New Energy Nexus

-

DATABASE (490)

-

ARTICLES (714)

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

BlackRock was founded in New York in 1988 by a group of Wall Streeters led by Laurence D. Fink. As of April 2019, it has US$6.25 trillion in assets under management. BlackRock, which has 70 offices in 30 countries, manages assets for clients in more than 100 countries. Clients include individual investors, foundations, companies and governments.

BlackRock was founded in New York in 1988 by a group of Wall Streeters led by Laurence D. Fink. As of April 2019, it has US$6.25 trillion in assets under management. BlackRock, which has 70 offices in 30 countries, manages assets for clients in more than 100 countries. Clients include individual investors, foundations, companies and governments.

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Huayi Brothers Media Corporation

Established in 1994 by Wang Zhongjun and Wang Zhonglei, Huayi Brothers Media Corporation (H. Brothers) is a large media and entertainment group in mainland China. It focuses on three major areas: film, TV and celebrity management; commercial properties that promote entertainment companies’ IP such as theme parks and film-themed tourist destinations; and new media projects such as social media, online gaming and internet fan community management. Alibaba, Tencent Holdings and PingAn have all been shareholders in H. Brothers since 2014.

Established in 1994 by Wang Zhongjun and Wang Zhonglei, Huayi Brothers Media Corporation (H. Brothers) is a large media and entertainment group in mainland China. It focuses on three major areas: film, TV and celebrity management; commercial properties that promote entertainment companies’ IP such as theme parks and film-themed tourist destinations; and new media projects such as social media, online gaming and internet fan community management. Alibaba, Tencent Holdings and PingAn have all been shareholders in H. Brothers since 2014.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

