New Energy Nexus

-

DATABASE (490)

-

ARTICLES (714)

CEO of Fundeen

Born in Ávila, Spain, Juan Ignacio Bautista Sánchez holds a Master of Science in Civil Engineering and a Bachelor of Science in Environmental Sciences from Alfonso X el Sabio University in Madrid. After working in asset management and due diligence in the renewable energy industry, first in Blue Tree Assets Management and later in Vela Energy, he presented his startup at Santander Bank's Yuzz entrepreneurship program. He won at the local level and was able to travel to Silicon Valley. Subsequent awards encouraged him to focus on Fundeen, where he has been serving as CEO since July 2017.

Born in Ávila, Spain, Juan Ignacio Bautista Sánchez holds a Master of Science in Civil Engineering and a Bachelor of Science in Environmental Sciences from Alfonso X el Sabio University in Madrid. After working in asset management and due diligence in the renewable energy industry, first in Blue Tree Assets Management and later in Vela Energy, he presented his startup at Santander Bank's Yuzz entrepreneurship program. He won at the local level and was able to travel to Silicon Valley. Subsequent awards encouraged him to focus on Fundeen, where he has been serving as CEO since July 2017.

CEO and Co-founder of Nusantics

Self-styled “bio-based economy enabler”, Sharlini Eriza Putri has held various industrial engineering roles since graduating in 2009 with a bachelor's in Chemical Engineering from Institut Teknologi Bandung. She joined Nestle as a management trainee and later became a process engineer until 2013. She left Nestle to read a master's in Sustainable Energy (Mechanical Engineering) at Imperial College London. In 2015, she started an independent consultancy for sustainable energy in Jakarta.In 2016, she became the head of center of excellence for the sugar industry conglomerate Samora Group. In 2019, she set up Nusantics to sell skincare products with natural ingredients. In 2020, Putri left Samora to work full-time at Nusantics as CEO.

Self-styled “bio-based economy enabler”, Sharlini Eriza Putri has held various industrial engineering roles since graduating in 2009 with a bachelor's in Chemical Engineering from Institut Teknologi Bandung. She joined Nestle as a management trainee and later became a process engineer until 2013. She left Nestle to read a master's in Sustainable Energy (Mechanical Engineering) at Imperial College London. In 2015, she started an independent consultancy for sustainable energy in Jakarta.In 2016, she became the head of center of excellence for the sugar industry conglomerate Samora Group. In 2019, she set up Nusantics to sell skincare products with natural ingredients. In 2020, Putri left Samora to work full-time at Nusantics as CEO.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Clime Capital is a clean energy-focused investment firm based in Singapore with a focus on early-stage companies. In June 2020, the VC launched the Southeast Asia Clean Energy Facility (SEACEF), a fund backed by philanthropic donors to support early-stage companies in commercializing clean energy solutions. The initial fund is valued at $10m. SEACEF’s first investment is in Xurya, an Indonesian startup providing solar power system leasing to commercial customers.

Clime Capital is a clean energy-focused investment firm based in Singapore with a focus on early-stage companies. In June 2020, the VC launched the Southeast Asia Clean Energy Facility (SEACEF), a fund backed by philanthropic donors to support early-stage companies in commercializing clean energy solutions. The initial fund is valued at $10m. SEACEF’s first investment is in Xurya, an Indonesian startup providing solar power system leasing to commercial customers.

Vence’s animal collars create “virtual fences” to monitor livestock movements and provide health data, saving ranchers 30% in farming costs and boosting grassland management.

Vence’s animal collars create “virtual fences” to monitor livestock movements and provide health data, saving ranchers 30% in farming costs and boosting grassland management.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

CEO and Co-founder of Dipole Tech

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Periksa.id’s web-based data management platform has a comprehensive suite of features to help improve profitability and productivity of Indonesia’s hospitals and clinics.

Periksa.id’s web-based data management platform has a comprehensive suite of features to help improve profitability and productivity of Indonesia’s hospitals and clinics.

Established in July 2009, GP Capital was co-funded by Shanghai International Group, Jiangsu Shagang Group, Huatai Securities and Hengdian Group. It specializes in establishing and managing industrial investment funds and private equity funds. GP Capital manages the RMB 20 billion Shanghai Financial Development Investment Fund. The Fund was sponsored by the Shanghai Municipal People’s Government with approval from the State Council and National Development and Reform Commission. Half of GP Capital's investment has gone to financial firms. It also invests in sectors such as consumer products, healthcare, new energy, culture, etc.

