New Enterprise Associates

-

DATABASE (475)

-

ARTICLES (709)

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Yonghua is a specialized investment company under Yongjin Group. With more than 20 years investment experience, it has invested in more than 100 companies, more than 50 of which are listed. Yonghua focuses on the most competitive companies in industries such as finance, e-commerce, education, healthcare, corporation service, new material and artificial intelligence.

Yonghua is a specialized investment company under Yongjin Group. With more than 20 years investment experience, it has invested in more than 100 companies, more than 50 of which are listed. Yonghua focuses on the most competitive companies in industries such as finance, e-commerce, education, healthcare, corporation service, new material and artificial intelligence.

Spiral Ventures (IMJ Investment Partners)

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

CFO and co-founder of Modulous Tech

Sarah Hordern is a co-founder, CFO and Group Development Leader at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where she has worked since 2019. She is simultaneously a non-executive director at Oxford University Hospitals NHS Foundation Trust and at lenders Newbury Building Society. She was previously executive advisor at the Cambridge Code 2018-19, the first digital tool that measures subconscious drivers of behavior, and spent two years as COO at residential management company Meyrick Estate Management. From 1999 to 2014, she was a joint managing director in the area of property and finance at Newbury Racecourse, one of the UK’s largest horse-racing establishments, where she was responsible for the design and commercial negotiations for a new community of 1,500 homes. Prior to this, Hordern spent five years at PwC in corporate tax management. She holds a Bachelor’s degree from Oxford University in Politics, Philosophy and Economics.

Sarah Hordern is a co-founder, CFO and Group Development Leader at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where she has worked since 2019. She is simultaneously a non-executive director at Oxford University Hospitals NHS Foundation Trust and at lenders Newbury Building Society. She was previously executive advisor at the Cambridge Code 2018-19, the first digital tool that measures subconscious drivers of behavior, and spent two years as COO at residential management company Meyrick Estate Management. From 1999 to 2014, she was a joint managing director in the area of property and finance at Newbury Racecourse, one of the UK’s largest horse-racing establishments, where she was responsible for the design and commercial negotiations for a new community of 1,500 homes. Prior to this, Hordern spent five years at PwC in corporate tax management. She holds a Bachelor’s degree from Oxford University in Politics, Philosophy and Economics.

COO and co-founder of Because Animals

Joshua Errett graduated in philosophy in 2004 and completed a postgraduate degree in journalism in 2006. He also completed an MBA in entrepreneurial and small business operations in Indiana University in 2015.In 2004, he co-founded Torontoist.com, a media website that attracted thousands of views per day. He left the startup to join New Brunswick Telegraph Journal as a reporter for one year before becoming digital managing editor for NOW magazine. In 2013, he went on to work for three years as a senior producer at the Canadian Broadcasting Corporation (CBC).He met Shannon Falconer at a cat rescue project in Toronto. The two pet owners co-founded the biotech Because Animals in 2016 to create more sustainable food for dogs and cats. Errett worked as a marketing manager at Equitable (EQ) Bank before working full-time as COO at Because Animals.

Joshua Errett graduated in philosophy in 2004 and completed a postgraduate degree in journalism in 2006. He also completed an MBA in entrepreneurial and small business operations in Indiana University in 2015.In 2004, he co-founded Torontoist.com, a media website that attracted thousands of views per day. He left the startup to join New Brunswick Telegraph Journal as a reporter for one year before becoming digital managing editor for NOW magazine. In 2013, he went on to work for three years as a senior producer at the Canadian Broadcasting Corporation (CBC).He met Shannon Falconer at a cat rescue project in Toronto. The two pet owners co-founded the biotech Because Animals in 2016 to create more sustainable food for dogs and cats. Errett worked as a marketing manager at Equitable (EQ) Bank before working full-time as COO at Because Animals.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beemine Lab: Nurturing the fast-growing CBD cosmetics market

