Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

The Boston-based Grantham Environmental Trust is part of the Grantham Foundation for the Protection of the Environment. The philanthropic organization was founded in 1997 by entrepreneurs Jeremy Grantham and his wife Hannelore as a private foundation controlled by family members. Grantham is chairman and co-founder of investment management firm GMO. The charitable trust has independent trustees like the CEOs of World Wildlife Fund US and the Rocky Mountain Institute. The trust’s Neglected Climate Opportunities LLC invests in little-funded yet promising climate change prevention technologies. Recent investments include the $12m Series A round of Vence, a US-based producer of a virtual fencing wearable for livestock management in May 2021 and the January 2021 investment round of US sustainable electrofuels producer Infinium.

The Boston-based Grantham Environmental Trust is part of the Grantham Foundation for the Protection of the Environment. The philanthropic organization was founded in 1997 by entrepreneurs Jeremy Grantham and his wife Hannelore as a private foundation controlled by family members. Grantham is chairman and co-founder of investment management firm GMO. The charitable trust has independent trustees like the CEOs of World Wildlife Fund US and the Rocky Mountain Institute. The trust’s Neglected Climate Opportunities LLC invests in little-funded yet promising climate change prevention technologies. Recent investments include the $12m Series A round of Vence, a US-based producer of a virtual fencing wearable for livestock management in May 2021 and the January 2021 investment round of US sustainable electrofuels producer Infinium.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Founder and Chairman of the Board of Shenma

Founder and Chairman of the Board at Shenma. In 2009, Chen took over Xindazhou Electric Motorcycles. She helped increase the company’s annual sales volume from 20–30 thousand to 500 thousand motorcycles in six years. During her time at Xindazhou, Chen realized there were significant untapped opportunities in rural financial services and started Shenma.

Founder and Chairman of the Board at Shenma. In 2009, Chen took over Xindazhou Electric Motorcycles. She helped increase the company’s annual sales volume from 20–30 thousand to 500 thousand motorcycles in six years. During her time at Xindazhou, Chen realized there were significant untapped opportunities in rural financial services and started Shenma.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

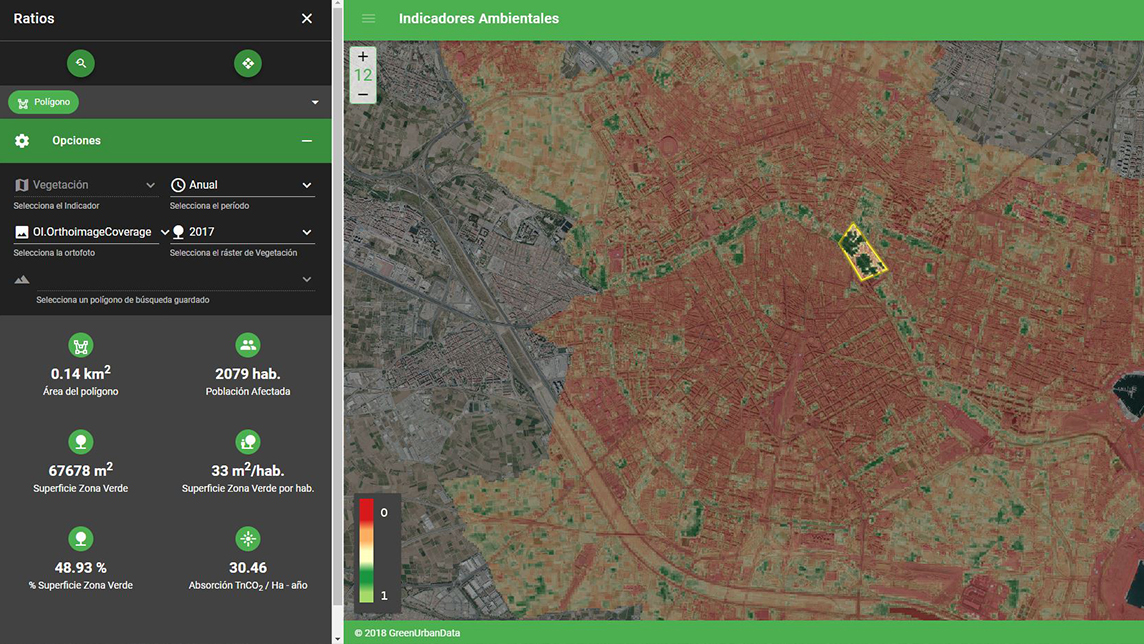

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.