New Energy Nexus

DATABASE (490)

ARTICLES (714)

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

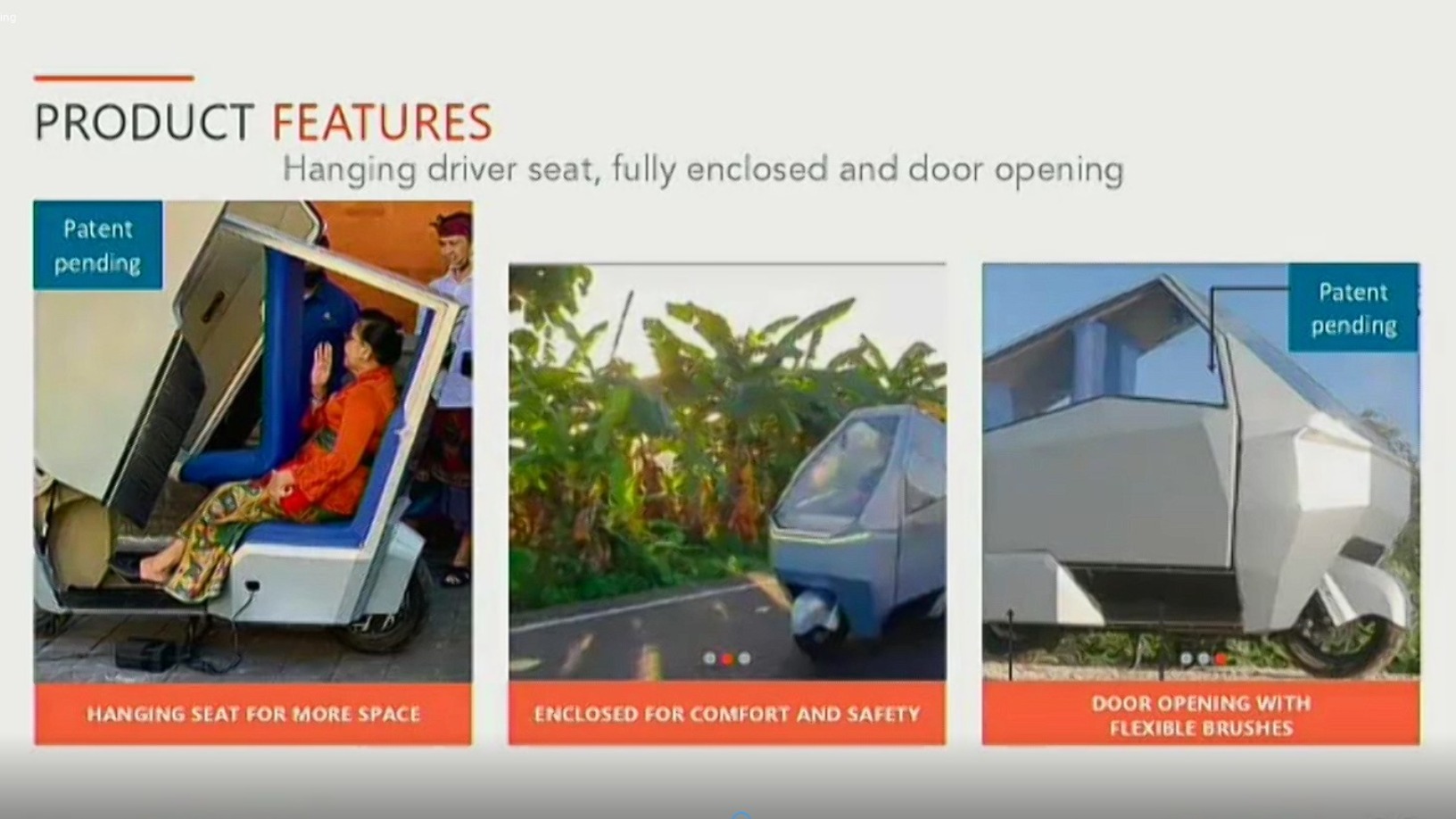

