New Enterprise Associates

-

DATABASE (475)

-

ARTICLES (709)

Co-founder, CEO of BEEVERYCREATIVE

Aurora Baptista has been a co-founding partner of BEEVERYCREATIVE since 2012 when it was known as bitBOX. She became its new CEO in August 2015. The Portuguese graduate in Business Management was also a postgrad at Harvard University in 2005.In 2008, Baptista started her own consultancy Cumprir Metas, Lda. She was an administrator at McKinsey for three years before becoming a partner at Arthur Andersen in 1990 for 11 years. She later became a partner at SGG Serviços Gerais deGestão (SGG) for over 18 years and a partner at Deloitte for seven years until 2008.

Aurora Baptista has been a co-founding partner of BEEVERYCREATIVE since 2012 when it was known as bitBOX. She became its new CEO in August 2015. The Portuguese graduate in Business Management was also a postgrad at Harvard University in 2005.In 2008, Baptista started her own consultancy Cumprir Metas, Lda. She was an administrator at McKinsey for three years before becoming a partner at Arthur Andersen in 1990 for 11 years. She later became a partner at SGG Serviços Gerais deGestão (SGG) for over 18 years and a partner at Deloitte for seven years until 2008.

Director and Founder of Mayordomo

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

Founder, CEO of Satelligence

Niels Wielaard is the Dutch CEO, founder and co-owner of Satelligence, a SaaS platform using satellite data and AI to help corporates improve their supply chain sustainability and track environmental risks. Before founding Satelligence in 2016, he spent 14 years at earth-monitoring company SarVision, which is a spin-off of Wageningen University in Utrecht, where he was a senior project manager and, previously, a remote sensing and geo-information specialist. Wielaard holds a master’s in Forestry from Wageningen University and has always been passionate about forest sustainability. His other work experience includes one year as a GIS research analyst at another Utrecht-based initiative, the Copernicus Institute of Sustainable Development, as part of a post-master’s research project developing a new mapping methodology for the design of biological corridors. He also completed stints during his studies working on pilot forestry-based carbon offset projects at an NGO and in forest certification research for the Dutch space agency, Space Netherlands.

Niels Wielaard is the Dutch CEO, founder and co-owner of Satelligence, a SaaS platform using satellite data and AI to help corporates improve their supply chain sustainability and track environmental risks. Before founding Satelligence in 2016, he spent 14 years at earth-monitoring company SarVision, which is a spin-off of Wageningen University in Utrecht, where he was a senior project manager and, previously, a remote sensing and geo-information specialist. Wielaard holds a master’s in Forestry from Wageningen University and has always been passionate about forest sustainability. His other work experience includes one year as a GIS research analyst at another Utrecht-based initiative, the Copernicus Institute of Sustainable Development, as part of a post-master’s research project developing a new mapping methodology for the design of biological corridors. He also completed stints during his studies working on pilot forestry-based carbon offset projects at an NGO and in forest certification research for the Dutch space agency, Space Netherlands.

CTO, co-founder of Teliman

Abdoulaye Maiga is CTO and co-founder at Teliman, Mali’s first on-demand mobility startup and one of francophone Africa’s first, where he has worked since its launch in 2018. Before that, he was CTO and co-founder at French real estate startup Wemblee where he still works part-time from Mali, initially simultaneously working as a salesforce administrator and developer in chemical company SEPPIC.Maiga previously worked at Rakuten in Tokyo for one year as a research and development VR scientist and also completed a stint at Accenture in Paris as an information system consultant. He also completed short stints in engineering at BCS Group in New Zealand and in business development at EATOPS in the Netherlands. The Malian national obtained two master’s degrees in innovation economics from Universite Paris-Saclay (2017) and in computer science from Keio University in Tokyo (2015), after winning scholarships to study overseas.

