Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Co-founder of Mapan by Ruma

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

CEO and founder of ATRenew (formerly Aihuishou)

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Co-founder and CTO of McFly

Liu Long graduated from Northwestern Polytechnic University based in Xi'an in 2010. The Information and Computing Science graduate went on to the Institute of Remote Sensing Applications (IRSA) at the Chinese Academy of Sciences to pursue a PhD in Microwave Remote Sensing in 2015. He stayed on at the IRSA as a research fellow with funding support from the Youth Science Fund program under the National Natural Science Foundation of China. In 2016, he co-founded agtech startup McFly with two Wuhan University alumni who are also experts in remote sensing technology.

Liu Long graduated from Northwestern Polytechnic University based in Xi'an in 2010. The Information and Computing Science graduate went on to the Institute of Remote Sensing Applications (IRSA) at the Chinese Academy of Sciences to pursue a PhD in Microwave Remote Sensing in 2015. He stayed on at the IRSA as a research fellow with funding support from the Youth Science Fund program under the National Natural Science Foundation of China. In 2016, he co-founded agtech startup McFly with two Wuhan University alumni who are also experts in remote sensing technology.

Pearson Affordable Learning Fund

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

Light-Up Capital (Dianliang Fund)

Founded in 2013 by Long Wei, a co-founder of Dianping, Light-Up Capital (also known as Dianliang Fund) focuses on companies in early through growth stage with specialization in robotics, artificial intelligence, mobile internet and mobile healthcare.

Founded in 2013 by Long Wei, a co-founder of Dianping, Light-Up Capital (also known as Dianliang Fund) focuses on companies in early through growth stage with specialization in robotics, artificial intelligence, mobile internet and mobile healthcare.

Co-founder, CEO of Heptasense

In 2017, Ricardo Santos became the CEO and co-founder of Heptasense. In November 2018, the Portuguese national has also founded Rocha Capital, a private fund to invest in other startups. Santos obtained a master's in Electrical and Computer Engineering from the Higher Technical Institute in Lisbon in 2015. He also has a degree in Biomedical Engineering and Biophysics from the University of Lisbon. Prior to co-founding Heptasense, he was a research fellow at the Portuguese Institute of Biophysics and Biomedical Engineering. He was also a Biomedical Engineering summer intern at the University of Nottingham in the UK in 2013.

In 2017, Ricardo Santos became the CEO and co-founder of Heptasense. In November 2018, the Portuguese national has also founded Rocha Capital, a private fund to invest in other startups. Santos obtained a master's in Electrical and Computer Engineering from the Higher Technical Institute in Lisbon in 2015. He also has a degree in Biomedical Engineering and Biophysics from the University of Lisbon. Prior to co-founding Heptasense, he was a research fellow at the Portuguese Institute of Biophysics and Biomedical Engineering. He was also a Biomedical Engineering summer intern at the University of Nottingham in the UK in 2013.

CEO and co-founder of Scoobic Urban Mobility

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

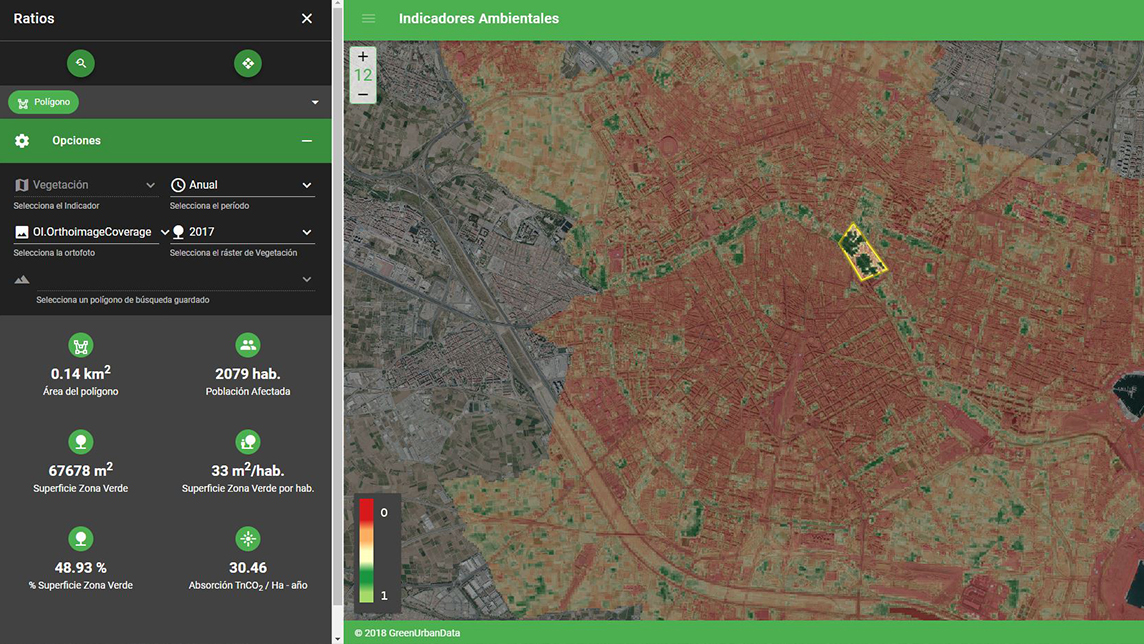

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.