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

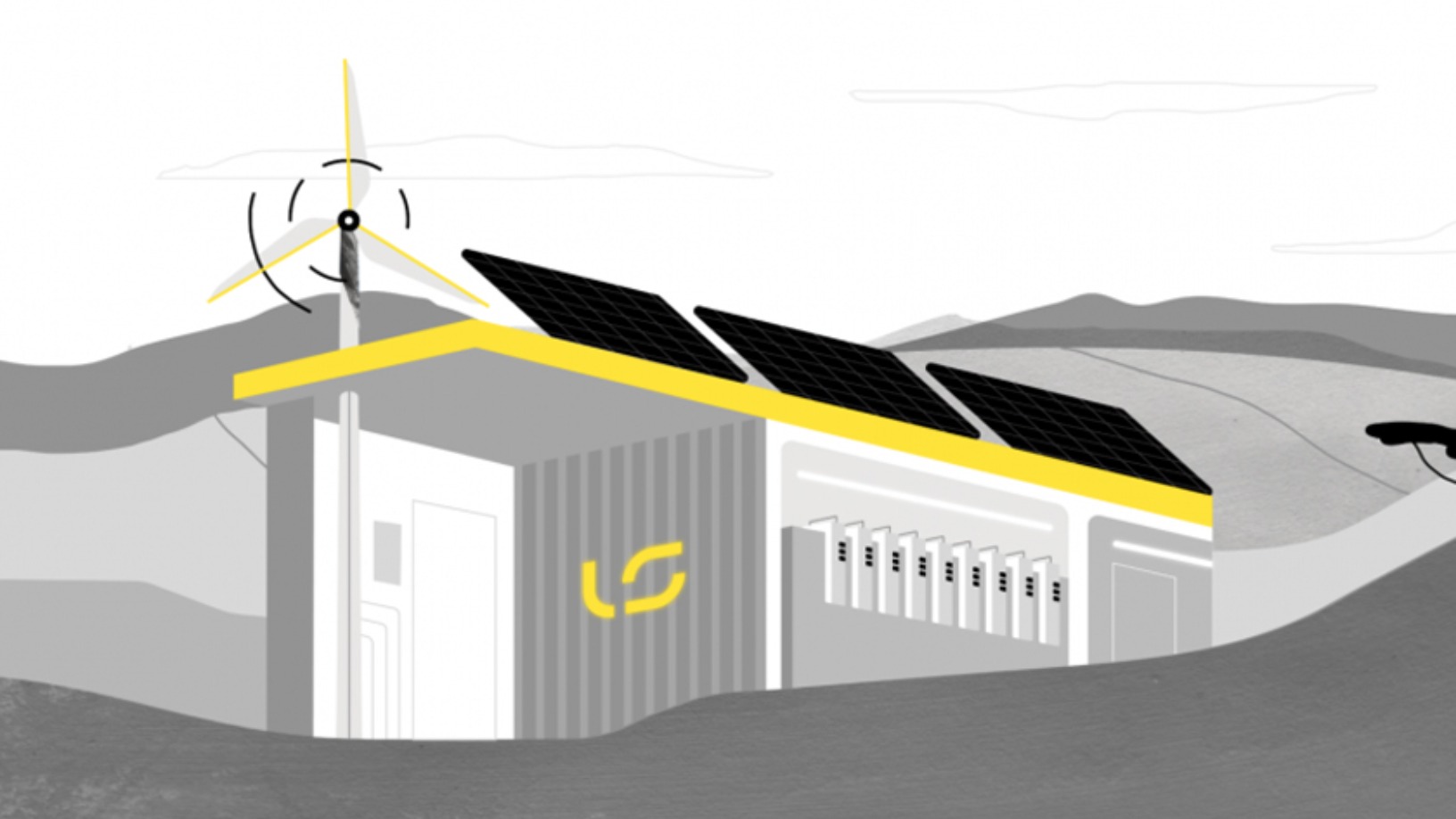

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

