Monk's Hill Ventures

-

DATABASE (609)

-

ARTICLES (556)

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Headed by the influential Beatriz González, the only woman to helm a VC firm in Spain, Seaya Ventures invests in early-stage startups looking toward international growth, especially in Latin America. Beatriz González is also the daughter of Francisco González Rodríguez, the chairman of Spain’s second largest bank BBVA.

Headed by the influential Beatriz González, the only woman to helm a VC firm in Spain, Seaya Ventures invests in early-stage startups looking toward international growth, especially in Latin America. Beatriz González is also the daughter of Francisco González Rodríguez, the chairman of Spain’s second largest bank BBVA.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

Part of the Zero2IPO VC/PE group, Zero2IPO Ventures was founded in 2011. It co-invests and/or co-leads investment in high-growth Chinese firms in all stages.

Part of the Zero2IPO VC/PE group, Zero2IPO Ventures was founded in 2011. It co-invests and/or co-leads investment in high-growth Chinese firms in all stages.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Founded in 2017, Suzhou Longmen Ventures mainly invests in businesses working on innovative drugs and medical devices. It manages tens of billions RMB in assets.

Founded in 2017, Suzhou Longmen Ventures mainly invests in businesses working on innovative drugs and medical devices. It manages tens of billions RMB in assets.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

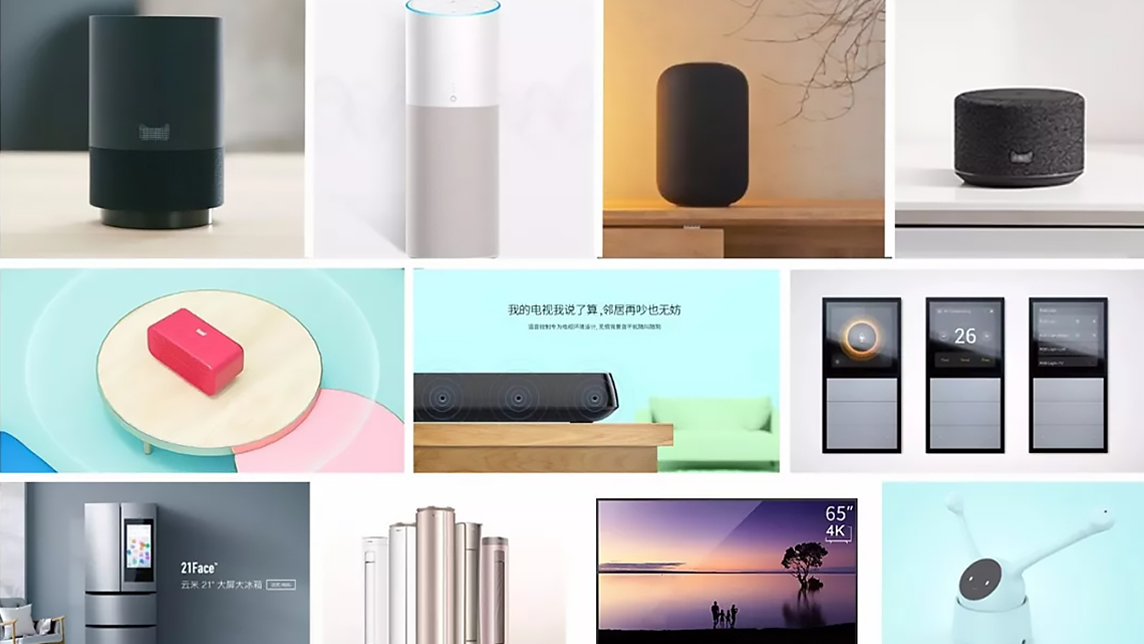

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

iLoF: Accelerating access to personalized medicine, from a drop of blood

Backed by Microsoft’s venture fund M12, Mayfield and Melinda Gates’s Pivotal Ventures, iLoF focuses on painless screening to facilitate disease detection, forecasting and drug development, from Alzheimer’s to Covid-19

Will China ride into a car-sharing future?

Chinese car-sharing startups face reckoning as more than 500 players crowd into a fast-growing, but young, market

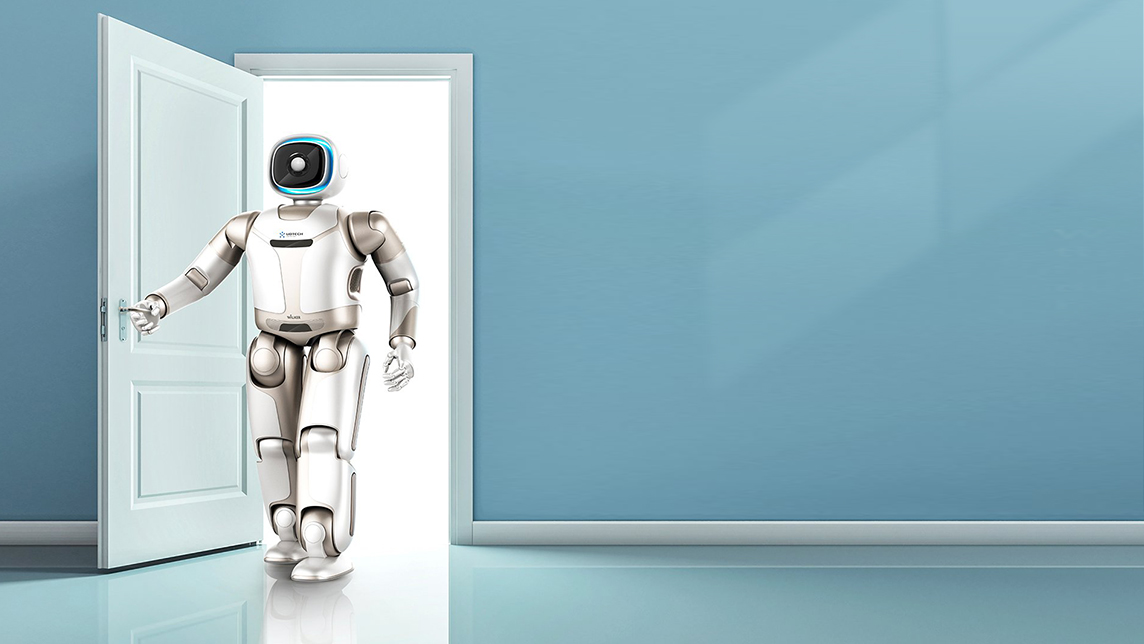

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Bukalapak CEO under fire for tweet about Indonesia’s R&D budget

Achmad Zaky is the latest top startup executive to get embroiled in a politically charged social media storm

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Sorry, we couldn’t find any matches for“Monk's Hill Ventures”.