Middle East

-

DATABASE (54)

-

ARTICLES (123)

Highly successful in the Middle East, Jolly Information Technology is a Chinese cross-border e-commerce company that sells products to over 175 territories with over 20 million registered users. It currently has branches or local operating teams in Hangzhou, Shenzhen, Guangzhou, Hong Kong, the Silicon Valley, Jordan, Saudi Arabia and Dubai. Its online shopping app Jolly is the best-known app in the Middle East.

Highly successful in the Middle East, Jolly Information Technology is a Chinese cross-border e-commerce company that sells products to over 175 territories with over 20 million registered users. It currently has branches or local operating teams in Hangzhou, Shenzhen, Guangzhou, Hong Kong, the Silicon Valley, Jordan, Saudi Arabia and Dubai. Its online shopping app Jolly is the best-known app in the Middle East.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

Co-founder and CEO of Investree

Veteran banker Adrian Asharyanto Gunadi graduated in Accounting from the University of Indonesia and later obtained an MBA from the Rotterdam School of Management, Eramus University. Adrian started his banking career at Citibank in 1998. He was then based at the Standard Chartered Bank in Dubai, UAE, managing global Islamic finance product structuring for the Middle East and North Africa region (MENA), South Asia and Southeast Asia. He specialized in Islamic banking for over eight years at Permata Bank and Bank Muamalat in Indonesia until 2015, when he left to co-found Investree.

Veteran banker Adrian Asharyanto Gunadi graduated in Accounting from the University of Indonesia and later obtained an MBA from the Rotterdam School of Management, Eramus University. Adrian started his banking career at Citibank in 1998. He was then based at the Standard Chartered Bank in Dubai, UAE, managing global Islamic finance product structuring for the Middle East and North Africa region (MENA), South Asia and Southeast Asia. He specialized in Islamic banking for over eight years at Permata Bank and Bank Muamalat in Indonesia until 2015, when he left to co-found Investree.

Co-founder and CEO of TroopTravel

Dennis Vilovic has lived in the Middle East, Africa and Europe; working as an operations and business development consultant for international organizations and private companies. Originally from Germany, Vilovic is the author of many publications and has also participated in the project “HNA Aleppo”, an analysis of the water supply system in Aleppo, Syria.A Socio-Economic Science graduate from the Leuphana University of Lüneburg in Germany, Vilovic established TroopTravel in April 2017. The multi-award winning platform helps corporates to organize global group meetings using Big Data, machine learning and meta-search engines.

Dennis Vilovic has lived in the Middle East, Africa and Europe; working as an operations and business development consultant for international organizations and private companies. Originally from Germany, Vilovic is the author of many publications and has also participated in the project “HNA Aleppo”, an analysis of the water supply system in Aleppo, Syria.A Socio-Economic Science graduate from the Leuphana University of Lüneburg in Germany, Vilovic established TroopTravel in April 2017. The multi-award winning platform helps corporates to organize global group meetings using Big Data, machine learning and meta-search engines.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

Co-founder and COO of Performetric

To help young girls excel in the field of technology, Olaide Olambiwonnu takes time out of running Performetric, the tech startup she co-founded, to mentor middle-school girls. Olambiwonnu holds master’s degrees in Electrical Engineering from UCLA and in Entrepreneurship and Innovation from MIT. She is currently the COO of Performetric.

To help young girls excel in the field of technology, Olaide Olambiwonnu takes time out of running Performetric, the tech startup she co-founded, to mentor middle-school girls. Olambiwonnu holds master’s degrees in Electrical Engineering from UCLA and in Entrepreneurship and Innovation from MIT. She is currently the COO of Performetric.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

Co-founder and CEO of Ekrut

Prior to establishing headhunting platform Ekrut in 2016, Steven Suliawan was an Entrepreneur-in-Residence at East Ventures. While at East Venture, he helped portfolio companies identify potential employees and recognized the need to streamline the manual process of sorting through job applications and resumes. Steven graduated with a bachelor's in Industrial Engineering from Ohio State University, USA.

Prior to establishing headhunting platform Ekrut in 2016, Steven Suliawan was an Entrepreneur-in-Residence at East Ventures. While at East Venture, he helped portfolio companies identify potential employees and recognized the need to streamline the manual process of sorting through job applications and resumes. Steven graduated with a bachelor's in Industrial Engineering from Ohio State University, USA.

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Covid-19: A closer look at how China's businesses and consumer behavior have changed

The lockdown in China has reshaped how people work and live. Some of the changes may be short-term, but others probably have become a part of life

Jojonomic's fintech PaaS helps corporates automate reimbursement, prevent fraud

Jojonomic is used by big companies including Pertamina Patra Niaga, Lazada, Tokopedia and Gojek

Delman helps enterprises wrangle data for machine learning and automation

With fresh $1.6m seed funding and high-profile partners, Delman’s data services are helping Indonesian clients achieve digital transformation

Belva Devara: The whiz kid transforming Indonesia’s education sector

Recently made advisor to the Indonesian president, edtech Ruangguru founder and CEO Belva Devara has also begun mentoring and promoting new startups in Indonesia

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

300 million users in 3 years: Cracking e-commerce the Pinduoduo way

The dark horse of online retail is our key to understanding China's new consumer growth story

