New Energy Nexus

-

DATABASE (490)

-

ARTICLES (714)

Technical advisor and co-founder of Bygen

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Forebright Capital originates from the PE investment team established in 2001 under the state-owned China Everbright which is listed in Hong Kong. Everbright was spun off in May 2014 as an independent company. With money raised from institutional investors and family offices at home and abroad, Forebright Capital currently manages four US-dollar funds. It mainly invests in sectors of clean energy, healthcare and fintech.

Forebright Capital originates from the PE investment team established in 2001 under the state-owned China Everbright which is listed in Hong Kong. Everbright was spun off in May 2014 as an independent company. With money raised from institutional investors and family offices at home and abroad, Forebright Capital currently manages four US-dollar funds. It mainly invests in sectors of clean energy, healthcare and fintech.

Co-founder and Joint CEO of Otten Coffee

A son of an entrepreneur, Jhoni Kusno is familiar with the world of entrepreneurship. Even though online business was new to the graduate from Mikroskil Medan, his passion for coffee inspired him to start a coffee supplies shop in January 2012. Long time Medan friend and college mate, Robin Boe joined his startup in October 2012 as a co-founder and joint CEO of Otten Coffee.

A son of an entrepreneur, Jhoni Kusno is familiar with the world of entrepreneurship. Even though online business was new to the graduate from Mikroskil Medan, his passion for coffee inspired him to start a coffee supplies shop in January 2012. Long time Medan friend and college mate, Robin Boe joined his startup in October 2012 as a co-founder and joint CEO of Otten Coffee.

Co-founder, CEO and Director of Business Development of Taralite, Co-founder and CEO of Hangry

Serial entrepreneur Abraham Viktor co-founded a bread enterprise Kayafood and a light concrete business Ixacon, while still a Finance undergraduate at Universitas Indonesia. After graduating in 2013, he worked as an analyst at the Boston Consulting Group and Nomura. In January 2015, he co-founded wedding fintech Wedlite that quickly led to the development of a new consumer and business loans platform Taralite.

Serial entrepreneur Abraham Viktor co-founded a bread enterprise Kayafood and a light concrete business Ixacon, while still a Finance undergraduate at Universitas Indonesia. After graduating in 2013, he worked as an analyst at the Boston Consulting Group and Nomura. In January 2015, he co-founded wedding fintech Wedlite that quickly led to the development of a new consumer and business loans platform Taralite.

CSO and Co-founder of WeDoctor (Guahao)

Zhang Xiaochun co-founded WeDoctor with Liao Jieyuan in 2010 and now serves as its CSO. He has a master's degree from Dongbei University of Finance and Economics and has worked in the Internet industry since 2000.The former CEO of Galaxy Internet Television was also the general manager of CNR New Media, a subsidiary of CNR (China National Radio) Media Group.

Zhang Xiaochun co-founded WeDoctor with Liao Jieyuan in 2010 and now serves as its CSO. He has a master's degree from Dongbei University of Finance and Economics and has worked in the Internet industry since 2000.The former CEO of Galaxy Internet Television was also the general manager of CNR New Media, a subsidiary of CNR (China National Radio) Media Group.

CTO and co-founder of Singrow

Xu Tao is a PhD candidate in molecular biology at NUS. He invented the Strawberry Hydroponic System. From 2016 to 2017, he also co-founded XMJ Agritech Co. Ltd in China. From 2015 to 2016, he was the technical director of the Institute of New Rural Development at Shanxi Agricultural University in China. He currently serves as CTO at Singrow.

Xu Tao is a PhD candidate in molecular biology at NUS. He invented the Strawberry Hydroponic System. From 2016 to 2017, he also co-founded XMJ Agritech Co. Ltd in China. From 2015 to 2016, he was the technical director of the Institute of New Rural Development at Shanxi Agricultural University in China. He currently serves as CTO at Singrow.

Pioneering SaaS with AI-refined content keeps healthcare workers up-to-date on the latest treatments, including clinical simulations with tests and research personalized to users.

Pioneering SaaS with AI-refined content keeps healthcare workers up-to-date on the latest treatments, including clinical simulations with tests and research personalized to users.

Spain’s fastest-growing car-as-a-service startup, now acquired by the Renault Group, is profit-making and operates across Spain, France and Italy, with 10,000+ subscribers.

Spain’s fastest-growing car-as-a-service startup, now acquired by the Renault Group, is profit-making and operates across Spain, France and Italy, with 10,000+ subscribers.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Orange 100 enables clients to launch pop-up shops quickly and easily in over 20 Chinese cities by connecting them with landlords and support service providers.