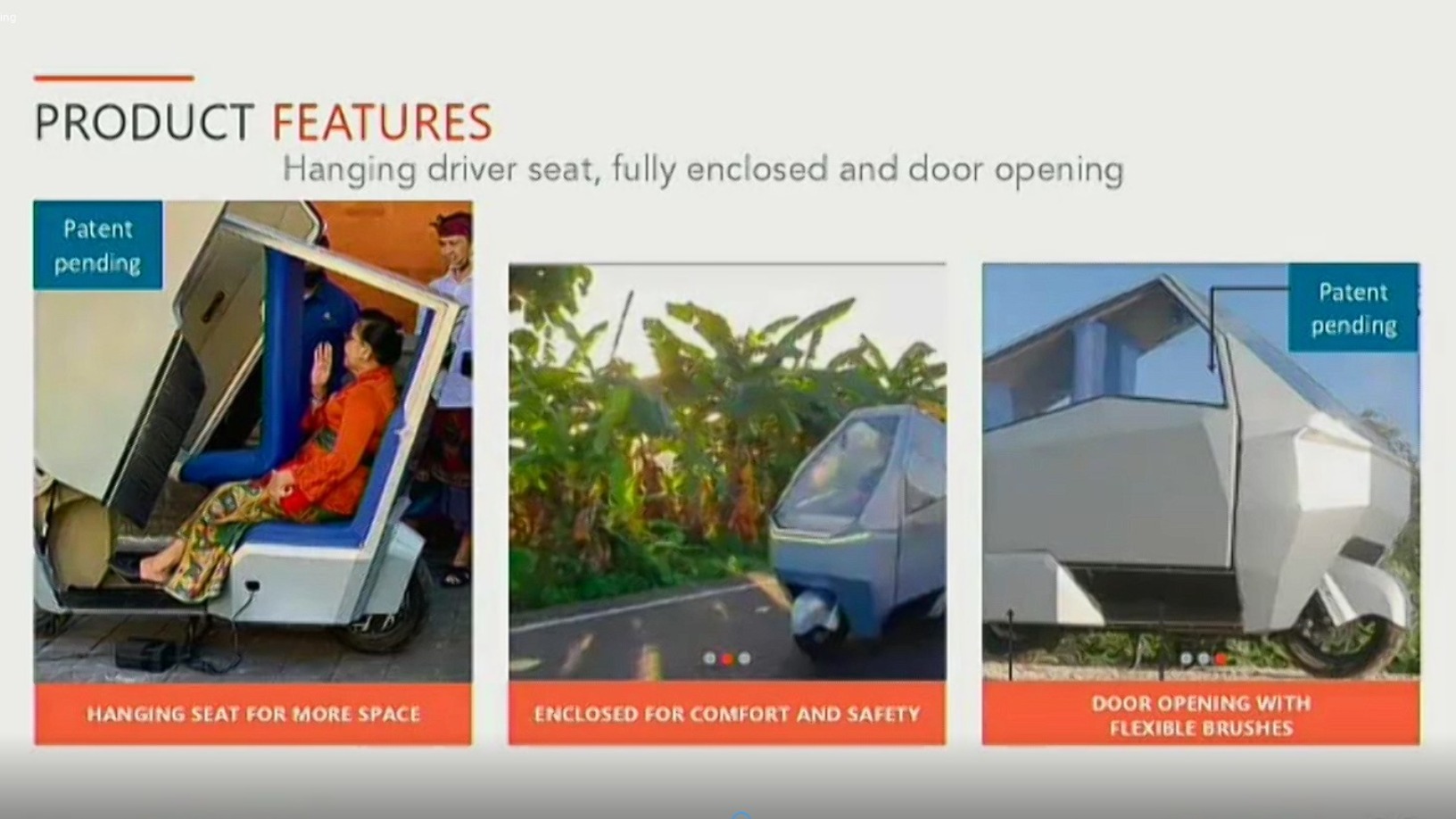

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

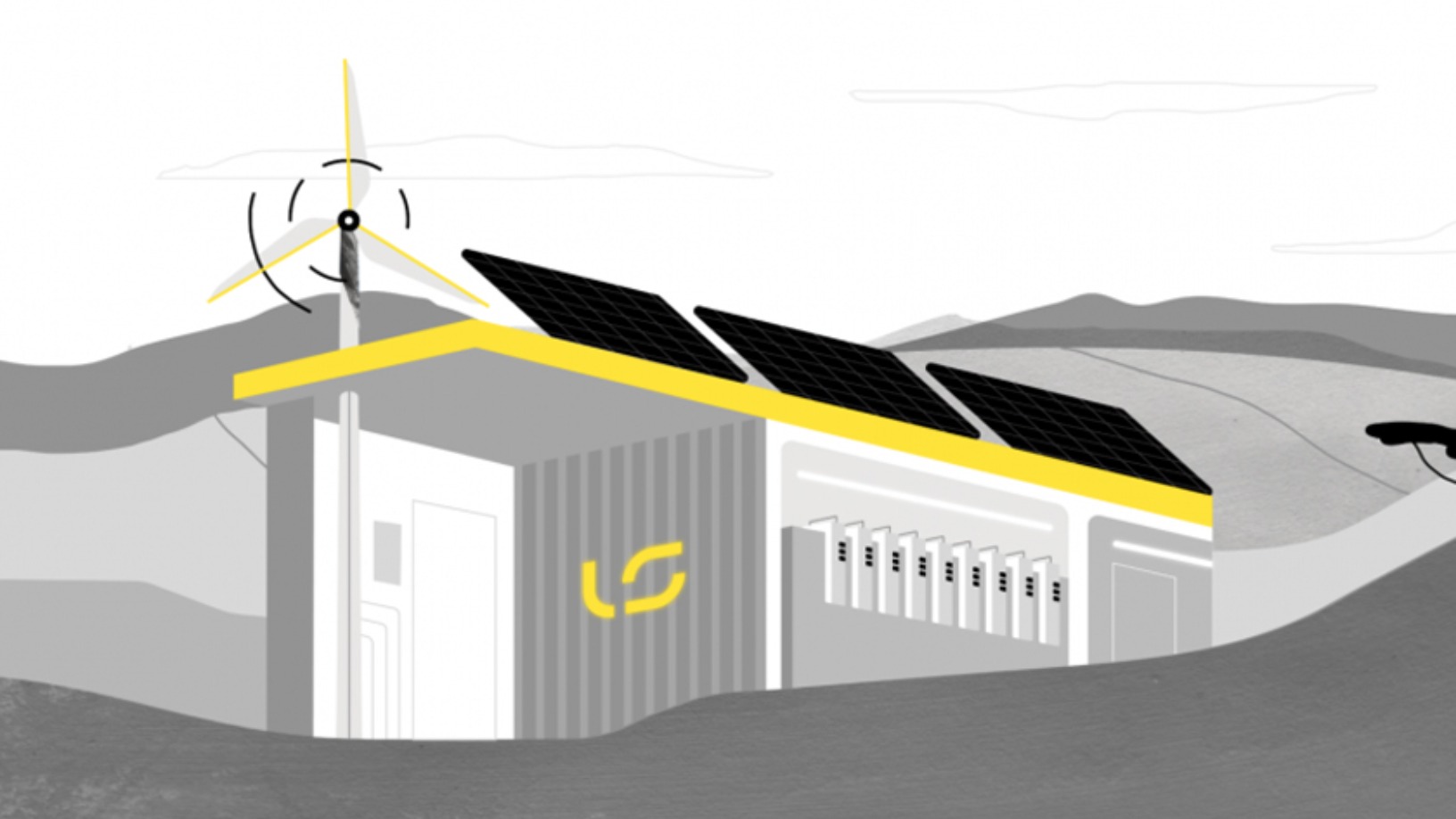

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