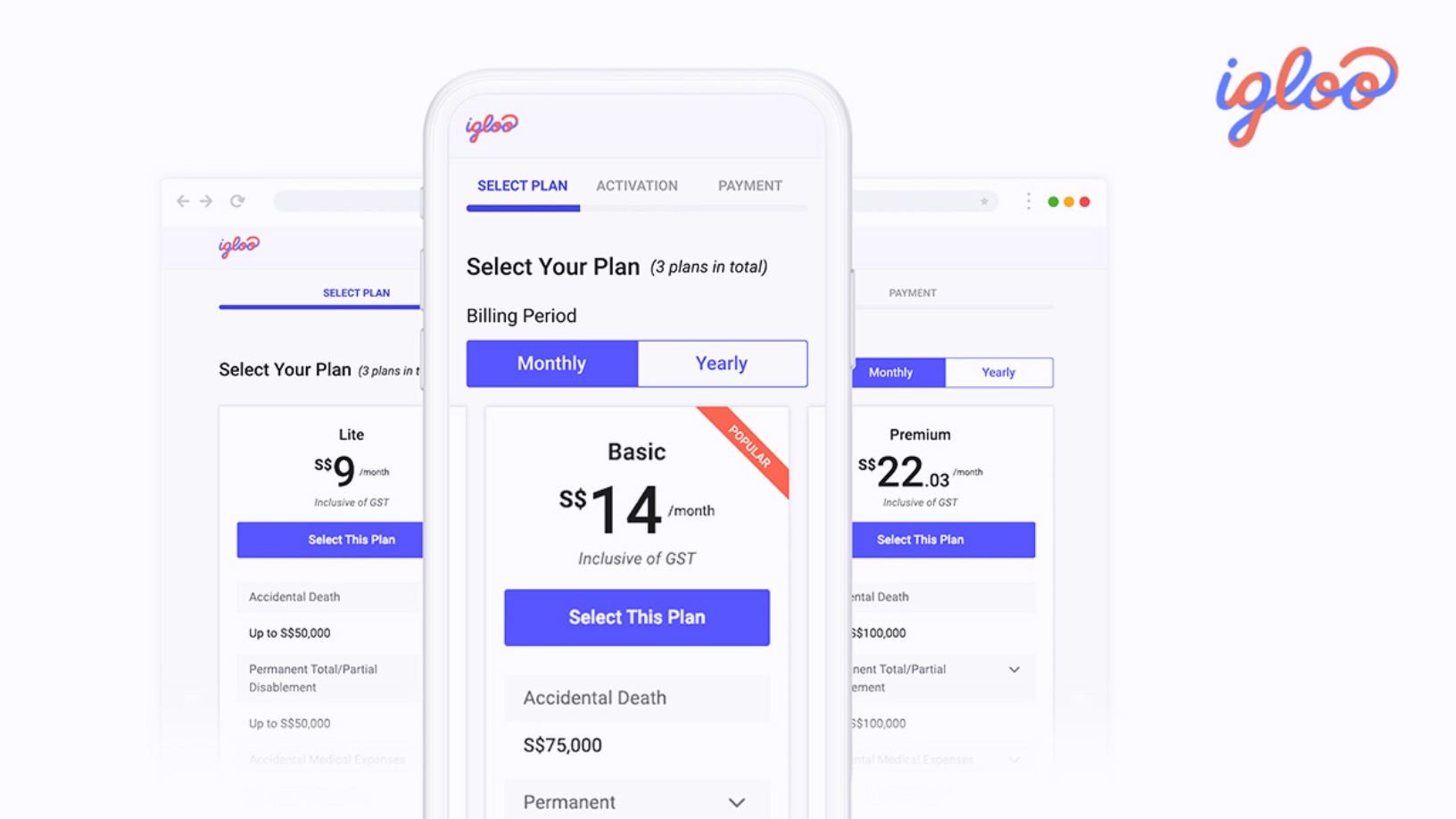

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

After emulating Chinese business models, Indonesian startups seek success abroad

Indonesia adapted and furthered the successful business models that created unicorns in China. Now, it's exporting its own to the rest of Southeast Asia, even beyond

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

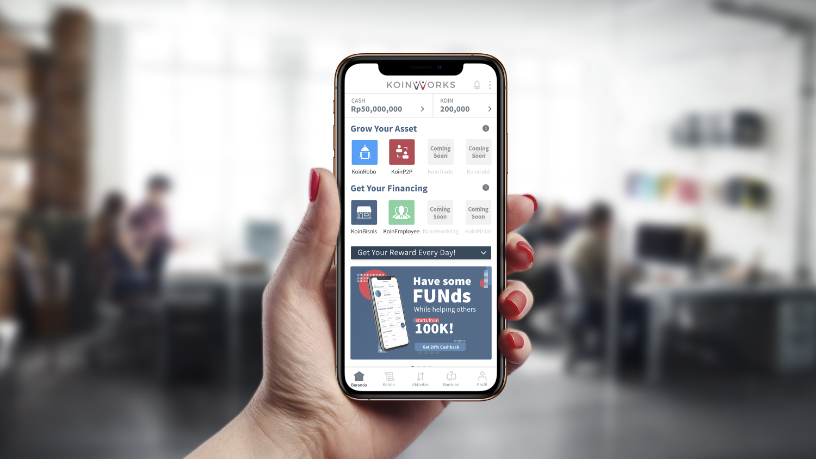

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Indogen Capital on exits, helping foreign startups succeed in Indonesia

Indogen Capital's Managing Partner Chandra Firmanto sheds some light on the VC's partnerships and exits to date, from Venteny to Spacemob

Du'Anyam: Empowering rural women to work independently and learn financial planning skills

Du’Anyam had to cancel bulk orders to survive the Covid-19 downturn, pivoting to B2C online sales, until the tourism and hospitality sectors recover

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Kopi Kenangan serves up an addictive blend of rapid expansion and profitability

Its recent $109m Series B infusion boosts the Indonesian startup's confidence for sustainability and regional expansion despite the current Covid-19 slowdown

Sorry, we couldn’t find any matches for“Middle East”.