New Energy Nexus

-

DATABASE (490)

-

ARTICLES (714)

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Co-founder of NPAW

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

COO and co-founder of OLIO

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

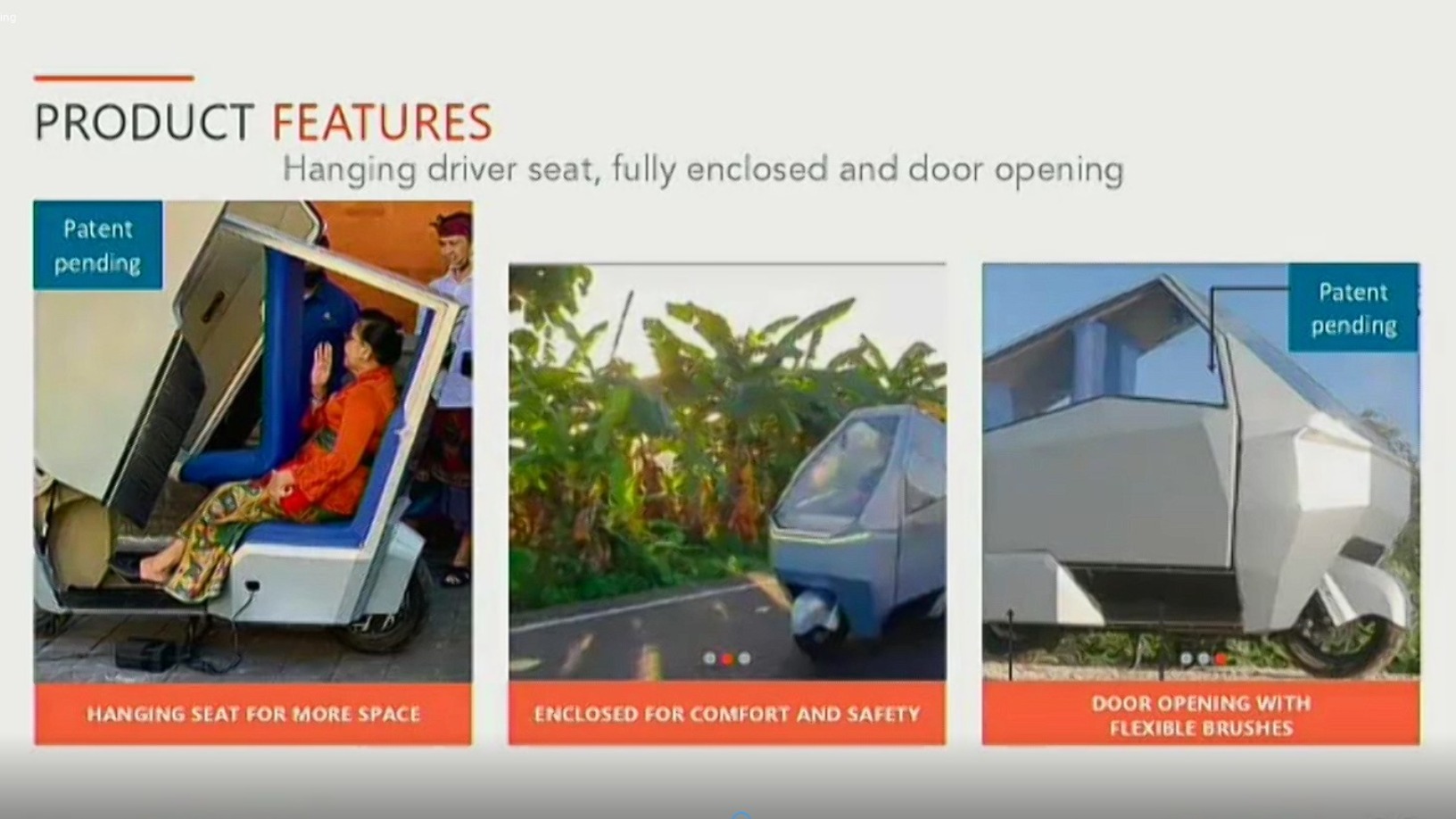

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

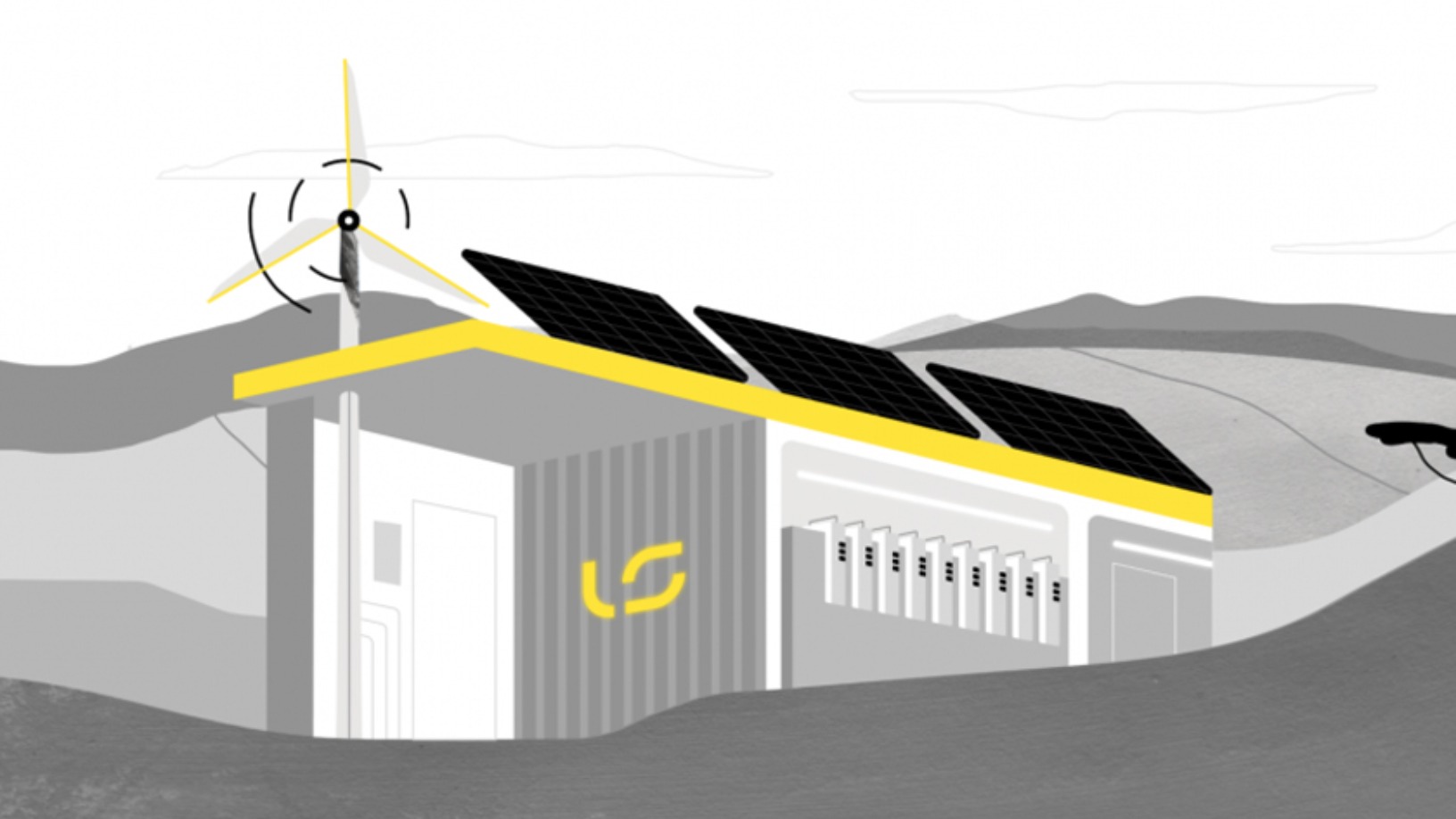

