New Oriental

-

DATABASE (388)

-

ARTICLES (695)

Co-founder of NPAW

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

COO and co-founder of OLIO

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

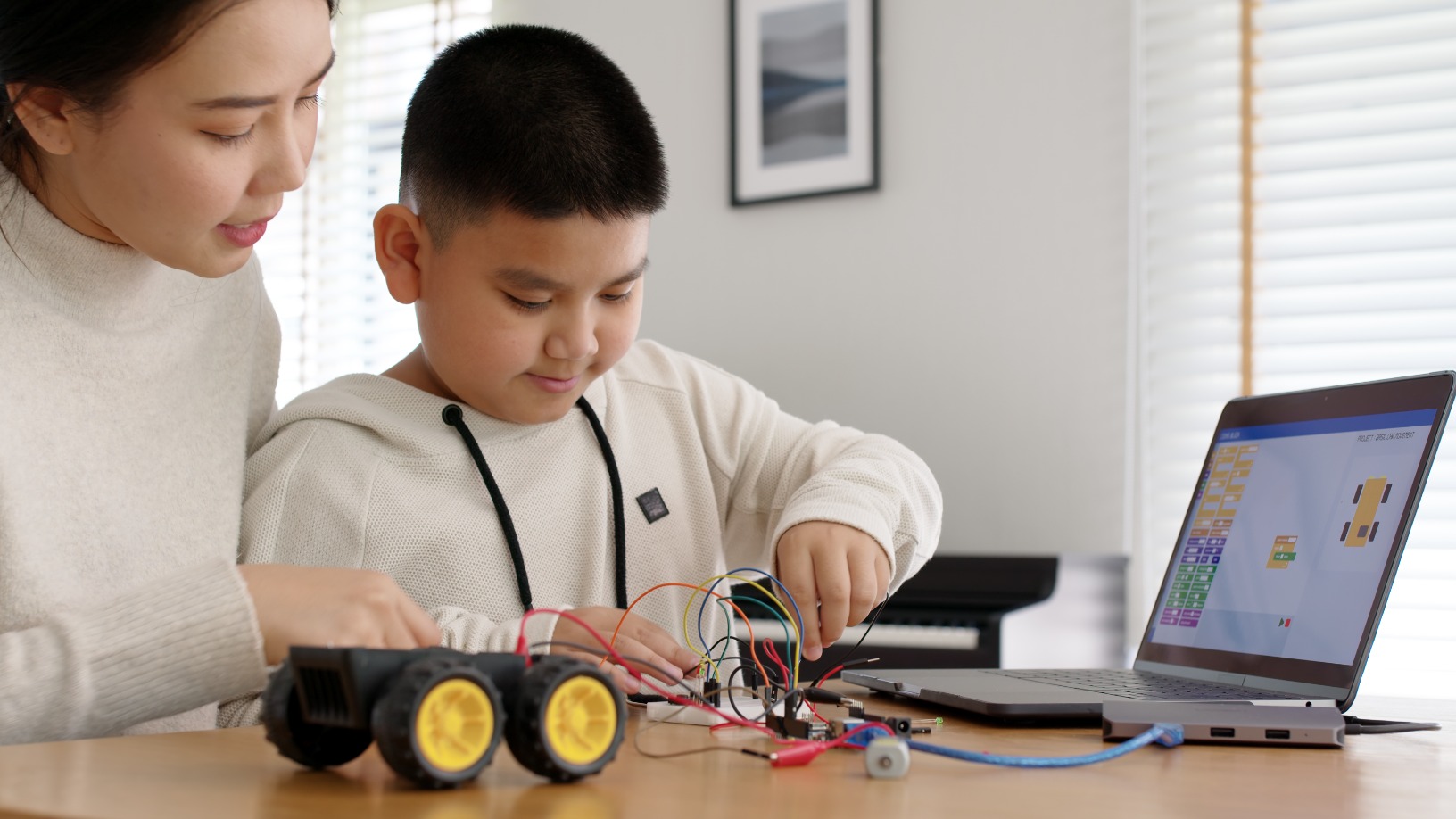

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Zhang Tong Jia Yuan is working to narrow the regional education gap in China