Established in July 2009, GP Capital was co-funded by Shanghai International Group, Jiangsu Shagang Group, Huatai Securities and Hengdian Group. It specializes in establishing and managing industrial investment funds and private equity funds. GP Capital manages the RMB 20 billion Shanghai Financial Development Investment Fund. The Fund was sponsored by the Shanghai Municipal People’s Government with approval from the State Council and National Development and Reform Commission. Half of GP Capital's investment has gone to financial firms. It also invests in sectors such as consumer products, healthcare, new energy, culture, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

Co-founder and CEO of Nodeflux

Meidy Fitranto is an experienced business analyst and manager with an industrial engineering background. Between 2010 and 2014, he filled supply chain management roles at two oil & gas companies, PT Energi Mega Persada and Kangean Energy Indonesia Ltd. In 2016, he established Nodeflux, a computer vision startup.

Meidy Fitranto is an experienced business analyst and manager with an industrial engineering background. Between 2010 and 2014, he filled supply chain management roles at two oil & gas companies, PT Energi Mega Persada and Kangean Energy Indonesia Ltd. In 2016, he established Nodeflux, a computer vision startup.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

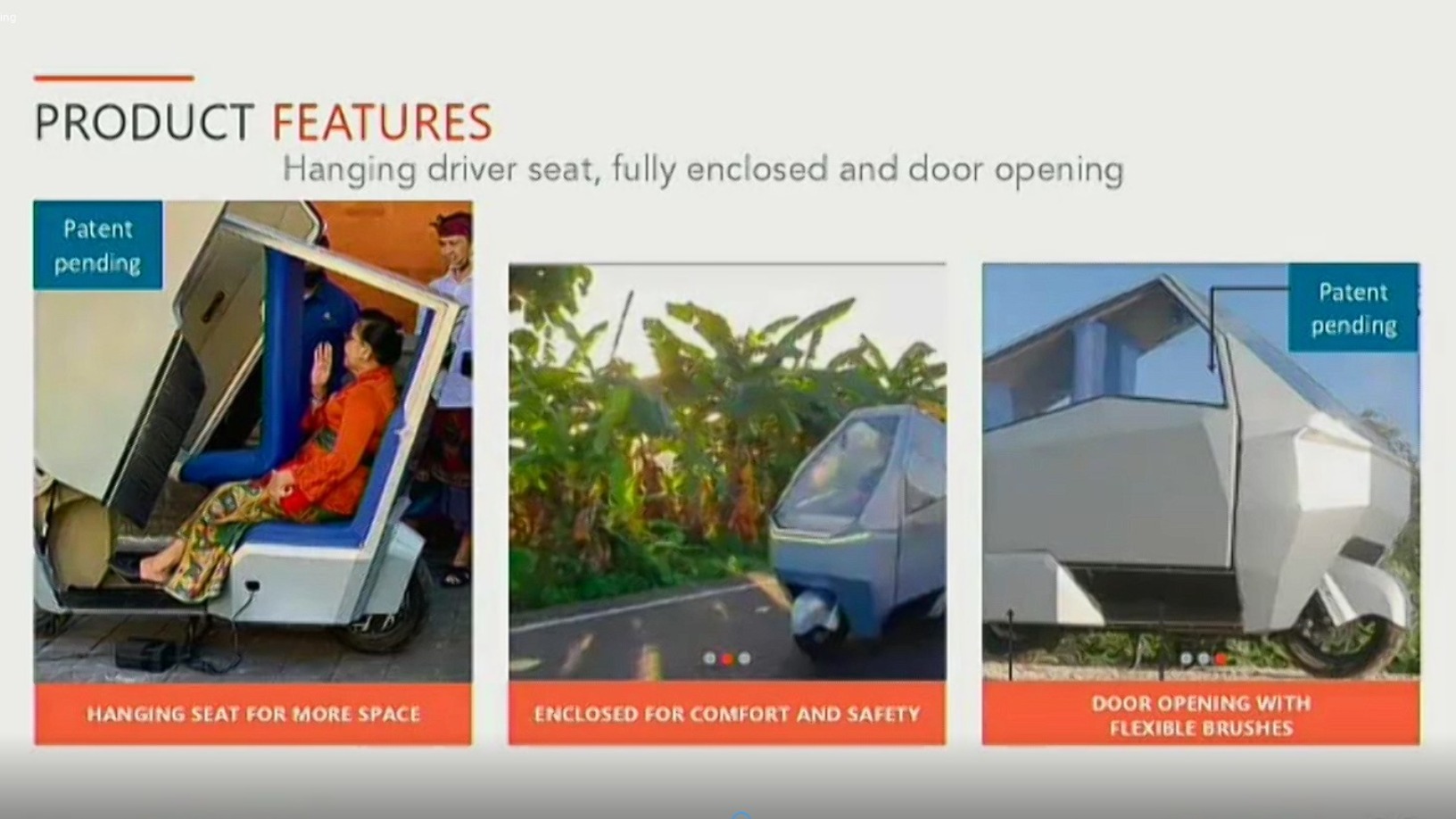

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

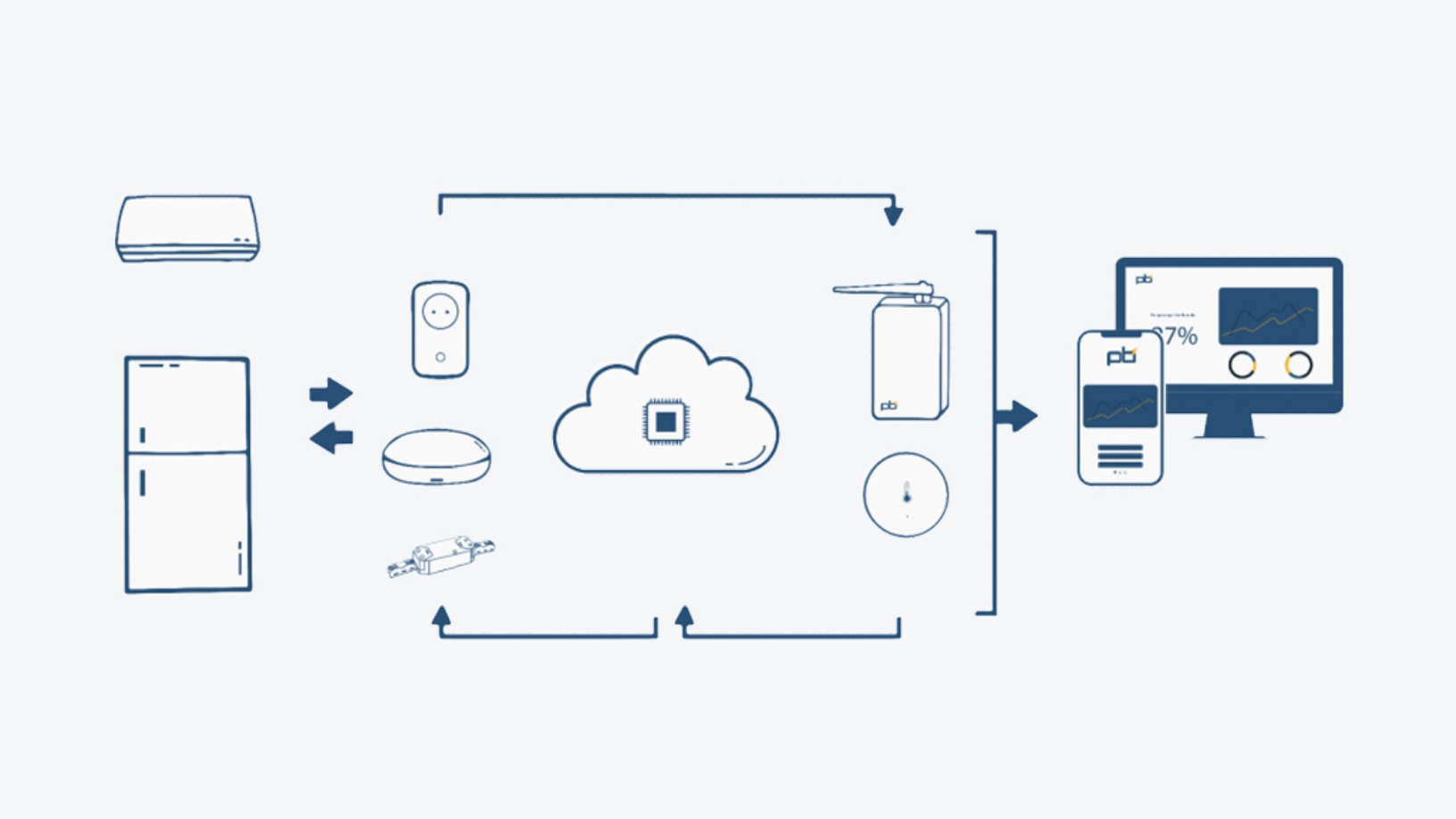

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Sorry, we couldn’t find any matches for“New Energy Nexus”.