Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

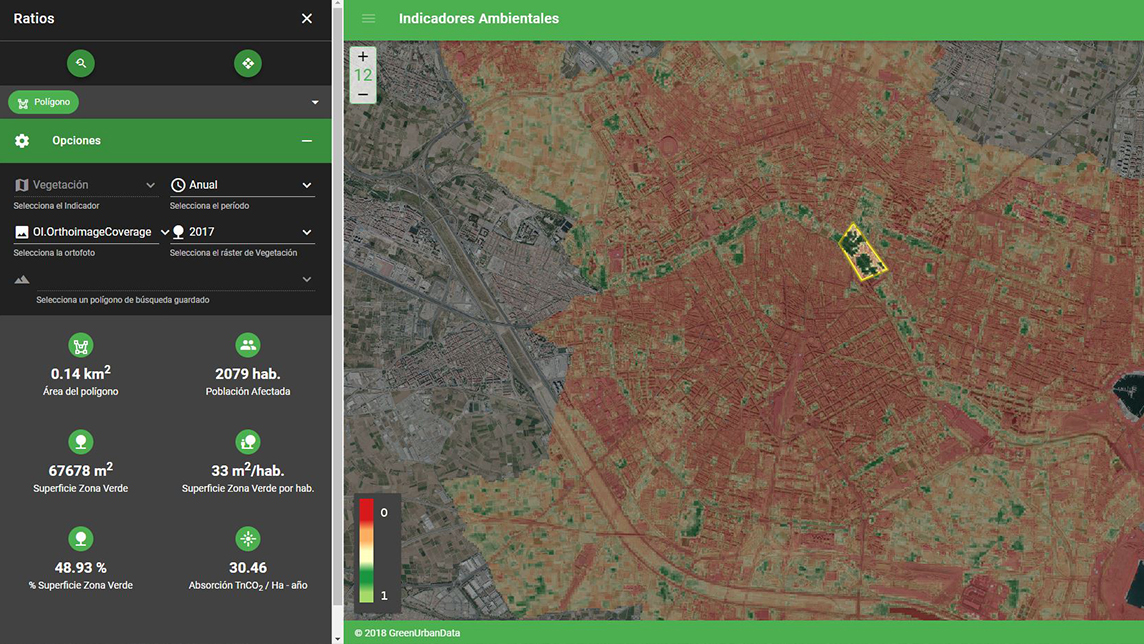

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.