Neglected Climate Opportunities Fund

-

DATABASE (441)

-

ARTICLES (395)

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

Co-founder of Tonic App

couldnt find a colour picDavid Bórsos is the Hungarian-born co-founder of Tonic App for medical doctors and currently works as an officer at the European Investment Fund in Luxembourg. He co-founded Tonic App after studying for his MBA at IE Business School in Madrid, where he met the rest of the co-founding team. Bórsos previously worked as Head of Business Intelligence at Job Today and as a Business Analyst at various levels at Goodyear, both in Luxembourg. He also holds a BSc from Deberceni Egyetem in Hungary and worked for Samsung Electronics and TVA in the same country.

couldnt find a colour picDavid Bórsos is the Hungarian-born co-founder of Tonic App for medical doctors and currently works as an officer at the European Investment Fund in Luxembourg. He co-founded Tonic App after studying for his MBA at IE Business School in Madrid, where he met the rest of the co-founding team. Bórsos previously worked as Head of Business Intelligence at Job Today and as a Business Analyst at various levels at Goodyear, both in Luxembourg. He also holds a BSc from Deberceni Egyetem in Hungary and worked for Samsung Electronics and TVA in the same country.

Co-Founder and CEO of Lemonilo

Harvard Law graduate Shinta Nurfauzia earned her bachelor's degree in law at Universitas Indonesia. After working as a banking and finance associate at Allen & Overy Indonesia, and as a law associate at Lubis, Santosa & Maramis, Nurfauzia received the prestigious Indonesia Endowment Fund For Education Scholarship to Harvard Law School. Post-Harvard, Nurfauzia worked as a consultant to the Indonesian government sustainability program (REDD+) before founding the healthcare platform Konsula. She started her first business at 14 years old, a pancake business, and then a luxury bag reseller business.After Konsula pivoted to health food company Lemonilo, Nurfauzia remained at the company. She is currently Lemonilo’s co-CEO, sharing the role with Ronald Wijaya.

Harvard Law graduate Shinta Nurfauzia earned her bachelor's degree in law at Universitas Indonesia. After working as a banking and finance associate at Allen & Overy Indonesia, and as a law associate at Lubis, Santosa & Maramis, Nurfauzia received the prestigious Indonesia Endowment Fund For Education Scholarship to Harvard Law School. Post-Harvard, Nurfauzia worked as a consultant to the Indonesian government sustainability program (REDD+) before founding the healthcare platform Konsula. She started her first business at 14 years old, a pancake business, and then a luxury bag reseller business.After Konsula pivoted to health food company Lemonilo, Nurfauzia remained at the company. She is currently Lemonilo’s co-CEO, sharing the role with Ronald Wijaya.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

CreditEase New Financial Industry Investment Fund

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Founded in 1993, WI Harper Group is a venture capital firm investing in early to growth stage companies across the US, Greater China and Asia Pacific. The group has invested in more than 400 companies in the fields of healthcare, biotech, artificial intelligence, robotics, fintech, sustainability and new media. It manages seven venture capital funds with over 100 successful IPO and M&A exits. With three strategic offices in San Francisco, Beijing and Taipei, the group seeks investment opportunities both in the US and Asia.

Founded in 1993, WI Harper Group is a venture capital firm investing in early to growth stage companies across the US, Greater China and Asia Pacific. The group has invested in more than 400 companies in the fields of healthcare, biotech, artificial intelligence, robotics, fintech, sustainability and new media. It manages seven venture capital funds with over 100 successful IPO and M&A exits. With three strategic offices in San Francisco, Beijing and Taipei, the group seeks investment opportunities both in the US and Asia.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

Guangzhou Yuexiu Industrial Investment Fund Management

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Qianhai Fund of Funds (Qianhai FoF)

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

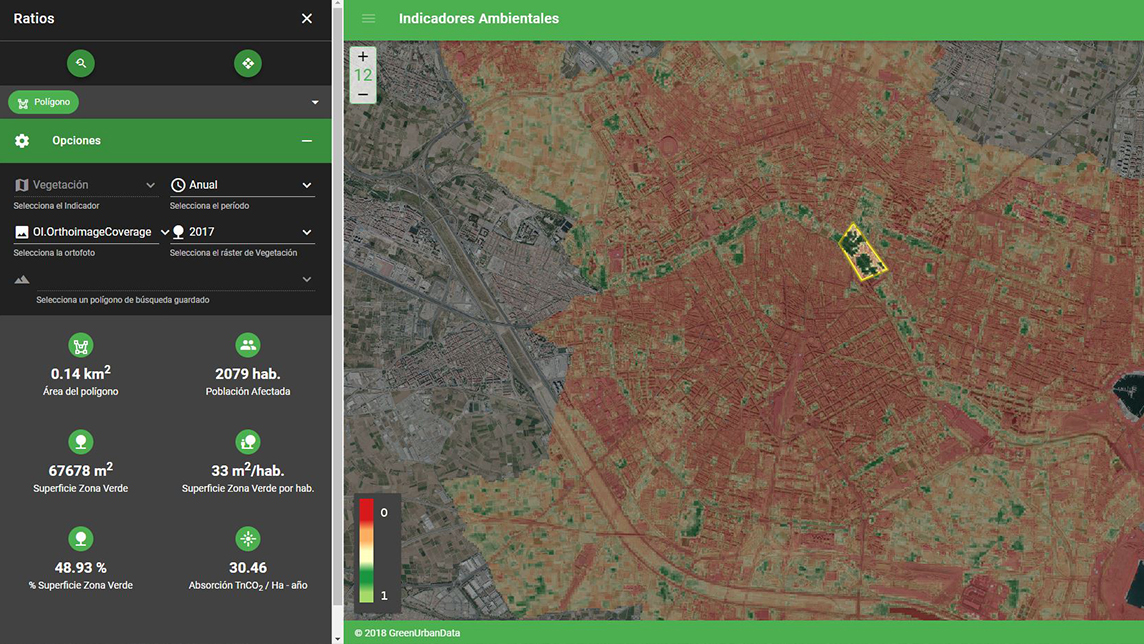

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“Neglected Climate Opportunities Fund”.