Monk's Hill Ventures

-

DATABASE (609)

-

ARTICLES (556)

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

Monk’s Hill Ventures is an investment company that builds on the partnership of entrepreneurs who have built and backed global companies based in Silicon Valley and Asia. The firm’s investors are driven to help Southeast Asian companies to expand globally.

Monk’s Hill Ventures is an investment company that builds on the partnership of entrepreneurs who have built and backed global companies based in Silicon Valley and Asia. The firm’s investors are driven to help Southeast Asian companies to expand globally.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Co-founder and CEO of Akseleran

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Co-founder & CEO of Parclick

Luis Paris is co-founder and CEO of Parclick, a parking reservation app. He is an Industrial engineer who built his career in the US, Europe and Venezuela leading projects for HP, Procter & Gamble and British American Tobacco. Paris holds an MBA and a master's in Supply Chain Management. He also attended an executive program at Harvard Business School where he specialized in new internet ventures and an M&A program at the London Business School.

Luis Paris is co-founder and CEO of Parclick, a parking reservation app. He is an Industrial engineer who built his career in the US, Europe and Venezuela leading projects for HP, Procter & Gamble and British American Tobacco. Paris holds an MBA and a master's in Supply Chain Management. He also attended an executive program at Harvard Business School where he specialized in new internet ventures and an M&A program at the London Business School.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Mobike founder Hu Weiwei: A crazy idea that touched millions of lives

In just three years, Hu Weiwei has changed the way over 150 million people travel in the city with her company’s dockless bikes

#WahyooChallenge: From charity to publicity

Inspired by social media trends, the Wahyoo team came up with a way to give back to society, and found their idea going viral

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

TherapyChat: Using AI to scale and improve accuracy in mental health treatment

Business for the Spanish startup has surged ninefold since Covid-19, with the company expanding to the UK and Italy

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

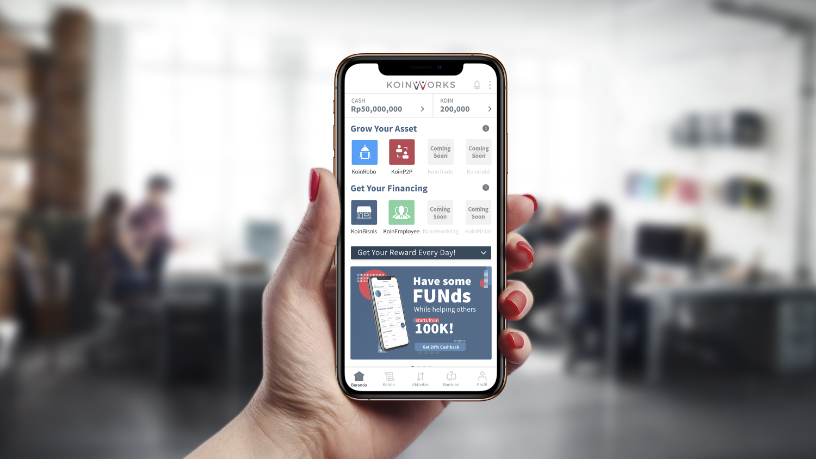

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

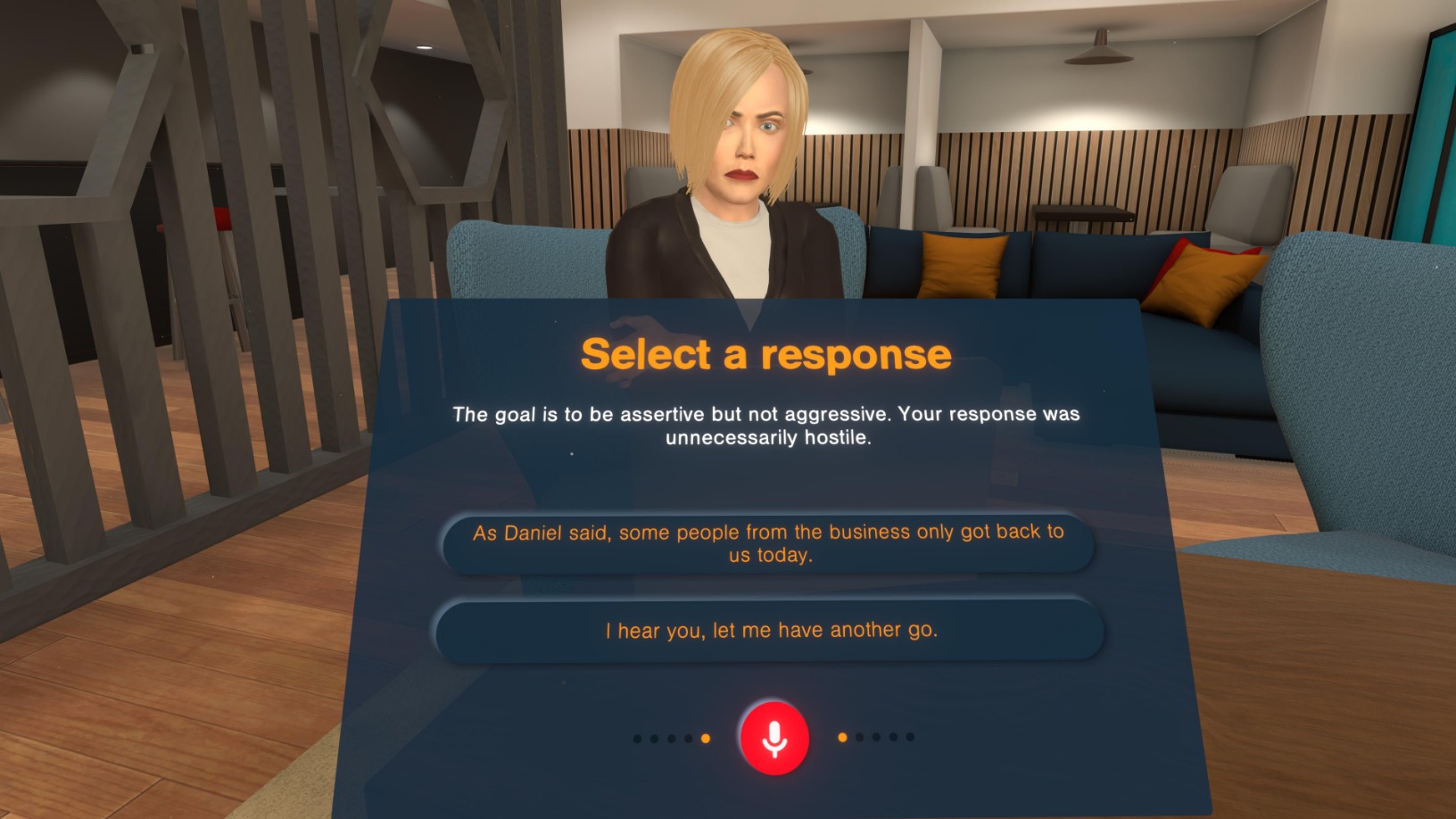

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

China’s startups have much to gain from the US-China trade war

The prolonged trade conflict may be exactly what Chinese startups need to strengthen their technological capabilities

Chat SDK startup Qiscus raising Series A, targets greater Southeast Asian presence

With clients like Bukalapak and Halodoc, the in-app chat specialist looks to expand its market beyond Indonesia

Sorry, we couldn’t find any matches for“Monk's Hill Ventures”.