Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

CPO and Co-founder of Kuaishou

Cheng Yixiao began his career as a software engineer at HP in Dalian where he met Kuaishou co-founder Yang Yuanxi. Cheng left HP to join Renren as an iPhone client software developer.In 2011, Cheng started a photo-sharing platform GIF Kuaishou and obtained some seed funding. In 2013, he was introduced to a successful entrepreneur Su Hua. They decided to pivot GIF Kuaishou into a video-sharing app, with Cheng as CPO and Su as CEO.Many believe that his earlier experiences of living in Tieling, a county in northeast China, and later in Beijing’s suburb Tiantongyuan, have helped him to identify business opportunities and develop social media tools for the grassroots. He has quite a reputation for his creativity and passion for product development in tech circles.

Cheng Yixiao began his career as a software engineer at HP in Dalian where he met Kuaishou co-founder Yang Yuanxi. Cheng left HP to join Renren as an iPhone client software developer.In 2011, Cheng started a photo-sharing platform GIF Kuaishou and obtained some seed funding. In 2013, he was introduced to a successful entrepreneur Su Hua. They decided to pivot GIF Kuaishou into a video-sharing app, with Cheng as CPO and Su as CEO.Many believe that his earlier experiences of living in Tieling, a county in northeast China, and later in Beijing’s suburb Tiantongyuan, have helped him to identify business opportunities and develop social media tools for the grassroots. He has quite a reputation for his creativity and passion for product development in tech circles.

Cloud Angel Fund was co-founded by China Broadband Capital, Sequoia China, Northern Light Venture Capital, GSR Ventures and Wu Capital in 2013. It operates as a VC firm and invests mainly in early-stage startups in China.

Cloud Angel Fund was co-founded by China Broadband Capital, Sequoia China, Northern Light Venture Capital, GSR Ventures and Wu Capital in 2013. It operates as a VC firm and invests mainly in early-stage startups in China.

CGN Industrial Investment Fund

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Co-founder, CEO and CFO of Growpal

Ahmad Rizqy Akbar is the CEO and CFO of Growpal, an investment crowdfunding platform for aquaculture and fishery projects. A graduate of Aquaculture studies from Indonesia’s Universitas Brawijaya, he has run his own fish and shrimp farm and had worked at Pertamina Dana Ventura, a venture capital fund owned by national oil and gas firm Pertamina. In 2017, he joined fellow Brawijaya graduate Paundra Noorbaskoro to establish Growpal.

Ahmad Rizqy Akbar is the CEO and CFO of Growpal, an investment crowdfunding platform for aquaculture and fishery projects. A graduate of Aquaculture studies from Indonesia’s Universitas Brawijaya, he has run his own fish and shrimp farm and had worked at Pertamina Dana Ventura, a venture capital fund owned by national oil and gas firm Pertamina. In 2017, he joined fellow Brawijaya graduate Paundra Noorbaskoro to establish Growpal.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Shansheng Equity Investment Fund

Shansheng Equity Investment Fund was launched in September 2020 with Beijing Huayao Zhongwei Investment Management as its manager.

Shansheng Equity Investment Fund was launched in September 2020 with Beijing Huayao Zhongwei Investment Management as its manager.

Co-founder and CEO of Seekmi

University of British Columbia alumna Clarissa Leung had worked as a software engineer at ATR Humanoid Robotics Computational Neuroscience, Panasonic and Barclays Investment bank before dipping her toes into the entrepreneurial world in Canada. After her MBA at Queen’s University in Ontario, Clarissa moved to Indonesia in 2014 to join venture capital fund AccelerAsia as managing director. However, she left a year later to become a co-founder of on-demand household services startup Seekmi and was appointed its CEO in 2016.

University of British Columbia alumna Clarissa Leung had worked as a software engineer at ATR Humanoid Robotics Computational Neuroscience, Panasonic and Barclays Investment bank before dipping her toes into the entrepreneurial world in Canada. After her MBA at Queen’s University in Ontario, Clarissa moved to Indonesia in 2014 to join venture capital fund AccelerAsia as managing director. However, she left a year later to become a co-founder of on-demand household services startup Seekmi and was appointed its CEO in 2016.

CEO and Co-founder of Cambricon Technologies

Founder and CEO of Cambricon Technologies. Chen, who has more than 10 years of experience in the field of artificial intelligence, is a professor at the Chinese Academy of Sciences. He graduated from the Special Class for the Gifted Young of the University of Science and Technology of China, a program that selects and nurtures the most intelligent Chinese students. Chen has received financial support from the National Science Fund for Distinguished Young Scholars, which was launched by the National Natural Science Foundation of China.

Founder and CEO of Cambricon Technologies. Chen, who has more than 10 years of experience in the field of artificial intelligence, is a professor at the Chinese Academy of Sciences. He graduated from the Special Class for the Gifted Young of the University of Science and Technology of China, a program that selects and nurtures the most intelligent Chinese students. Chen has received financial support from the National Science Fund for Distinguished Young Scholars, which was launched by the National Natural Science Foundation of China.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

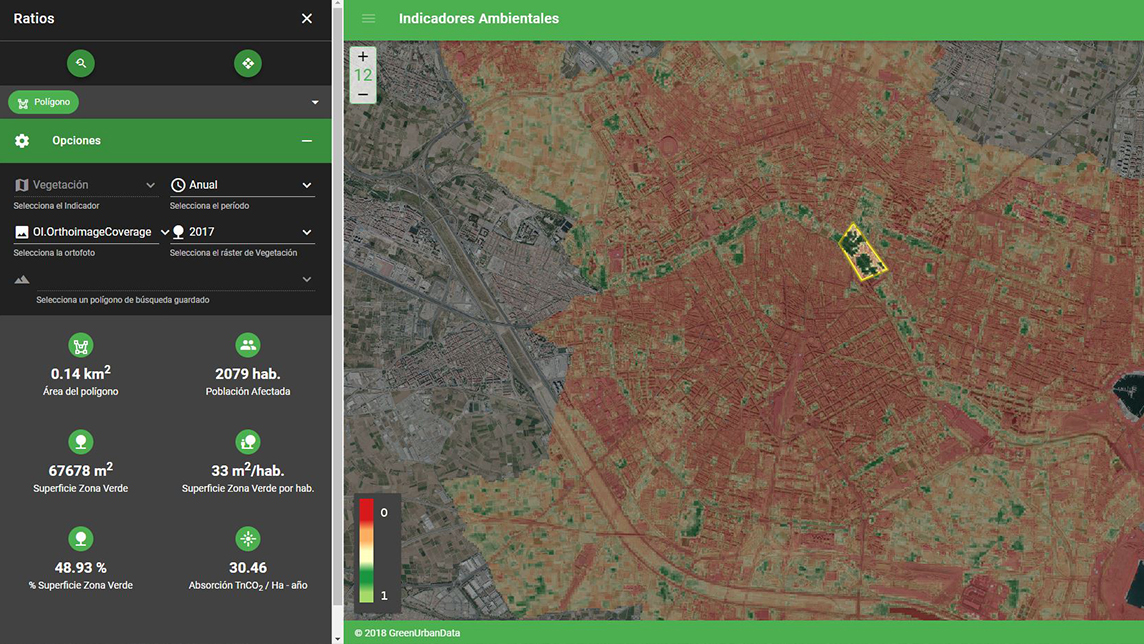

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.