This startup started with the objective of relieving parental concerns about child safety in kindergarten but has since set its sights much higher

Bailian.ai: Using Internet big data, AI to help corporates acquire customers

Previously, a salesperson who got five or six customer leads was considered fortunate. Now, using Bailian.ai, thousands, or even millions, of leads can be found at once

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Koala Reading: Using AI to help children read, learn better in Chinese

This edtech app matches Chinese students with reading materials based on level, not age or grade in school

Squirrel AI: Edtech's AI-based personalized tutoring eases load for students and teachers

Used by more than 3m students, unicorn Squirrel AI tracks learning outcomes in real time and adapts teaching, proving more effective than traditional methods

Luo Yonghao: Maverick founder who gave Smartisan its allure, but couldn't build a winner

The Smartisan founder and internet celebrity is making a comeback with live commerce, after failing to sell enough smartphones at his own company

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Raw Data: Bringing new predictability to harvests

Spanish ML, big data startup helps farmers perfect wine and fruit production in a fast-growing precision agtech sector

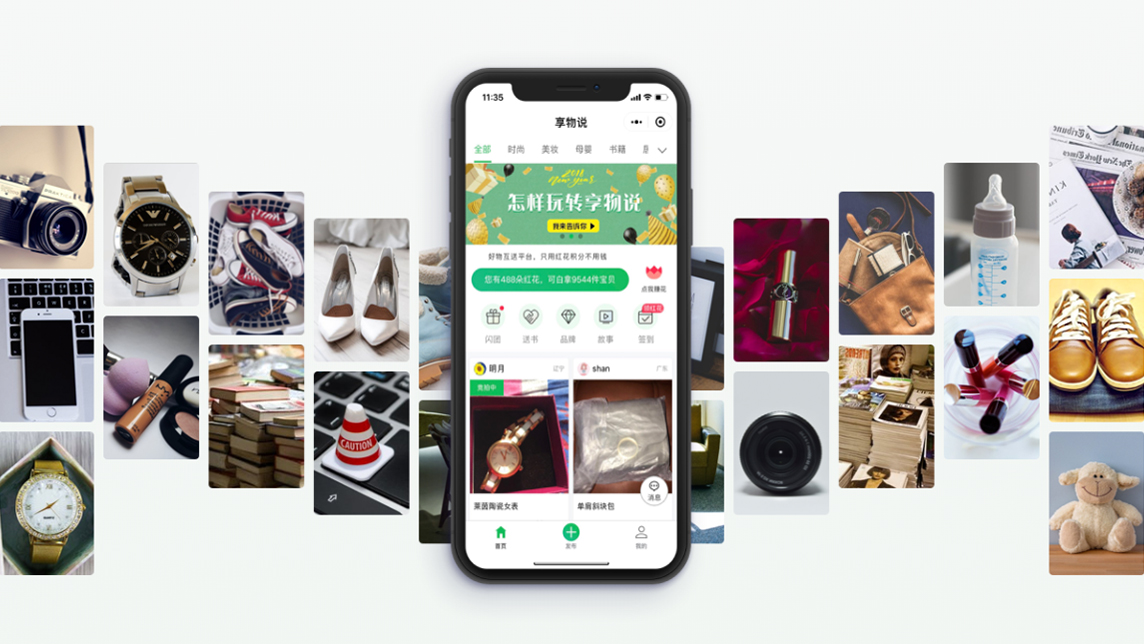

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Canika: A new app offering more budget-friendly weddings

Canika woos young couples with more flexible prices and options in Indonesia's $7bn wedding planning market

Sorry, we couldn’t find any matches for“New Oriental”.