Abdoulaye Maiga is CTO and co-founder at Teliman, Mali’s first on-demand mobility startup and one of francophone Africa’s first, where he has worked since its launch in 2018. Before that, he was CTO and co-founder at French real estate startup Wemblee where he still works part-time from Mali, initially simultaneously working as a salesforce administrator and developer in chemical company SEPPIC.Maiga previously worked at Rakuten in Tokyo for one year as a research and development VR scientist and also completed a stint at Accenture in Paris as an information system consultant. He also completed short stints in engineering at BCS Group in New Zealand and in business development at EATOPS in the Netherlands. The Malian national obtained two master’s degrees in innovation economics from Universite Paris-Saclay (2017) and in computer science from Keio University in Tokyo (2015), after winning scholarships to study overseas.

CEO and founder of Diamond Foundry

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

With about $2 billion under management, this VC fund invests primarily in early- and growth-stage global companies with substantial businesses in China, namely in the semiconductor, Internet, wireless, new media and cleantech sectors. GSR Ventures has backed Didi, Ele.me, among others, and was involved in the $2.8 billion purchase of an 80% stake in Philips's LED components and automotive business. It has offices in Beijing, Hong Kong and Silicon Valley.

With about $2 billion under management, this VC fund invests primarily in early- and growth-stage global companies with substantial businesses in China, namely in the semiconductor, Internet, wireless, new media and cleantech sectors. GSR Ventures has backed Didi, Ele.me, among others, and was involved in the $2.8 billion purchase of an 80% stake in Philips's LED components and automotive business. It has offices in Beijing, Hong Kong and Silicon Valley.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

CMB International is a wholly-owned subsidiary of China Merchants Bank. It has two private equity funds. The first, based in Shenzhen, was founded in 2017, and the second, based in Hong Kong, was founded in 2010. CMB International's Shenzhen division invests in the internet, healthcare, automobile, new energy and consumption sectors.

CMB International is a wholly-owned subsidiary of China Merchants Bank. It has two private equity funds. The first, based in Shenzhen, was founded in 2017, and the second, based in Hong Kong, was founded in 2010. CMB International's Shenzhen division invests in the internet, healthcare, automobile, new energy and consumption sectors.

NUMA is a Paris-based innovation hub with offices in New York, Berlin, Moscow, Barcelona, Mexico City, Casablanca in Morocco and Bengalaru, India. Supported by its 130 staff members, the company runs training and startup acceleration programs globally. To date, 300 startups have participated in NUMA's acceleration program, which was developed in partnership with the City of Paris. To date, NUMA has seen 17 exits from its investments.

NUMA is a Paris-based innovation hub with offices in New York, Berlin, Moscow, Barcelona, Mexico City, Casablanca in Morocco and Bengalaru, India. Supported by its 130 staff members, the company runs training and startup acceleration programs globally. To date, 300 startups have participated in NUMA's acceleration program, which was developed in partnership with the City of Paris. To date, NUMA has seen 17 exits from its investments.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beemine Lab: Nurturing the fast-growing CBD cosmetics market

The first biotech company in Spain to produce CBD-rich cosmetics, The Beemine Lab is in a market poised to reach nearly $1bn by 2024, or 10% of the total skincare market

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

DataHunter helps businesses navigate the data deluge

This startup helps translate business data into easily understandable charts and graphs, enabling managers to make better informed decisions

