Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

The world’s most valuable fintech firm, Ant Financial Services originated from Alipay, the third-party payments platform under the Alibaba Group. Today, it also runs a money-market fund and an online bank. Ant Financial has more than 450 million active users. It has also expanded into foreign markets, including the US, UK, Germany, Thailand and Australia, and expects more than 60% of its transactions to come from outside China by 2026. It targets to serve 2 billion users then.

The world’s most valuable fintech firm, Ant Financial Services originated from Alipay, the third-party payments platform under the Alibaba Group. Today, it also runs a money-market fund and an online bank. Ant Financial has more than 450 million active users. It has also expanded into foreign markets, including the US, UK, Germany, Thailand and Australia, and expects more than 60% of its transactions to come from outside China by 2026. It targets to serve 2 billion users then.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

La Famiglia is a Munich-based VC fund founded in 2016, comprising family businesses, tech entrepreneurs, business angels and industry experts led by Jeanette Fürstenberg and Robert Lacher. To date, it has managed one exit, API payroll engine, Rollbox. It has invested in 23 companies, including in OnTruck's Series B round and in the Series A round of CloudNC, Coya, Asana Rebel and FreightHub. Logistics and AI are two principal areas of interest for its investments.

La Famiglia is a Munich-based VC fund founded in 2016, comprising family businesses, tech entrepreneurs, business angels and industry experts led by Jeanette Fürstenberg and Robert Lacher. To date, it has managed one exit, API payroll engine, Rollbox. It has invested in 23 companies, including in OnTruck's Series B round and in the Series A round of CloudNC, Coya, Asana Rebel and FreightHub. Logistics and AI are two principal areas of interest for its investments.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Yangon-based social impact investor Phandeeyar Accelerator was born out of Code for Change Myanmar, a series of hackathons in 2014 and its accelerator is the Yangon chapter of Founder Institute. It is a keen part of Myanmar’s nascent tech ecosystem.With a $2m fund, the VC began investing in local startups in 2017 with a maximum funding of $25,000. It has invested in 17 companies including restaurant booking app Resdi and apartment sharing app Nay Var.

Yangon-based social impact investor Phandeeyar Accelerator was born out of Code for Change Myanmar, a series of hackathons in 2014 and its accelerator is the Yangon chapter of Founder Institute. It is a keen part of Myanmar’s nascent tech ecosystem.With a $2m fund, the VC began investing in local startups in 2017 with a maximum funding of $25,000. It has invested in 17 companies including restaurant booking app Resdi and apartment sharing app Nay Var.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

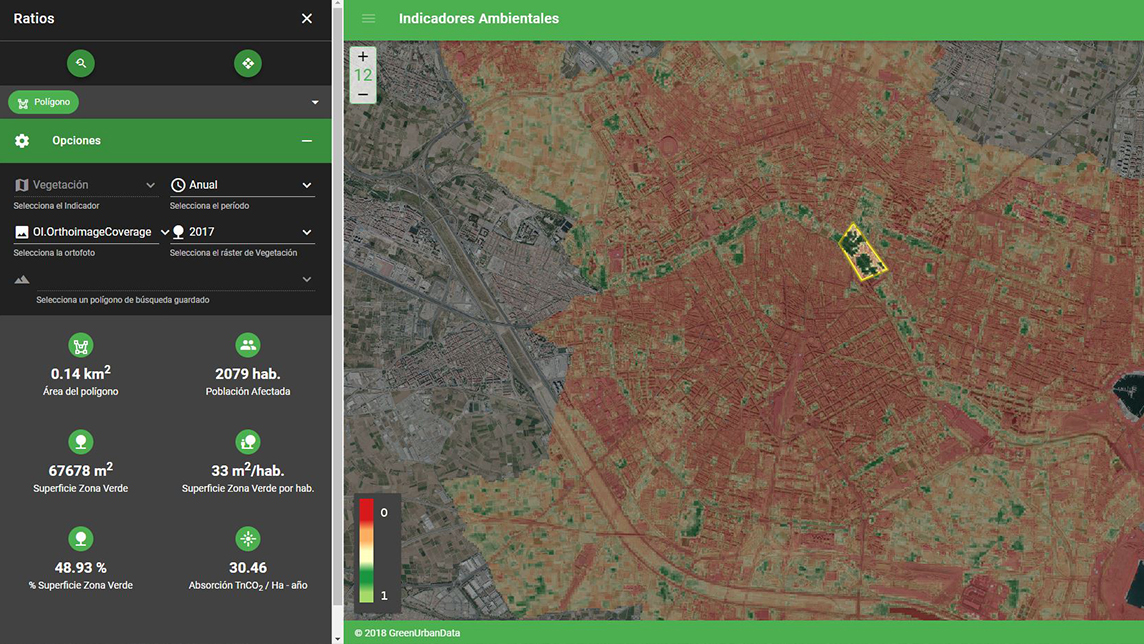

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.