New Energy Nexus

-

DATABASE (490)

-

ARTICLES (714)

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

Shenzhen Sunrise New Energy Co. Ltd.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Co-founder, General Manager of Oimo

Clara Hardy is GM and co-founder of Spanish bioplastics startup Oimo. She has worked there since 1Q19 and her duties include fundraising, marcom, stakeholder relations and business intelligence. This is her first major position. She was previously an intern at several large organizations, including the Walt Disney Company where she worked in digital marketing for a year. Hardy also spent several months as Digital Marketing Manager at Nexus Training and Mobility. She holds a Bachelor of Science in Business Management and Marketing from London’s Brunel University.

Clara Hardy is GM and co-founder of Spanish bioplastics startup Oimo. She has worked there since 1Q19 and her duties include fundraising, marcom, stakeholder relations and business intelligence. This is her first major position. She was previously an intern at several large organizations, including the Walt Disney Company where she worked in digital marketing for a year. Hardy also spent several months as Digital Marketing Manager at Nexus Training and Mobility. She holds a Bachelor of Science in Business Management and Marketing from London’s Brunel University.

President and Co-founder of Xpeng Motors

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Haitong Kaiyuan Investment is the wholly owned private equity investment firm by Haiting Securities in 2008. It focuses on new energy, new material, biotechnology, IT, communication and advanced manufacturing sectors.

Haitong Kaiyuan Investment is the wholly owned private equity investment firm by Haiting Securities in 2008. It focuses on new energy, new material, biotechnology, IT, communication and advanced manufacturing sectors.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

China’s first and largest enterprise-level trading desk, Chinapex provides a real-time AI-powered customer data platform for marketing, personalization and analytics.

China’s first and largest enterprise-level trading desk, Chinapex provides a real-time AI-powered customer data platform for marketing, personalization and analytics.

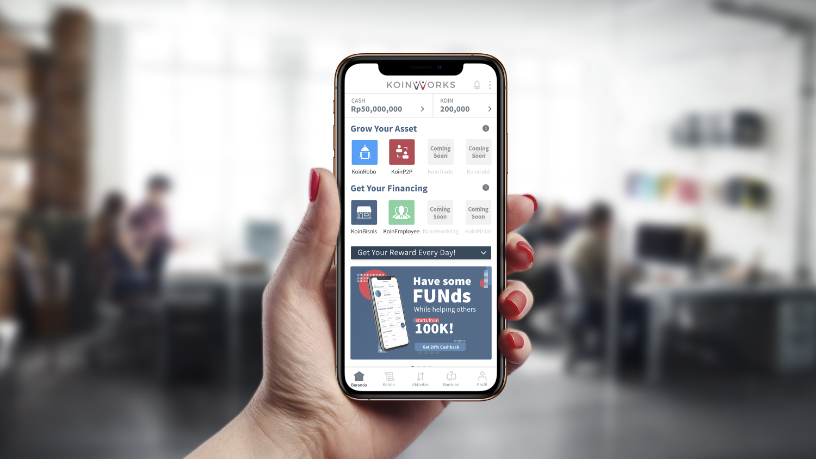

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

In Indonesia, Ramadan goes hi-tech

From consumption to charity, tech startups have come to play a key role in Ramadan traditions in Indonesia

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

In China's frothy tea drink universe, startups learn to battle

Tea shop startups like Nayuki and Heytea are staying afloat by turning to high-quality organic ingredients and greater brand visibility

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

From real estate to rearing insects for food: Magalarva's way to a sustainable future

The Indonesian agritech startup is already using insects to replace fishmeal and has new funding to grow further

Sorry, we couldn’t find any matches for“New Energy Nexus”.