The first biotech company in Spain to produce CBD-rich cosmetics, The Beemine Lab is in a market poised to reach nearly $1bn by 2024, or 10% of the total skincare market

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

DataHunter helps businesses navigate the data deluge

This startup helps translate business data into easily understandable charts and graphs, enabling managers to make better informed decisions

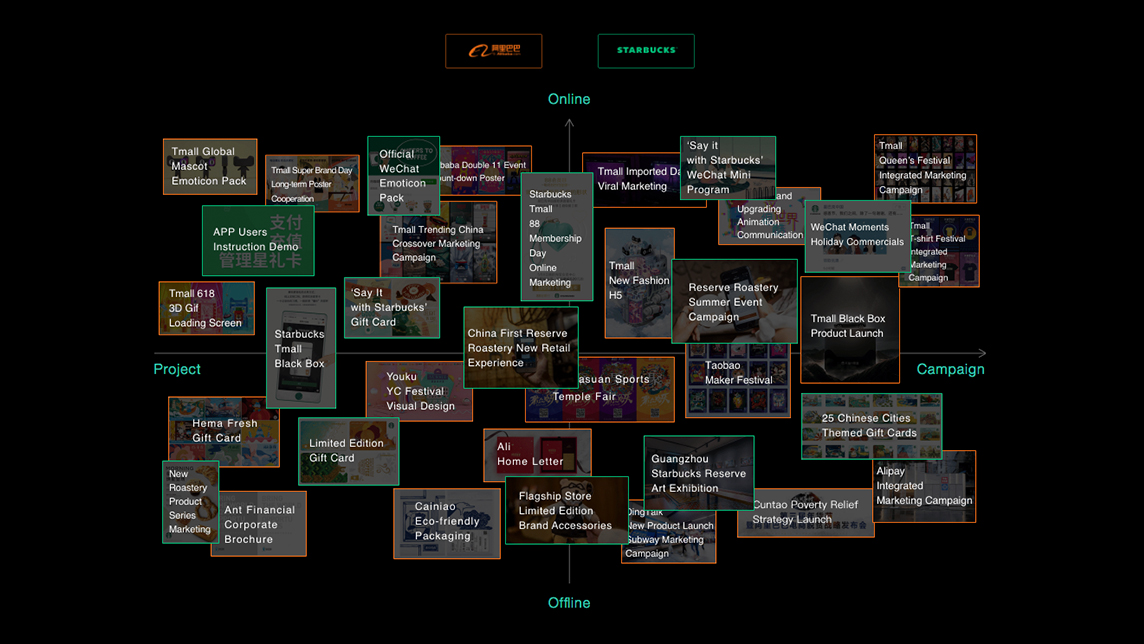

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

Chat SDK startup Qiscus raising Series A, targets greater Southeast Asian presence

With clients like Bukalapak and Halodoc, the in-app chat specialist looks to expand its market beyond Indonesia

