New Food Invest

-

DATABASE (617)

-

ARTICLES (740)

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Next Chance Invest SL is part of the family firm Next Chance Group that was founded in 2010 by Nicolás Luca de Tena, a well-known Spanish entrepreneur and angel investor. Based in Madrid, the firm invested in the city's Spanish food delivery company La Nevera Roja in 2013. The "Red Fridge", acquired by Rocket Internet for €80m in 2016, was later sold on to Just Eat a year later. Next Chance normally invests between €500,000 and €2m on the scaling tech startups with annual turnover of over €2m.

Next Chance Invest SL is part of the family firm Next Chance Group that was founded in 2010 by Nicolás Luca de Tena, a well-known Spanish entrepreneur and angel investor. Based in Madrid, the firm invested in the city's Spanish food delivery company La Nevera Roja in 2013. The "Red Fridge", acquired by Rocket Internet for €80m in 2016, was later sold on to Just Eat a year later. Next Chance normally invests between €500,000 and €2m on the scaling tech startups with annual turnover of over €2m.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

FBG Invest is an industry network of investors based in Falkenberg, south Sweden. The network focuses on VC investments in local enterprises. Besides Mycorena in Gothenburg, FBG’s other investment is Consumiq that runs a Swedish grocery shopping app matlistan.

FBG Invest is an industry network of investors based in Falkenberg, south Sweden. The network focuses on VC investments in local enterprises. Besides Mycorena in Gothenburg, FBG’s other investment is Consumiq that runs a Swedish grocery shopping app matlistan.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Shenzhen Sunrise New Energy Co. Ltd.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

Founder and CEO of Tiger Brokers

Founder and CEO of Tiger Brokers. Wu Tianhua received his B.S. & M.S in Computer Science from Tsinghua University. Later, he co-founded Youdao, a new online education startup under the Nasdaq-listed NetEase group. By the time he left, Youdao’s user base had grown to the hundreds of millions. Wu had begun to familiarize himself with investing when he was an undergraduate and started to invest in the US stock market around 2010. Investing in the US stock market was very complicated then and in 2014, he decided to build his own service to make investing easier.

Founder and CEO of Tiger Brokers. Wu Tianhua received his B.S. & M.S in Computer Science from Tsinghua University. Later, he co-founded Youdao, a new online education startup under the Nasdaq-listed NetEase group. By the time he left, Youdao’s user base had grown to the hundreds of millions. Wu had begun to familiarize himself with investing when he was an undergraduate and started to invest in the US stock market around 2010. Investing in the US stock market was very complicated then and in 2014, he decided to build his own service to make investing easier.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

The charm of Jike: From search engine to popular social network

App's success shows enthusiasm for a personalized, community-based content and search platform, emulated even by Tencent

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

B’Smart: Innovative IoT systems add ML for smart fleet management

Pivoting from Wi-Fi systems to smart fleet management, B'Smart is expanding rapidly to tap the US$12.7bn IoT for logistics market

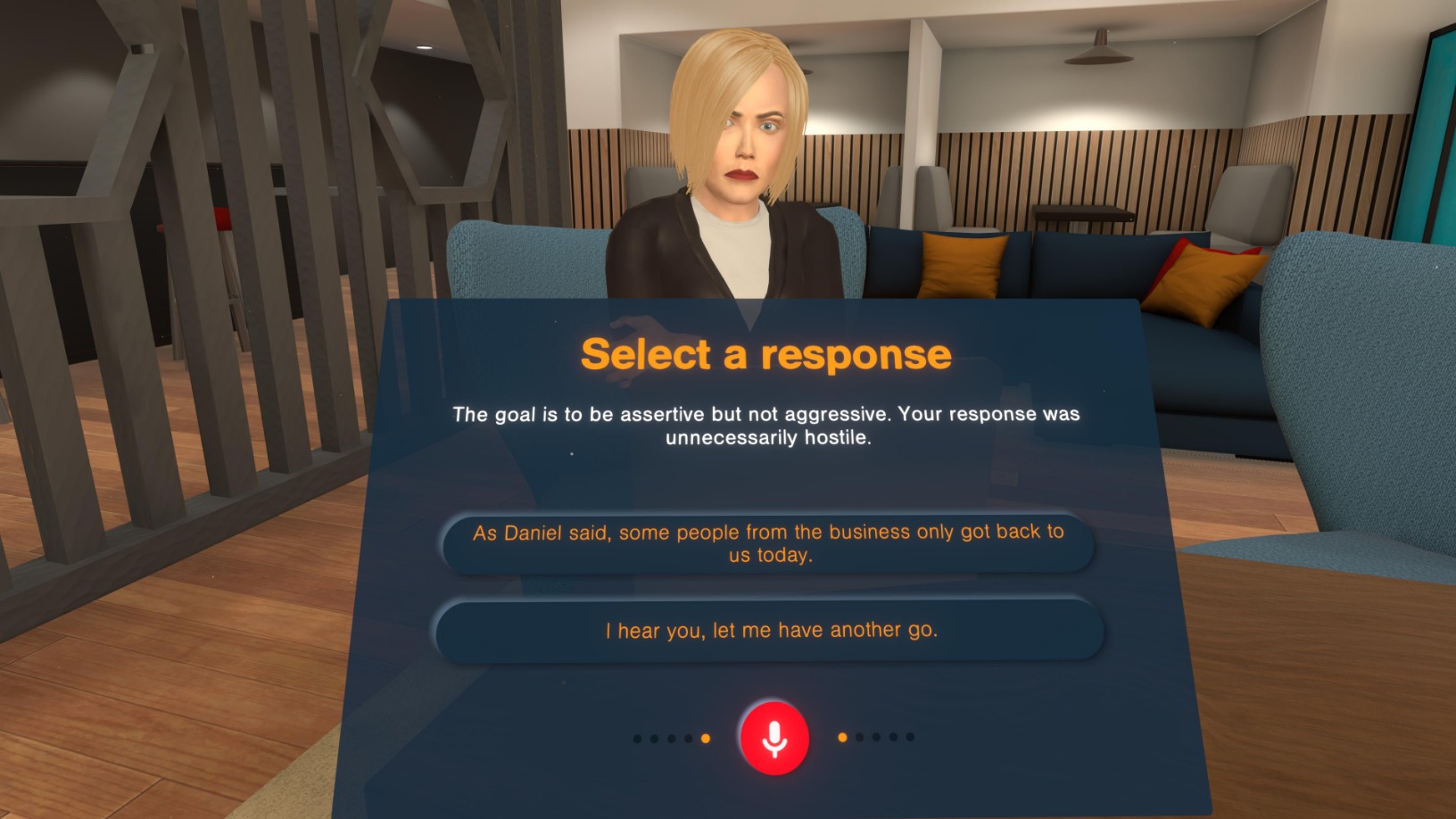

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Lalibela Global-Networks: A mission to digitalize, move Africa's healthcare system to the cloud

This year’s Web Summit winner, Lalibela Global-Networks, is digitalizing Africa’s paper-based healthcare system in a low-cost, low-code way to save lives and make healthcare affordable

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

From Tekapedia to HayoKerja: How failure led to a less exciting business model – and success

Borrowing the e-commerce marketplace model, Tekapedia tried to match businesses with blue-collar hires, but it soon realized the sector had simpler needs

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Allen Zhang: Father of WeChat and its string of innovations

Get to know the man behind the app in every Chinese user's smartphone

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Indonesia finance ministry cans e-commerce tax compliance law

The ministry says the law was misunderstood, but industry players had long questioned the need for such regulation

Sorry, we couldn’t find any matches for“New Food Invest”.