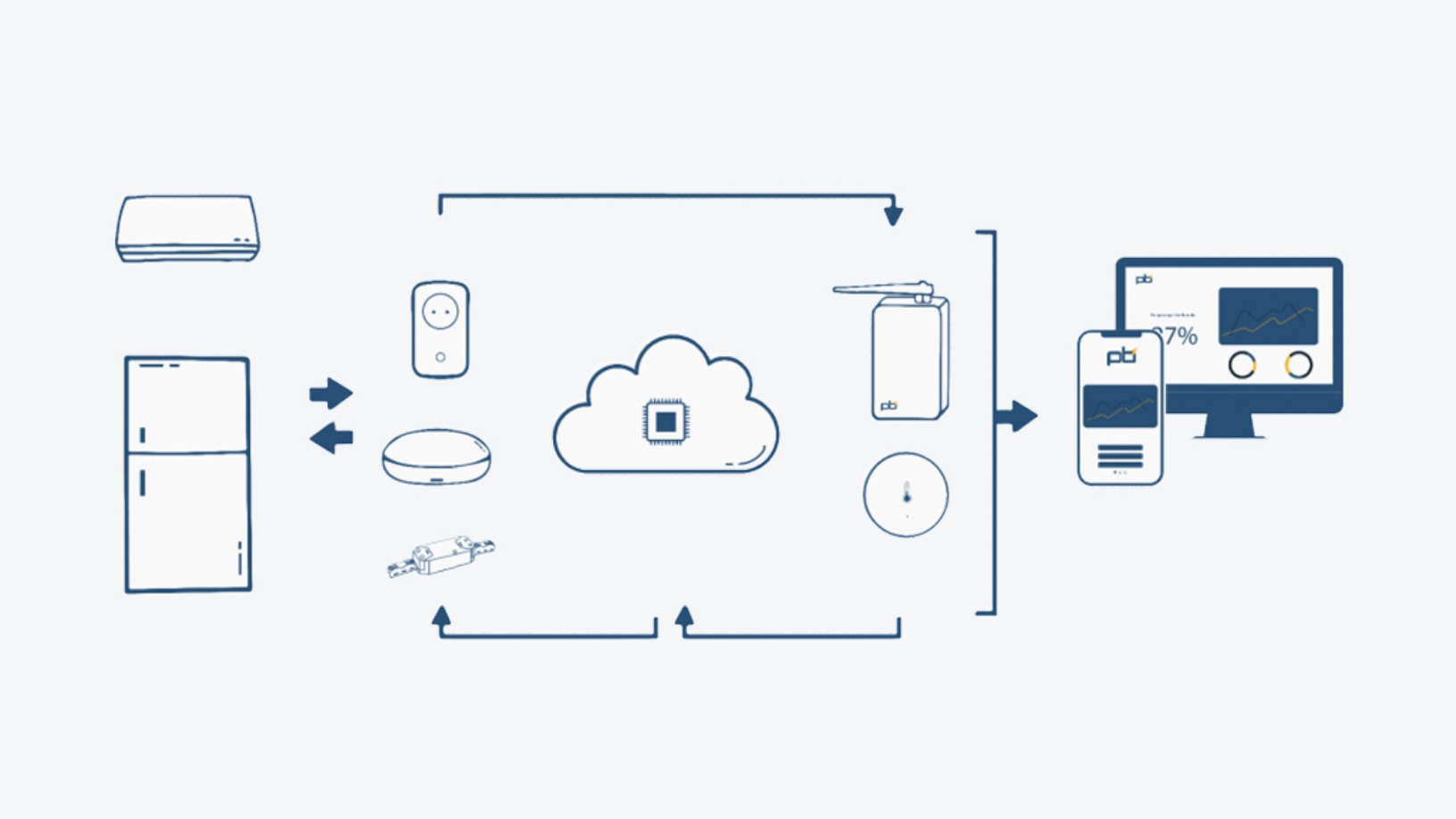

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Sorry, we couldn’t find any matches for“New Energy Nexus”.