Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Karnataka Information and Biotechnology Venture Fund (KITVEN)

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Co-founder and Commissioner of Tanamduit

Indra Suryawan is the co-founder of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Between 1997 and 2001, he was the department head of business and development at Bank Bali. He later joined Jatis Solutions, which specializes in developing enterprise IT applications, leaving as deputy CEO in 2010. Between 2013 and 2017, Indra was the CEO of PT Digital Artha Media, which developed Bank Mandiri's e-cash system. Indra holds a master's in Management and Finance from Prasetiya Mulya Business School, Indonesia.

Indra Suryawan is the co-founder of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Between 1997 and 2001, he was the department head of business and development at Bank Bali. He later joined Jatis Solutions, which specializes in developing enterprise IT applications, leaving as deputy CEO in 2010. Between 2013 and 2017, Indra was the CEO of PT Digital Artha Media, which developed Bank Mandiri's e-cash system. Indra holds a master's in Management and Finance from Prasetiya Mulya Business School, Indonesia.

Co-founder and CEO of Tanamduit

Rini Hapsari is currently the CEO of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Her career spans IT and banking, working at Bank Bali and Lippo Bank between 1999 and 2004. From 2005 to 2010, she worked at enterprise IT firm Jatis Solutions, becoming the head of the division in charge of Jatis' Avantrade wealth management software. She was also vice president at Bakrie Telecom between 2012 and 2015. Rini graduated from the University of Indonesia with a bachelor's degree in Anthropology.

Rini Hapsari is currently the CEO of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Her career spans IT and banking, working at Bank Bali and Lippo Bank between 1999 and 2004. From 2005 to 2010, she worked at enterprise IT firm Jatis Solutions, becoming the head of the division in charge of Jatis' Avantrade wealth management software. She was also vice president at Bakrie Telecom between 2012 and 2015. Rini graduated from the University of Indonesia with a bachelor's degree in Anthropology.

Co-founder and Technology & Innovation Director of Tanamduit

Ferry Aprilianto has over 17 years of experience as an IT engineer. From 2000 to 2005, he was a project manager at enterprise IT firm Jatis Solutions, where he worked on mutual fund distribution systems for major Indonesian banks. In 2005, he became an independent IT consultant, working for companies in Indonesia and the Philippines. In 2013, he joined the company that developed Bank Mandiri's e-cash system, Digital Artha Media, as an IT architect. Ferry graduated from the University of Indonesia with a bachelor's in Electrical and Electronic Engineering.

Ferry Aprilianto has over 17 years of experience as an IT engineer. From 2000 to 2005, he was a project manager at enterprise IT firm Jatis Solutions, where he worked on mutual fund distribution systems for major Indonesian banks. In 2005, he became an independent IT consultant, working for companies in Indonesia and the Philippines. In 2013, he joined the company that developed Bank Mandiri's e-cash system, Digital Artha Media, as an IT architect. Ferry graduated from the University of Indonesia with a bachelor's in Electrical and Electronic Engineering.

Yuantai Investment Partners Fund

Yuantai Investment Partners Fund is co-founded by You Qingyi, the partner of China Soft Investment Corporation, and Shao Yangdong, the former financial analyst in investment banking department of Salomon Brothers Inc. with more than 20 years experience in investment.

Yuantai Investment Partners Fund is co-founded by You Qingyi, the partner of China Soft Investment Corporation, and Shao Yangdong, the former financial analyst in investment banking department of Salomon Brothers Inc. with more than 20 years experience in investment.

CEO of Krakakoa

Sabrina Mustopo is the founder and CEO of Krakakoa Chocolate, a "farmer-to-bar" social enterprise that works directly with smallholder cocoa farmers to produce chocolate. She is also an independent consultant with experience in strategy, project management, agriculture and sustainable development. Mustopo previously worked in Singapore as an associate and research analyst for international consultancy McKinsey & Co., where she focused on climate change and agricultural topics and served public sector clients in the Asia-Pacific region and East Africa. She graduated magna cum laude from Cornell University in Ithaca, New York, with a Bachelor of Science degree in International Agriculture and Rural Development.

Sabrina Mustopo is the founder and CEO of Krakakoa Chocolate, a "farmer-to-bar" social enterprise that works directly with smallholder cocoa farmers to produce chocolate. She is also an independent consultant with experience in strategy, project management, agriculture and sustainable development. Mustopo previously worked in Singapore as an associate and research analyst for international consultancy McKinsey & Co., where she focused on climate change and agricultural topics and served public sector clients in the Asia-Pacific region and East Africa. She graduated magna cum laude from Cornell University in Ithaca, New York, with a Bachelor of Science degree in International Agriculture and Rural Development.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

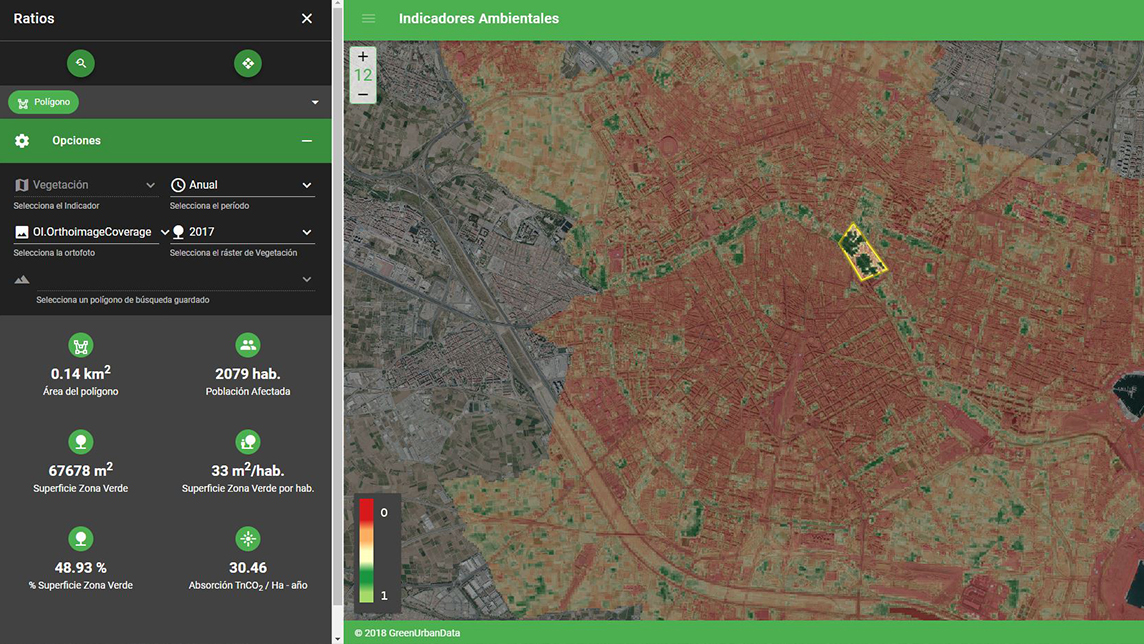

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.