Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

Leonardo DiCaprio is a Hollywood actor and angel investor, who runs his own charitable foundation in aid of climate action, wildlife protection, and ecosystems and communities under threat. Since 1998, the Leonardo DiCaprio Foundation has invested more than $100m in some 132 organizations worldwide, the majority of which are charities. DiCaprio has also invested in 12 for-profit companies in recent years. The most recent of these investments include his 2018 participation in the Series A round for Magnus, an app that has been called Shazam for art, as well as a 4Q17 investment in Swiss deeptech player and provider of VR and AR applications technology, MindMaze.

Leonardo DiCaprio is a Hollywood actor and angel investor, who runs his own charitable foundation in aid of climate action, wildlife protection, and ecosystems and communities under threat. Since 1998, the Leonardo DiCaprio Foundation has invested more than $100m in some 132 organizations worldwide, the majority of which are charities. DiCaprio has also invested in 12 for-profit companies in recent years. The most recent of these investments include his 2018 participation in the Series A round for Magnus, an app that has been called Shazam for art, as well as a 4Q17 investment in Swiss deeptech player and provider of VR and AR applications technology, MindMaze.

Founded by Zhang Guiping, brother of Suning Commerce Group Chairman Zhang Jindong. The Zhang brothers co-founded Suning in 1987 and divided the business in 1999 into Suning Universal, listed as one of the top 20 real estate companies in China, and Suning Commerce, one of the largest appliance retailers in China. The investment conducted by Suning Universal in China mainly focuses on culture and entertainment industry. Suning Universal is expanding to the US, Hong Kong, Singapore, Canada, Australia, France and South Korea, seeking investment opportunities in real estate, entertainment, healthcare, and culture industries.

Founded by Zhang Guiping, brother of Suning Commerce Group Chairman Zhang Jindong. The Zhang brothers co-founded Suning in 1987 and divided the business in 1999 into Suning Universal, listed as one of the top 20 real estate companies in China, and Suning Commerce, one of the largest appliance retailers in China. The investment conducted by Suning Universal in China mainly focuses on culture and entertainment industry. Suning Universal is expanding to the US, Hong Kong, Singapore, Canada, Australia, France and South Korea, seeking investment opportunities in real estate, entertainment, healthcare, and culture industries.

Startupbootcamp Commerce Amsterdam

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

China Literature was founded in March 2015 by merging Tencent Literature and Shanda Literature. It went public on the Stock Exchange of Hong Kong in November 2017. It owns online reading brand Qidian.com and acquired film and television production company New Classic Media in August 2018. It focuses on building a premium e-reading platform at home and abroad while seeking business opportunities in the adaptation of its copyrighted literary works into film and television productions, comics and animation and video games. As at late June 2019, there are over 11.7m pieces of literary works in its online library.

China Literature was founded in March 2015 by merging Tencent Literature and Shanda Literature. It went public on the Stock Exchange of Hong Kong in November 2017. It owns online reading brand Qidian.com and acquired film and television production company New Classic Media in August 2018. It focuses on building a premium e-reading platform at home and abroad while seeking business opportunities in the adaptation of its copyrighted literary works into film and television productions, comics and animation and video games. As at late June 2019, there are over 11.7m pieces of literary works in its online library.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Managing Director and co-founder of String Bio

Vinod Kumar originally founded Samrat Wears clothing company in India in 1993 and went on to graduate in mechanical engineering in 1997 at BMS College of Engineering in India.In 2000, he completed a master’s in supply chain management, industrial and manufacturing systems engineering at Ohio University in the US. He started his career at Bell Labs as a product engineer. In 2000, he worked at telco Alcatel-Lucent that later became part of Nokia. In 2008, he held various senior roles and became senior director at tech company Juniper Networks in Silicon Valley. In 2013, he joined his wife Ezhil Subbian to set up String Bio in India. He became a full-time managing director of the company in 2015. In 2019, he became a fellow member at Unreasonable, an investment fund and organization for supporting innovative entrepreneurs to solve social and environmental issues worldwide.

Vinod Kumar originally founded Samrat Wears clothing company in India in 1993 and went on to graduate in mechanical engineering in 1997 at BMS College of Engineering in India.In 2000, he completed a master’s in supply chain management, industrial and manufacturing systems engineering at Ohio University in the US. He started his career at Bell Labs as a product engineer. In 2000, he worked at telco Alcatel-Lucent that later became part of Nokia. In 2008, he held various senior roles and became senior director at tech company Juniper Networks in Silicon Valley. In 2013, he joined his wife Ezhil Subbian to set up String Bio in India. He became a full-time managing director of the company in 2015. In 2019, he became a fellow member at Unreasonable, an investment fund and organization for supporting innovative entrepreneurs to solve social and environmental issues worldwide.

Shanshui Investment (Born For Maker Fund)

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Castel Capital is a privately-owned Dutch venture capital and equity platform. The company also works with co-investors and private family offices to build bespoke investment portfolios. Castel focuses on both tech and non-tech business opportunities across Europe. Seed funding of €100,000–€500,000 and Series A rounds of €500,000–€1 million are generally available for tech deals. Castel has a hands-on management approach and seeks to add value to the portfolio companies. The firm has invested in 10 startups in diverse sectors like digital health, fintech and transportation.

