New Energy Nexus

-

DATABASE (490)

-

ARTICLES (714)

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

Shenzhen Sunrise New Energy Co. Ltd.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Co-founder, General Manager of Oimo

Clara Hardy is GM and co-founder of Spanish bioplastics startup Oimo. She has worked there since 1Q19 and her duties include fundraising, marcom, stakeholder relations and business intelligence. This is her first major position. She was previously an intern at several large organizations, including the Walt Disney Company where she worked in digital marketing for a year. Hardy also spent several months as Digital Marketing Manager at Nexus Training and Mobility. She holds a Bachelor of Science in Business Management and Marketing from London’s Brunel University.

Clara Hardy is GM and co-founder of Spanish bioplastics startup Oimo. She has worked there since 1Q19 and her duties include fundraising, marcom, stakeholder relations and business intelligence. This is her first major position. She was previously an intern at several large organizations, including the Walt Disney Company where she worked in digital marketing for a year. Hardy also spent several months as Digital Marketing Manager at Nexus Training and Mobility. She holds a Bachelor of Science in Business Management and Marketing from London’s Brunel University.

President and Co-founder of Xpeng Motors

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Haitong Kaiyuan Investment is the wholly owned private equity investment firm by Haiting Securities in 2008. It focuses on new energy, new material, biotechnology, IT, communication and advanced manufacturing sectors.

Haitong Kaiyuan Investment is the wholly owned private equity investment firm by Haiting Securities in 2008. It focuses on new energy, new material, biotechnology, IT, communication and advanced manufacturing sectors.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

China’s first and largest enterprise-level trading desk, Chinapex provides a real-time AI-powered customer data platform for marketing, personalization and analytics.

China’s first and largest enterprise-level trading desk, Chinapex provides a real-time AI-powered customer data platform for marketing, personalization and analytics.

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Sophie's Bionutrients: Alternative protein from microalgae

Inspired by fish in the ocean, the startup developed microalgae-based flour that can take on unlimited forms, textures or colors to make almost any alt protein product

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

IP Buoys: Mooring 4.0 smart buoys to protect marine ecosystems

Save the Posidonia! That’s the call from enterprising sailors who, with their startup IP Buoys, have found a way to protect the seagrass and marine life from the damaging impact of nautical tourism

Onesight: Reducing building construction errors with 3D, AR/VR visualization apps

Shanghai-based Onesight provides a digital alternative to 2D architectural drawings for teams working on construction sites

Indonesian local crafts marketplace Qlapa shuts down

Series A funding failed to keep startup afloat as business remains unprofitable, regional heavyweights close in

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Squirrel AI: Edtech's AI-based personalized tutoring eases load for students and teachers

Used by more than 3m students, unicorn Squirrel AI tracks learning outcomes in real time and adapts teaching, proving more effective than traditional methods

Graviky Labs: Sustainable ink made from air pollution

Conceptualized at MIT and named among the Best Inventions of 2019 by TIME Magazine, Graviky Labs’ carbon-negative ink is made from upcycled emissions captured with a proprietary device

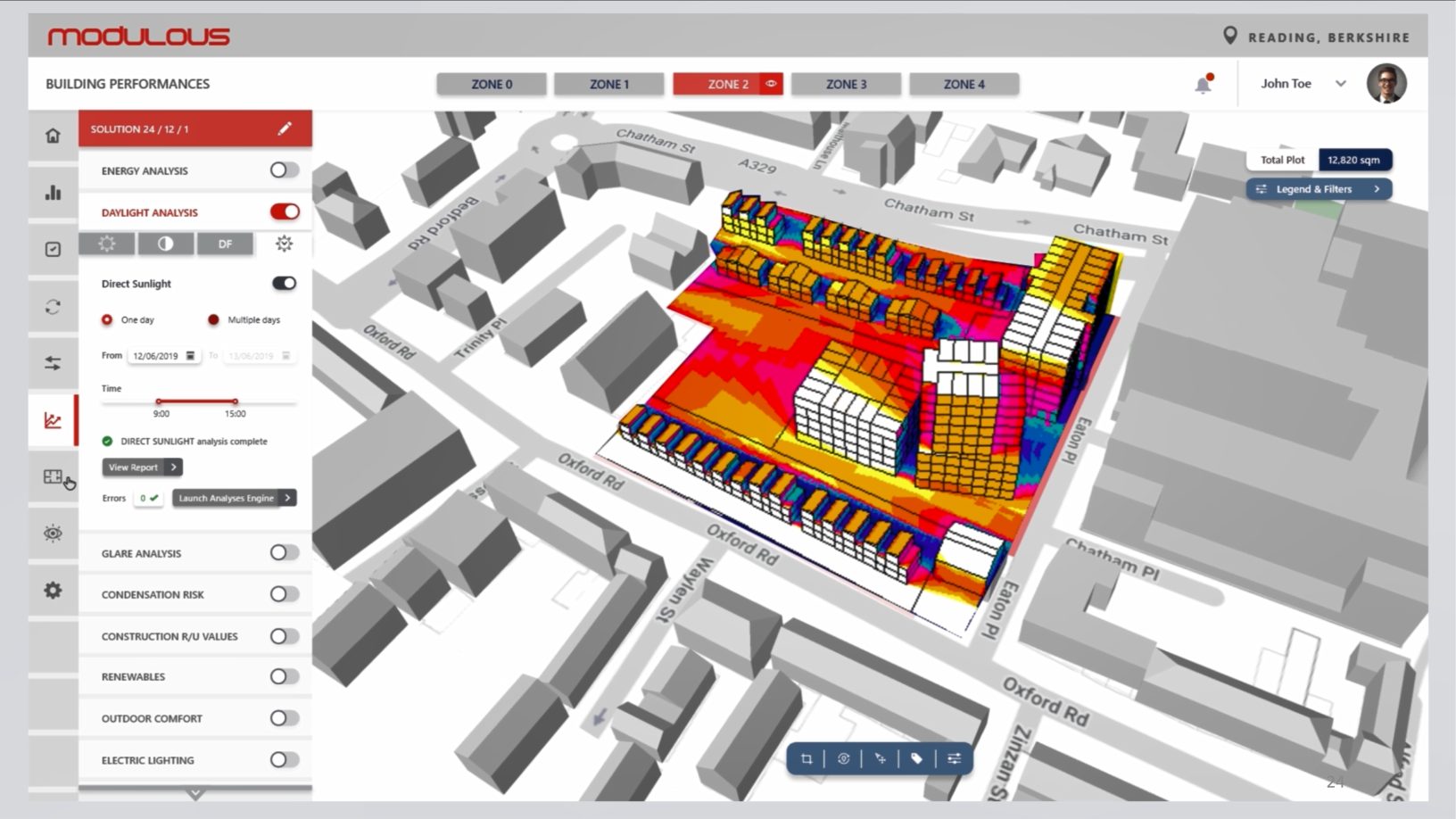

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Smart Agrifood Summit: Investors on key focuses and outlook in European agrifood

From boosting public-private funds to grow more European scale-ups, to improving the investment ecosystem, key investors at the Smart Agrifood Summit offer their take on how the EU agrifood sector could go a longer way

Sorry, we couldn’t find any matches for“New Energy Nexus”.