Monk's Hill Ventures

-

DATABASE (609)

-

ARTICLES (556)

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Co-founder and CEO of Akseleran

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Alex Sicart: Democratizing the Internet with blockchain

The 20-year-old tech wiz and blockchain advocate is seeking a digital revolution where decentralized systems will empower societies

Carbo Culture: Adapting indigenous techniques to remove and store CO2

By turning biomass into biochar, the startup’s technology locks carbon into a stable, solid form, with a storage life of over 2,000 years

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Gojek CEO resigns to join Indonesia's new cabinet; named education minister

Nadiem Makarim was confirmed as Indonesia's education and culture minister and will become "a passive shareholder" in Gojek

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Bewe: From LatAm to the US, scaling fitness and wellness business globally post-Covid

Serial entrepreneur Diego Ballesteros’s latest venture Bewe seeks to disrupt the lucrative US wellness and fitness market with more competitive pricing

How millennials travel: Waynabox for low-cost, X-factor surprise getaways

Play online vacation games and let computers plan your holidays from just €150

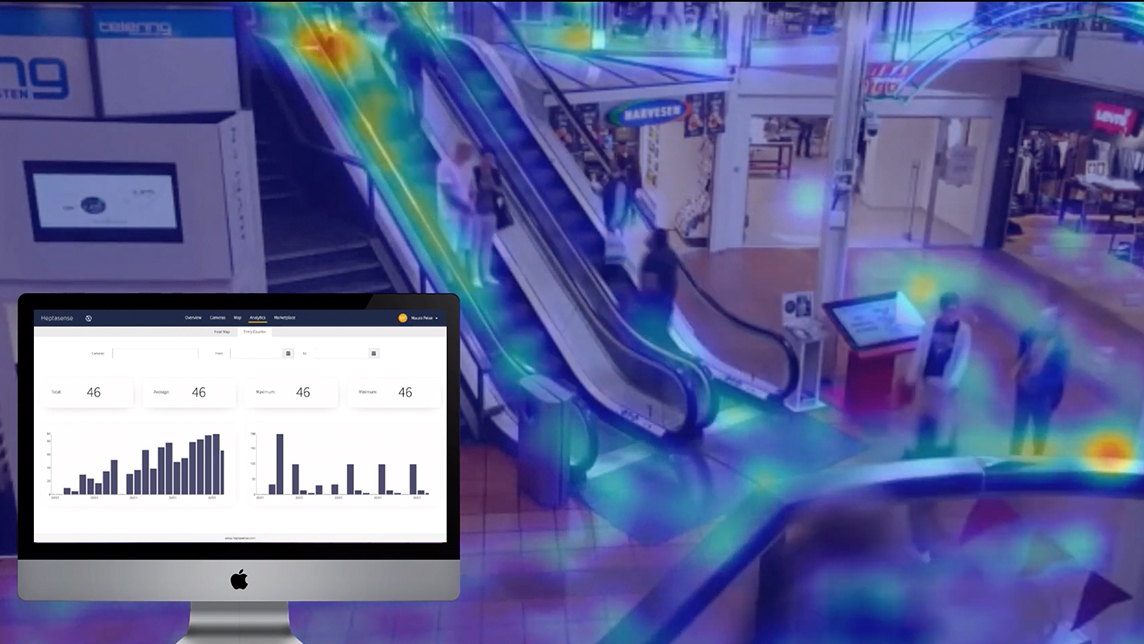

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

Ontruck CTO: How to build, scale technology in the road freight sector

Iterate fast and understand your clients, explains Samuel Fuentes, co-founder and CTO of Ontruck, because "for us, innovation is business as usual”

More than desire: When resale sneakers become objects of speculation

Sneaker resale platforms like Poizon and Nice feel the heat as China regulators panned such trading for getting out of control

Storial: Budding writers test their talent and turn a profit

By helping new authors monetize their work, Storial gives budding literary talent a launching pad

Sorry, we couldn’t find any matches for“Monk's Hill Ventures”.