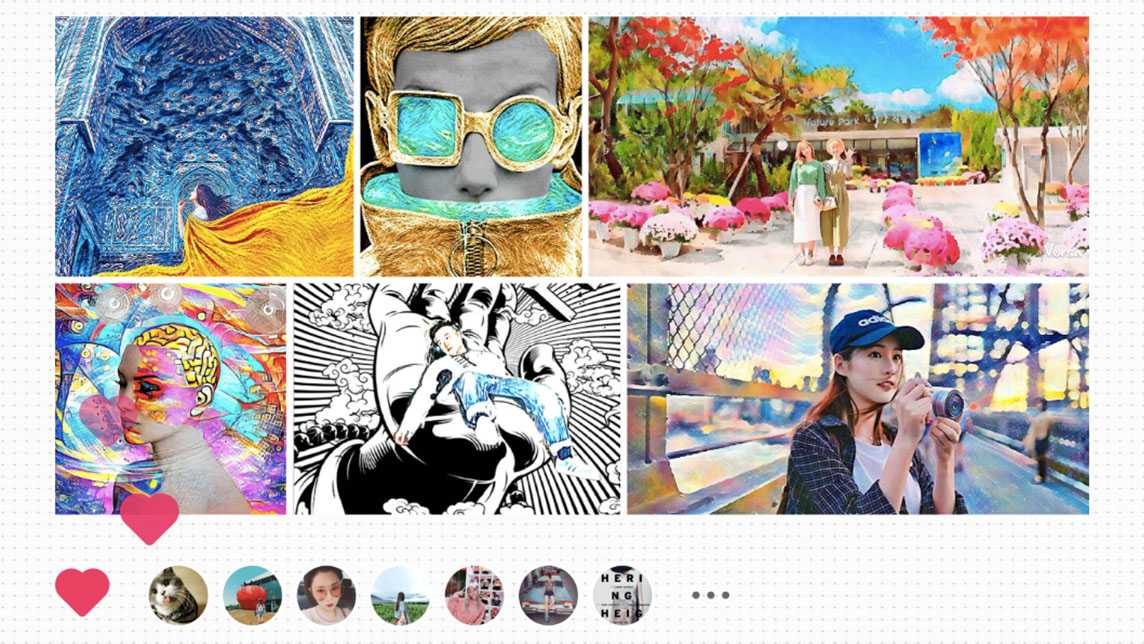

Makaron, an AI-powered "Photoshop for smartphones," has over 20m users

Want to make your photo look like it was taken anywhere in the world – even if you were not physically there? Photo-editing app Makaron allows you to do this within a few seconds using your mobile phone

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

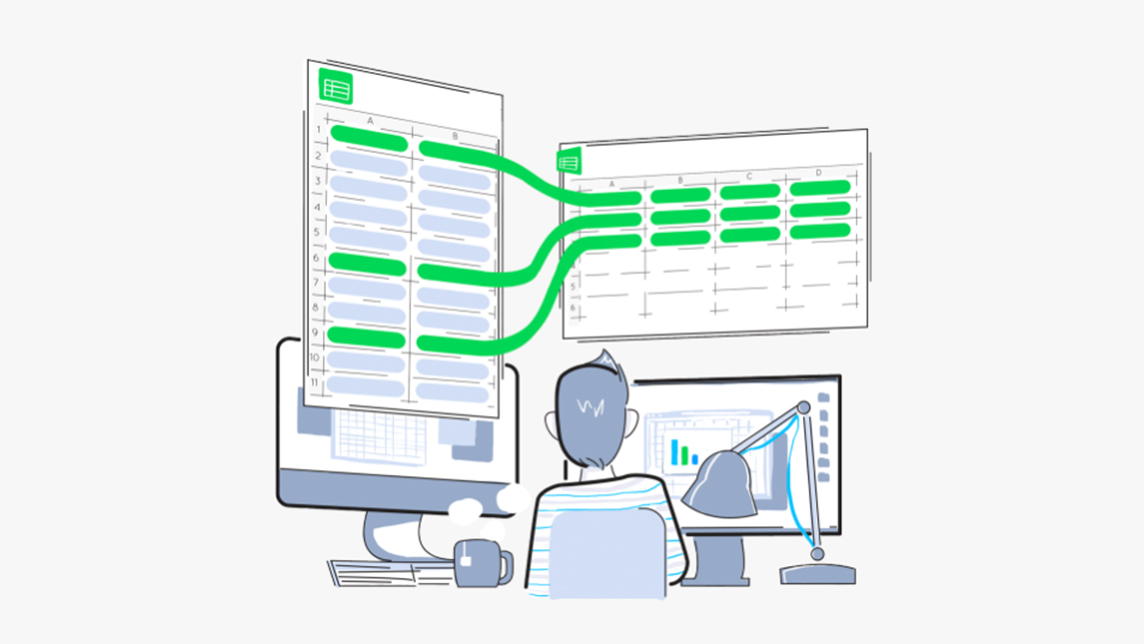

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sorry, we couldn’t find any matches for“New Enterprise Associates”.