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

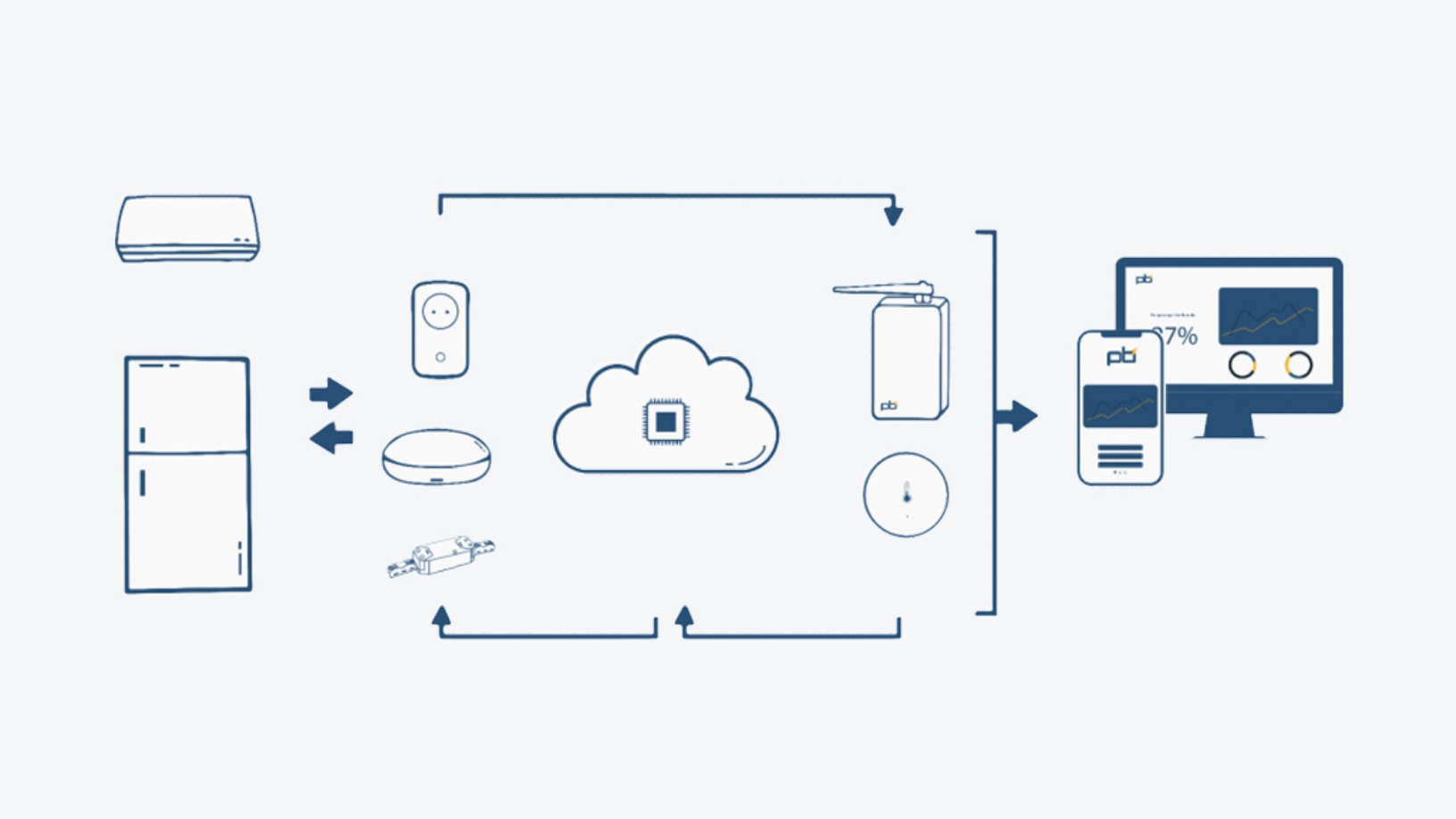

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Sorry, we couldn’t find any matches for“New Energy Nexus”.