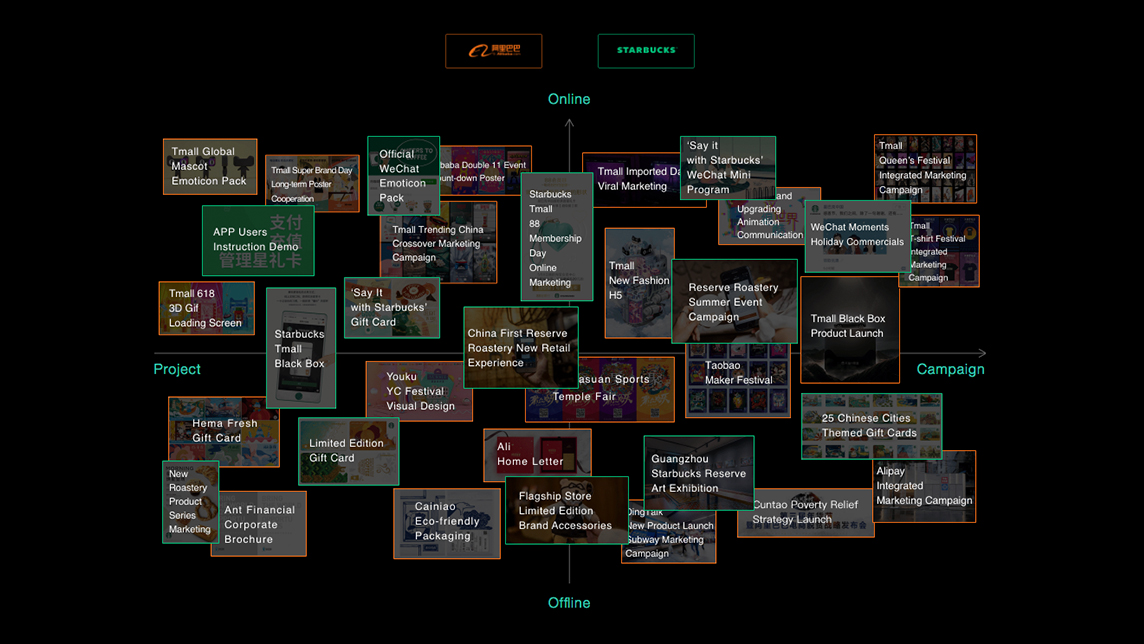

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

Chat SDK startup Qiscus raising Series A, targets greater Southeast Asian presence

With clients like Bukalapak and Halodoc, the in-app chat specialist looks to expand its market beyond Indonesia

Makaron, an AI-powered "Photoshop for smartphones," has over 20m users

Want to make your photo look like it was taken anywhere in the world – even if you were not physically there? Photo-editing app Makaron allows you to do this within a few seconds using your mobile phone

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

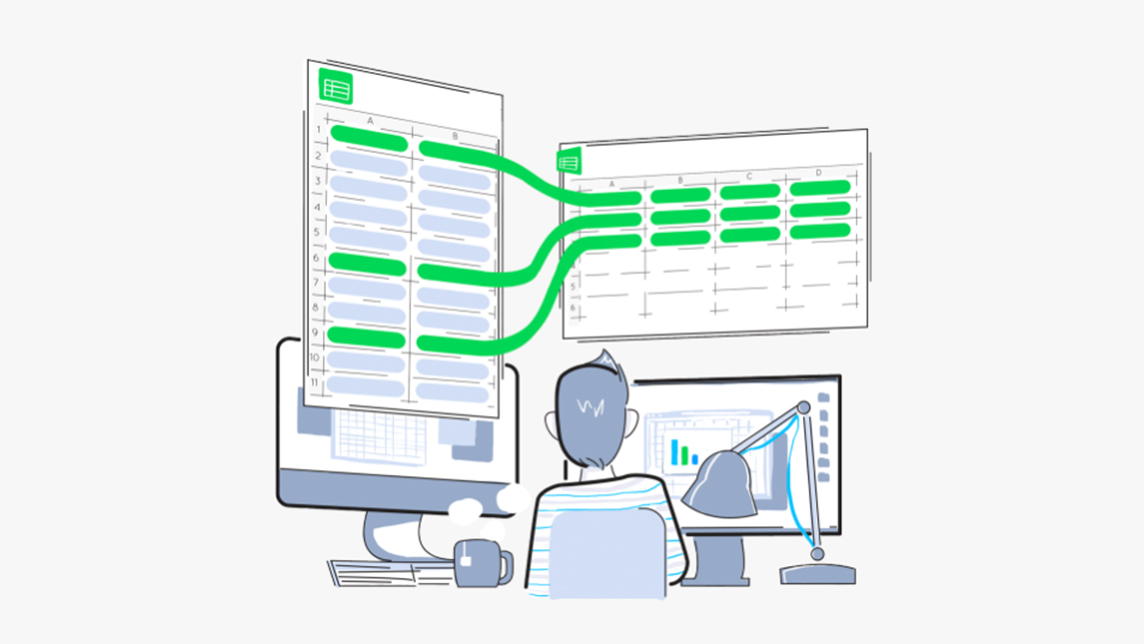

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sorry, we couldn’t find any matches for“New Enterprise Associates”.