Mobile World Congress

-

DATABASE (368)

-

ARTICLES (502)

Focused on seed/early-stage investing, Zhonglu Capital is the private equity arm of Zhonglu Group, controlled by Shanghai investor Chen Rong. It uses owned capital in making equity investment, backing 40 to 50 companies a year in the TMT sectors; and specifically in recent years, in lifestyle O2O, enterprise IT, mobile healthcare, fintech, VR & AR.

Focused on seed/early-stage investing, Zhonglu Capital is the private equity arm of Zhonglu Group, controlled by Shanghai investor Chen Rong. It uses owned capital in making equity investment, backing 40 to 50 companies a year in the TMT sectors; and specifically in recent years, in lifestyle O2O, enterprise IT, mobile healthcare, fintech, VR & AR.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Former investment banker Tian Jiangchuan is co-founder of Initial Venture Capital, which focuses on early-stage investment in the mobile internet, O2O, e-commerce and education sectors. She holds a bachelor’s degree in Statistics and Economics from the University of London, and was an associate director at UBS. Tian was born in 1987.

Former investment banker Tian Jiangchuan is co-founder of Initial Venture Capital, which focuses on early-stage investment in the mobile internet, O2O, e-commerce and education sectors. She holds a bachelor’s degree in Statistics and Economics from the University of London, and was an associate director at UBS. Tian was born in 1987.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Established in Shanghai in 2011, PreAngel Fund has set up six funds with a total of RMB 600 million in assets under management. So far, the firm has invested RMB 300 million in over 300 Chinese and American tech companies in the fields of mobile internet, hardware, healthcare, finance, insurance, e-commerce, sports, among others.

Established in Shanghai in 2011, PreAngel Fund has set up six funds with a total of RMB 600 million in assets under management. So far, the firm has invested RMB 300 million in over 300 Chinese and American tech companies in the fields of mobile internet, hardware, healthcare, finance, insurance, e-commerce, sports, among others.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Toutiao is a mobile news aggregation platform. It has invested in over 30 startups for financial and strategic reasons. Because Toutiao requires a lot of content, it has invested heavily in content-based startups such as AI Era, Kuaikan, etc. It also invests in social media platforms and similar content providers, e.g., Dailyhunt.in, Flipagram and Musical.ly.

Toutiao is a mobile news aggregation platform. It has invested in over 30 startups for financial and strategic reasons. Because Toutiao requires a lot of content, it has invested heavily in content-based startups such as AI Era, Kuaikan, etc. It also invests in social media platforms and similar content providers, e.g., Dailyhunt.in, Flipagram and Musical.ly.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

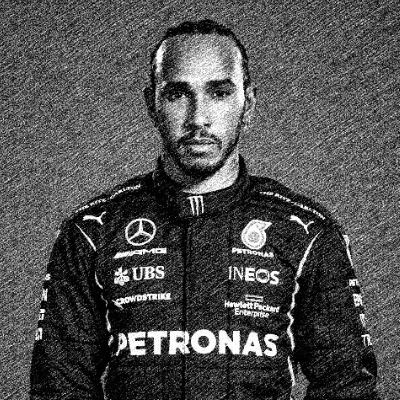

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Co-founder and CEO of Minutes Apps

Angki Rinaldy Lasimpala graduated in 2006 from the Universitas Gunadarma in Indonesia, with an engineering degree in Information Technology. He worked as a systems engineer for two years before venturing into the world of digital marketing.He has worked at various digital marketing companies, such as Klix Digital, PT Numedia Global, Edge Asia and Alpha Salmon. In 2016, he finally decided to become the CEO of Minutes Barber, which he had been developing since 2015. The booking app for barbers was recently rebranded as Minutes Apps, to cover a wide variety of personal grooming services in Indonesia.

Angki Rinaldy Lasimpala graduated in 2006 from the Universitas Gunadarma in Indonesia, with an engineering degree in Information Technology. He worked as a systems engineer for two years before venturing into the world of digital marketing.He has worked at various digital marketing companies, such as Klix Digital, PT Numedia Global, Edge Asia and Alpha Salmon. In 2016, he finally decided to become the CEO of Minutes Barber, which he had been developing since 2015. The booking app for barbers was recently rebranded as Minutes Apps, to cover a wide variety of personal grooming services in Indonesia.

Co-founder and CEO of Konserku (by Konsaato)

National University of Singapore graduate Danny Widodo is a veteran in the entertainment industry. Besides working at JP Morgan as a credit risk analyst, he also had extracurricular interests at Give.sg and the National Arts Council. He left JP Morgan in 2011 to work as a production manager at Resorts World Sentosa for three years. Danny also co-founded an indie music production firm iamLOCALIZED in 2012 that was funded by the NUS Entrepreneurship Centre Innovation/Entrepreneurship Practicum Grant. In 2015, Danny returned to Indonesia and established a concert crowdfunding platform Konsaato that was transformed into Konserku in 2017.

National University of Singapore graduate Danny Widodo is a veteran in the entertainment industry. Besides working at JP Morgan as a credit risk analyst, he also had extracurricular interests at Give.sg and the National Arts Council. He left JP Morgan in 2011 to work as a production manager at Resorts World Sentosa for three years. Danny also co-founded an indie music production firm iamLOCALIZED in 2012 that was funded by the NUS Entrepreneurship Centre Innovation/Entrepreneurship Practicum Grant. In 2015, Danny returned to Indonesia and established a concert crowdfunding platform Konsaato that was transformed into Konserku in 2017.

Co-founder & COO of Ontruck

Indonesian Rika Christanto grew up in the US. A Harvard MBA graduate she has worked as an investment banking analyst in the technology group of Morgan Stanley and has over four years of consultancy experience in McKinsey.Christanto's first experience in the logistics sector was when she worked for an NGO in Uganda leading the operations to create a nationwide dairy supply chain. She left the consultancy world in 2016 to join OnTruck, an innovation-oriented logistics company that optimizes road freight transportation through technology, as a co-founder and CFO. She’s currently the company’s COO, leading both operations and finance.

Indonesian Rika Christanto grew up in the US. A Harvard MBA graduate she has worked as an investment banking analyst in the technology group of Morgan Stanley and has over four years of consultancy experience in McKinsey.Christanto's first experience in the logistics sector was when she worked for an NGO in Uganda leading the operations to create a nationwide dairy supply chain. She left the consultancy world in 2016 to join OnTruck, an innovation-oriented logistics company that optimizes road freight transportation through technology, as a co-founder and CFO. She’s currently the company’s COO, leading both operations and finance.

Co-founder and CEO of Halofina

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Orain: Making vending machines smarter and more profitable

Vending machines can now interact with consumers and offer FMCG retailers valuable data, thanks to smart hardware from Barcelona-based Orain

Teliman: Driver-centered mobility model assisting Malian development

The startup addresses a basic necessity with its on-demand ride-hailing services while supporting the personal and economic progress of its drivers, including empowering women

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

How millennials travel: Waynabox for low-cost, X-factor surprise getaways

Play online vacation games and let computers plan your holidays from just €150

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

Interview with Qlue CEO, part II: Smart cities in Indonesia and beyond

Continuing from the first part of an interview, Qlue CEO Rama Raditya discusses trends, achievements and challenges in smart city development

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

Zoundream: Deciphering and mining the data in baby cries

The world’s first algorithm to translate baby cries into actionable insights for parents and hospitals seeks to boost early detection of pathologies and developmental disorders

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Sorry, we couldn’t find any matches for“Mobile World Congress”.