New Food Invest

-

DATABASE (617)

-

ARTICLES (740)

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Next Chance Invest SL is part of the family firm Next Chance Group that was founded in 2010 by Nicolás Luca de Tena, a well-known Spanish entrepreneur and angel investor. Based in Madrid, the firm invested in the city's Spanish food delivery company La Nevera Roja in 2013. The "Red Fridge", acquired by Rocket Internet for €80m in 2016, was later sold on to Just Eat a year later. Next Chance normally invests between €500,000 and €2m on the scaling tech startups with annual turnover of over €2m.

Next Chance Invest SL is part of the family firm Next Chance Group that was founded in 2010 by Nicolás Luca de Tena, a well-known Spanish entrepreneur and angel investor. Based in Madrid, the firm invested in the city's Spanish food delivery company La Nevera Roja in 2013. The "Red Fridge", acquired by Rocket Internet for €80m in 2016, was later sold on to Just Eat a year later. Next Chance normally invests between €500,000 and €2m on the scaling tech startups with annual turnover of over €2m.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

FBG Invest is an industry network of investors based in Falkenberg, south Sweden. The network focuses on VC investments in local enterprises. Besides Mycorena in Gothenburg, FBG’s other investment is Consumiq that runs a Swedish grocery shopping app matlistan.

FBG Invest is an industry network of investors based in Falkenberg, south Sweden. The network focuses on VC investments in local enterprises. Besides Mycorena in Gothenburg, FBG’s other investment is Consumiq that runs a Swedish grocery shopping app matlistan.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Shenzhen Sunrise New Energy Co. Ltd.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

Founder and CEO of Tiger Brokers

Founder and CEO of Tiger Brokers. Wu Tianhua received his B.S. & M.S in Computer Science from Tsinghua University. Later, he co-founded Youdao, a new online education startup under the Nasdaq-listed NetEase group. By the time he left, Youdao’s user base had grown to the hundreds of millions. Wu had begun to familiarize himself with investing when he was an undergraduate and started to invest in the US stock market around 2010. Investing in the US stock market was very complicated then and in 2014, he decided to build his own service to make investing easier.

Founder and CEO of Tiger Brokers. Wu Tianhua received his B.S. & M.S in Computer Science from Tsinghua University. Later, he co-founded Youdao, a new online education startup under the Nasdaq-listed NetEase group. By the time he left, Youdao’s user base had grown to the hundreds of millions. Wu had begun to familiarize himself with investing when he was an undergraduate and started to invest in the US stock market around 2010. Investing in the US stock market was very complicated then and in 2014, he decided to build his own service to make investing easier.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

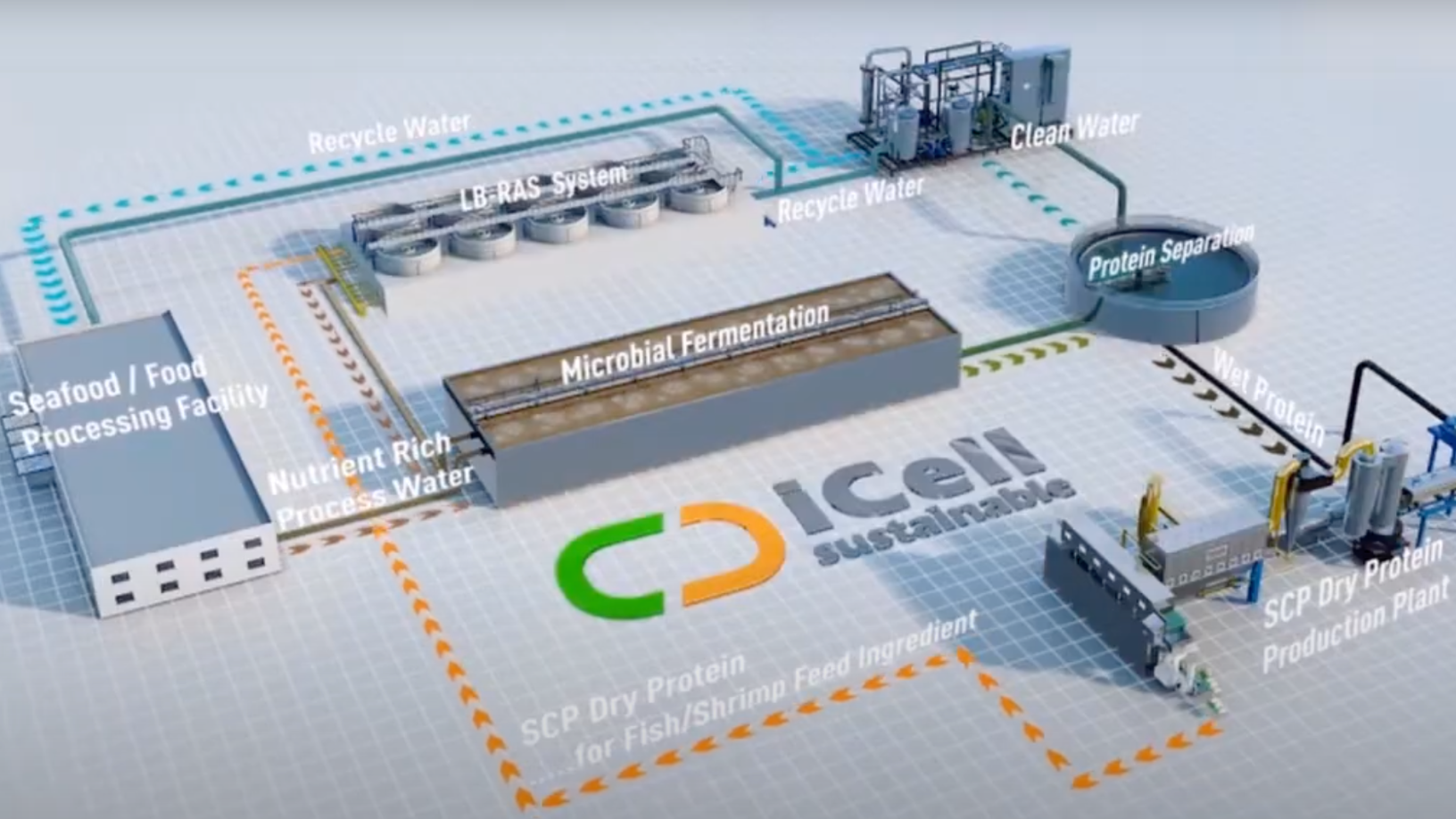

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

Covid-19: A closer look at how China's businesses and consumer behavior have changed

The lockdown in China has reshaped how people work and live. Some of the changes may be short-term, but others probably have become a part of life

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Yimutian: China agriculture e-commerce's comeback kid

As the world’s most populous country faces potential food supply shortages, Yimutian, China’s No. 1 agro trading marketplace, is seeing more opportunities

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

Modern China Tea Shop: Cool hangout for yuppies in Chairman Mao's Hunan

The tea house in Changsha, the provincial capital of Hunan, is creating a storm in a teacup, serving tea lattes that go viral across China

Sorry, we couldn’t find any matches for“New Food Invest”.