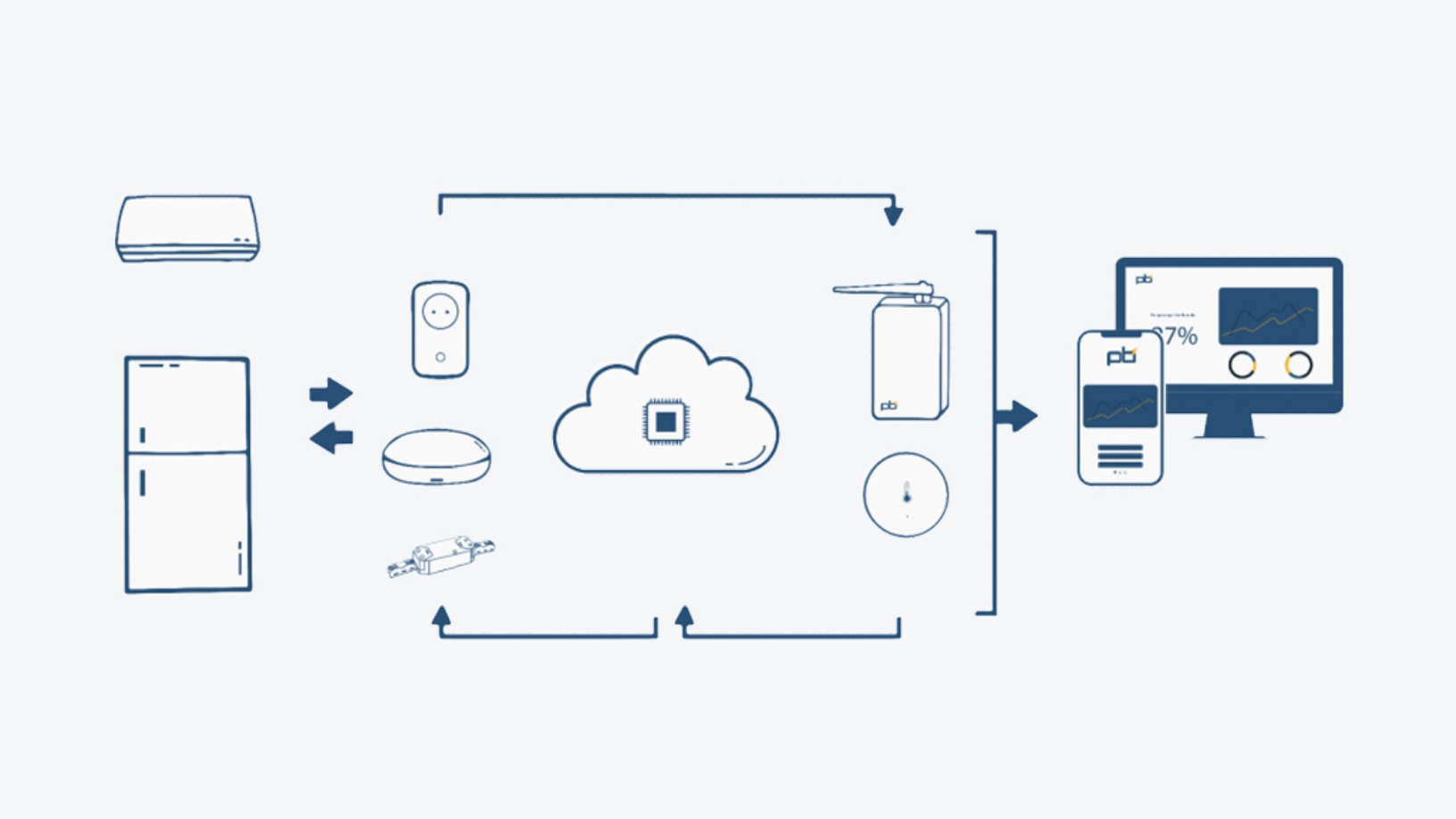

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Sorry, we couldn’t find any matches for“New Energy Nexus”.