community initiative in Helsinki.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Gopher Asset Management is a subsidiary of Noah Holdings, China’s first and largest independent wealth management company and only NYSE-listed wealth manager. Set up in 2010, Gopher’s assets under management reached RMB 86.7 billion in 2015, up 74.3% from 2014. Of these assets, PE/VC assets more than tripled to comprise 43.7% of total portfolio in 2015, versus 20.9% in 2014. Gopher’s investments cover nearly 1,000 high-growth companies in TMT, mobile Internet, IoT, healthcare, high-tech manufacturing and more. In 2016, it is focusing on Internet-based businesses relating to big data in healthcare, education, culture and finance.

Gopher Asset Management is a subsidiary of Noah Holdings, China’s first and largest independent wealth management company and only NYSE-listed wealth manager. Set up in 2010, Gopher’s assets under management reached RMB 86.7 billion in 2015, up 74.3% from 2014. Of these assets, PE/VC assets more than tripled to comprise 43.7% of total portfolio in 2015, versus 20.9% in 2014. Gopher’s investments cover nearly 1,000 high-growth companies in TMT, mobile Internet, IoT, healthcare, high-tech manufacturing and more. In 2016, it is focusing on Internet-based businesses relating to big data in healthcare, education, culture and finance.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

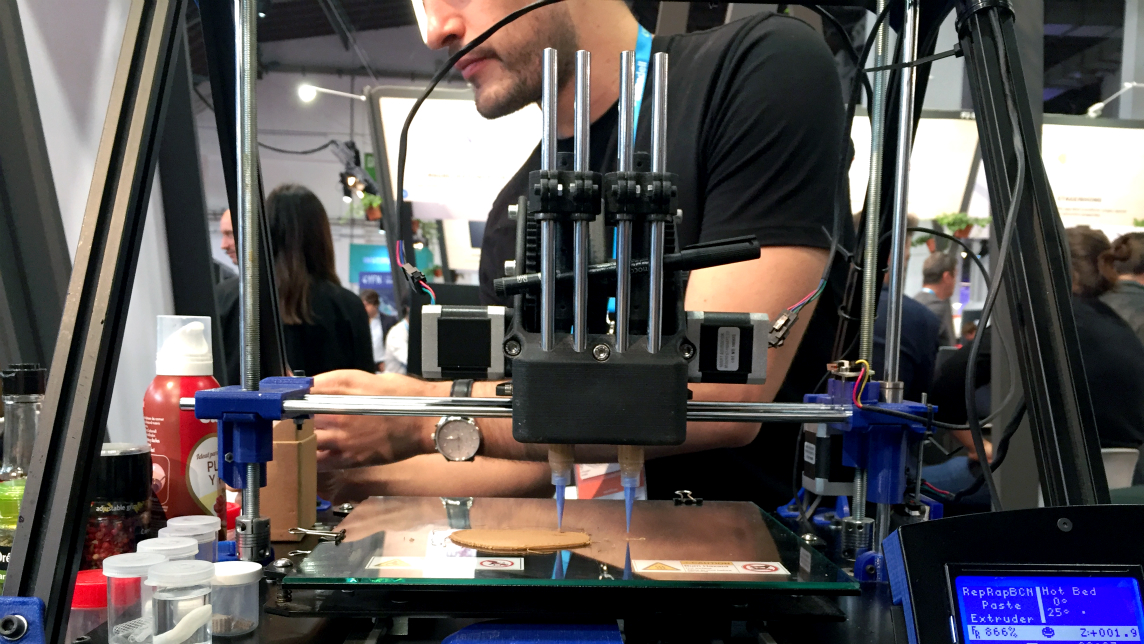

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Shiyin Tech's self-service 3D food printers let you create your own desserts

Anyone with a smartphone can use one of 200 Shiyin Tech 3D printers to produce a chocolate dessert in under five minutes

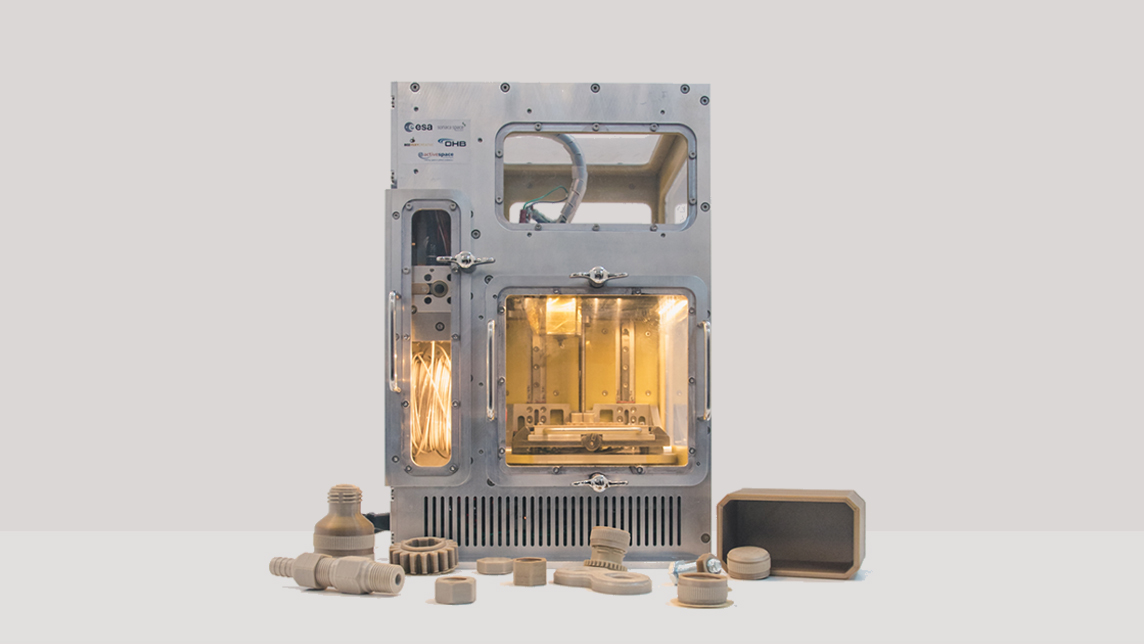

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

3D printing foodtech Natural Machines joins Euronext's pre-IPO training program

With its 3D printed vegan candies and snowflake pizzas, Natural Machines already has more than 300 companies using its Foodini food printer, which it’s upgrading with laser tech for simultaneous cooking too

Sorry, we couldn’t find any matches for“Meat-Tech 3D”.