Orange 100 enables clients to launch pop-up shops quickly and easily in over 20 Chinese cities by connecting them with landlords and support service providers.

China’s first wardrobe-leasing app for women – the largest in Asia – allows customers to rent designer pieces from more than 500 high-end brands.

China’s first wardrobe-leasing app for women – the largest in Asia – allows customers to rent designer pieces from more than 500 high-end brands.

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

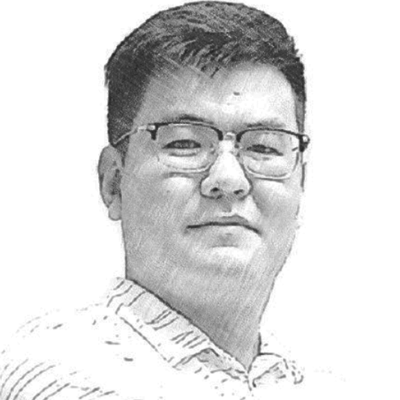

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

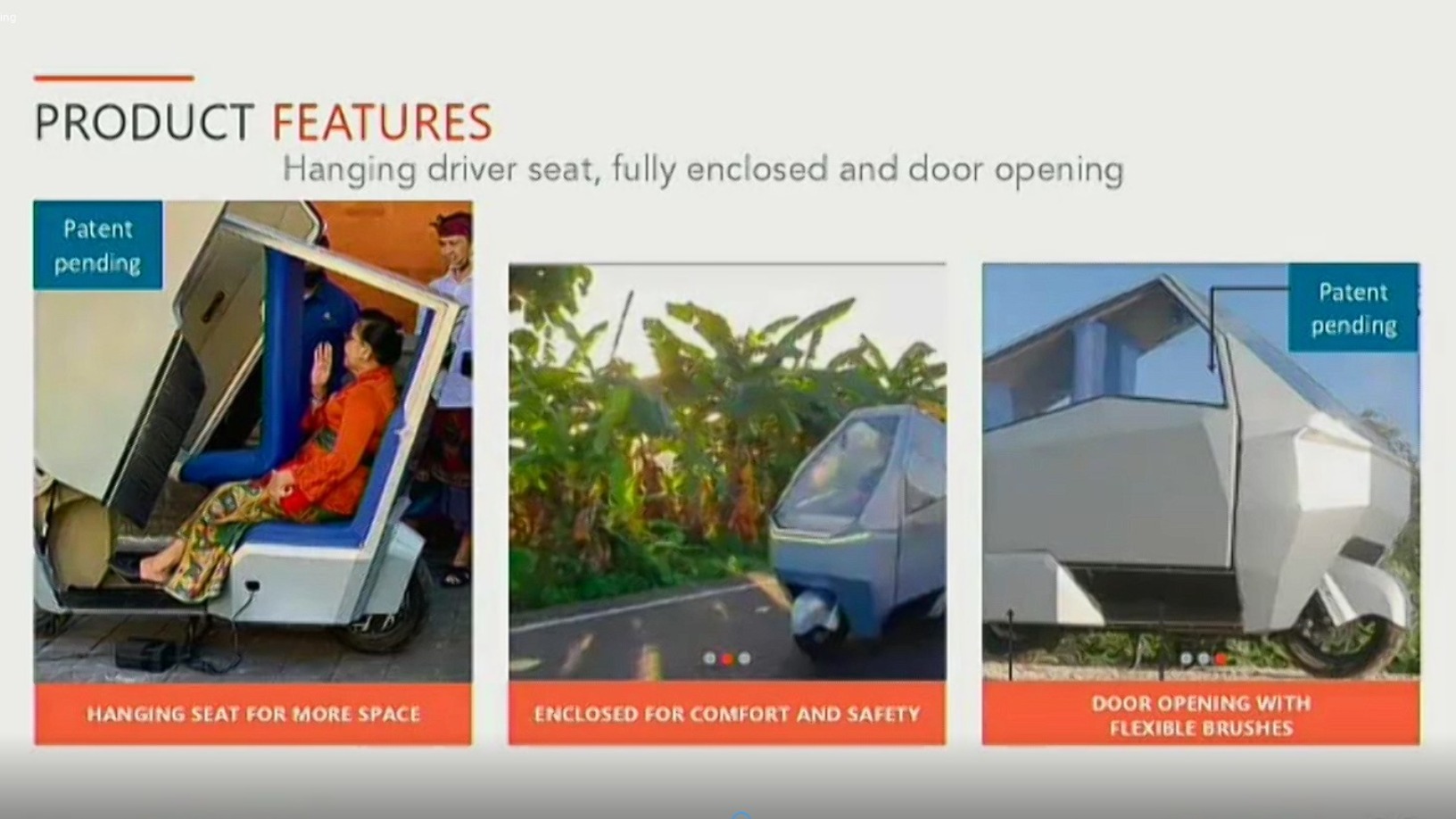

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

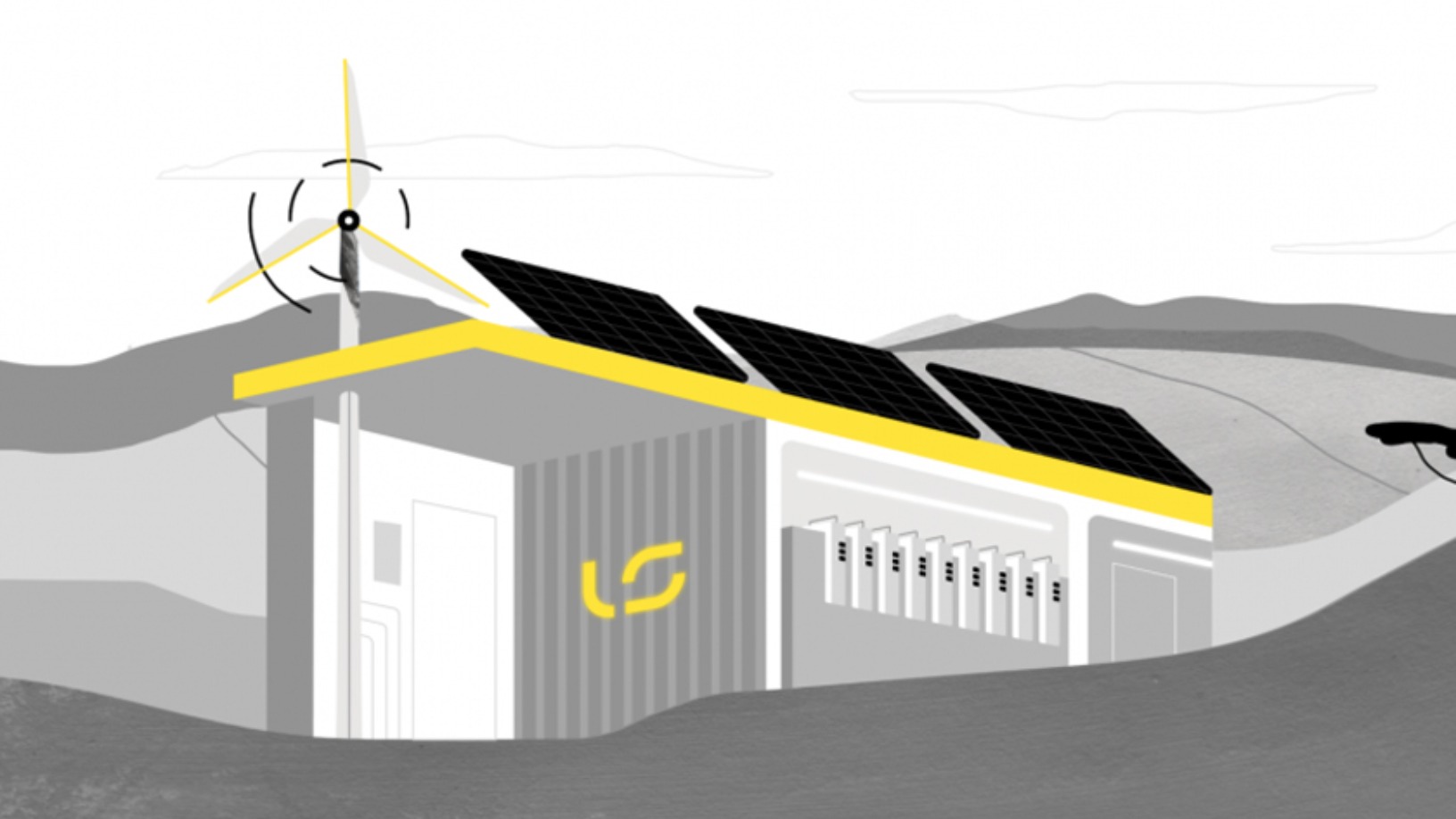

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Sorry, we couldn’t find any matches for“New Energy Nexus”.