Castel Capital is a privately-owned Dutch venture capital and equity platform. The company also works with co-investors and private family offices to build bespoke investment portfolios. Castel focuses on both tech and non-tech business opportunities across Europe. Seed funding of €100,000–€500,000 and Series A rounds of €500,000–€1 million are generally available for tech deals. Castel has a hands-on management approach and seeks to add value to the portfolio companies. The firm has invested in 10 startups in diverse sectors like digital health, fintech and transportation.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

CEO and Co-founder of Plastic Bank

David Katz is the Canadian co-founder, president and CEO of Plastic Bank, a-first-of-a-kind social enterprise startup that monetizes plastic waste collection for some of the world’s poorest communities. Katz was inspired by a university seminar about recycling plastic waste in 2013 and founded Plastic Bank with CTO and brand strategist Shaun Frankson in Vancouver.In 2019, he became a fellow for the Unreasonable Group’s Impact Hub in Vancouver, an organization that supports social and environmental entrepreneurship. In 2011, he also founded Vancouver’s Core Values Institute, a consulting and global thought leadership platform for entrepreneurs.In 2014, he was also president of Vancouver’s chapter of the Entrepreneurs Organization for one year. He was named Global Citizen of the Year in 2014 by the international organization that has a network of over 10,000 business owners in 131 chapters across 40 countries. He also won the 2017 UN Lighthouse award for Planetary Health and Plastic Bank received the Paris COP21 Climate Conference Sustania Community Award in 2015.Katz completed a diploma in Hospitality Administration & Management at the British Columbia Institute of Technology in 1991 and started his own business in 1992 as founder and CEO of Nero Alarms. From 2005 to 2014, Katz worked full-time as the founder and president of Nero Global Tracking, a SaaS platform created to monitor the operations of mobile service vehicles. Nero SaaS is used in many Canadian cities and by the nation’s Defence Ministry. The company is now part of Vecima Networks Inc.

David Katz is the Canadian co-founder, president and CEO of Plastic Bank, a-first-of-a-kind social enterprise startup that monetizes plastic waste collection for some of the world’s poorest communities. Katz was inspired by a university seminar about recycling plastic waste in 2013 and founded Plastic Bank with CTO and brand strategist Shaun Frankson in Vancouver.In 2019, he became a fellow for the Unreasonable Group’s Impact Hub in Vancouver, an organization that supports social and environmental entrepreneurship. In 2011, he also founded Vancouver’s Core Values Institute, a consulting and global thought leadership platform for entrepreneurs.In 2014, he was also president of Vancouver’s chapter of the Entrepreneurs Organization for one year. He was named Global Citizen of the Year in 2014 by the international organization that has a network of over 10,000 business owners in 131 chapters across 40 countries. He also won the 2017 UN Lighthouse award for Planetary Health and Plastic Bank received the Paris COP21 Climate Conference Sustania Community Award in 2015.Katz completed a diploma in Hospitality Administration & Management at the British Columbia Institute of Technology in 1991 and started his own business in 1992 as founder and CEO of Nero Alarms. From 2005 to 2014, Katz worked full-time as the founder and president of Nero Global Tracking, a SaaS platform created to monitor the operations of mobile service vehicles. Nero SaaS is used in many Canadian cities and by the nation’s Defence Ministry. The company is now part of Vecima Networks Inc.

CCO and co-founder of Modulous Tech

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

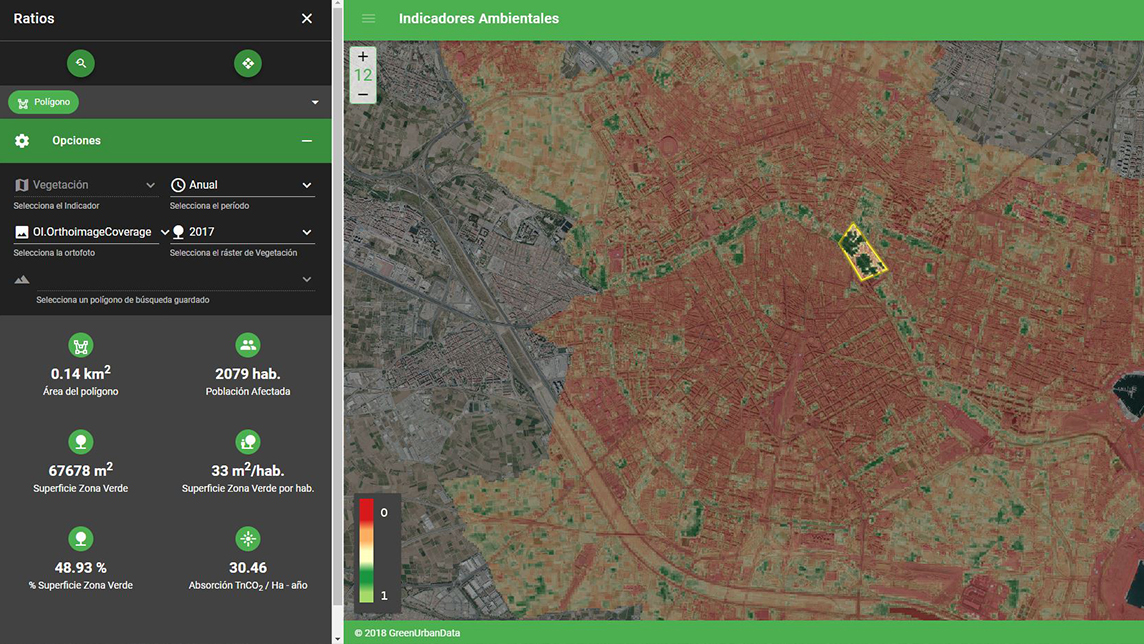

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.