New Oriental

-

DATABASE (388)

-

ARTICLES (695)

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Adrian Cheng Chi-kong is a third generation heir to HK billionaire Cheng Yu-tung.Adrian Cheng Chi-kong founded K11 brand in 2008, and became Executive Vice-Chairman at New World Development in 2015.Besides traditional retail, he invests in more areas such as food, fashion, technology.He founded C Ventures to invest in the businesses that focus on millennials. C Ventures has invested in Moda Operandi, an American fashion startup, Flont, luxury jewelry rental service, among others.He invested in American AI startup ObEN and Chinese cooking video platform Daydaycook, etc, through K11.He also invested in Aibee, Hua Medicine and Xiaohongshu as individual investor.

Adrian Cheng Chi-kong is a third generation heir to HK billionaire Cheng Yu-tung.Adrian Cheng Chi-kong founded K11 brand in 2008, and became Executive Vice-Chairman at New World Development in 2015.Besides traditional retail, he invests in more areas such as food, fashion, technology.He founded C Ventures to invest in the businesses that focus on millennials. C Ventures has invested in Moda Operandi, an American fashion startup, Flont, luxury jewelry rental service, among others.He invested in American AI startup ObEN and Chinese cooking video platform Daydaycook, etc, through K11.He also invested in Aibee, Hua Medicine and Xiaohongshu as individual investor.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

CEO and Founder of Didimo

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Zhang Tong Jia Yuan is working to narrow the regional education gap in China

This startup started with the objective of relieving parental concerns about child safety in kindergarten but has since set its sights much higher

Bailian.ai: Using Internet big data, AI to help corporates acquire customers

Previously, a salesperson who got five or six customer leads was considered fortunate. Now, using Bailian.ai, thousands, or even millions, of leads can be found at once

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Koala Reading: Using AI to help children read, learn better in Chinese

This edtech app matches Chinese students with reading materials based on level, not age or grade in school

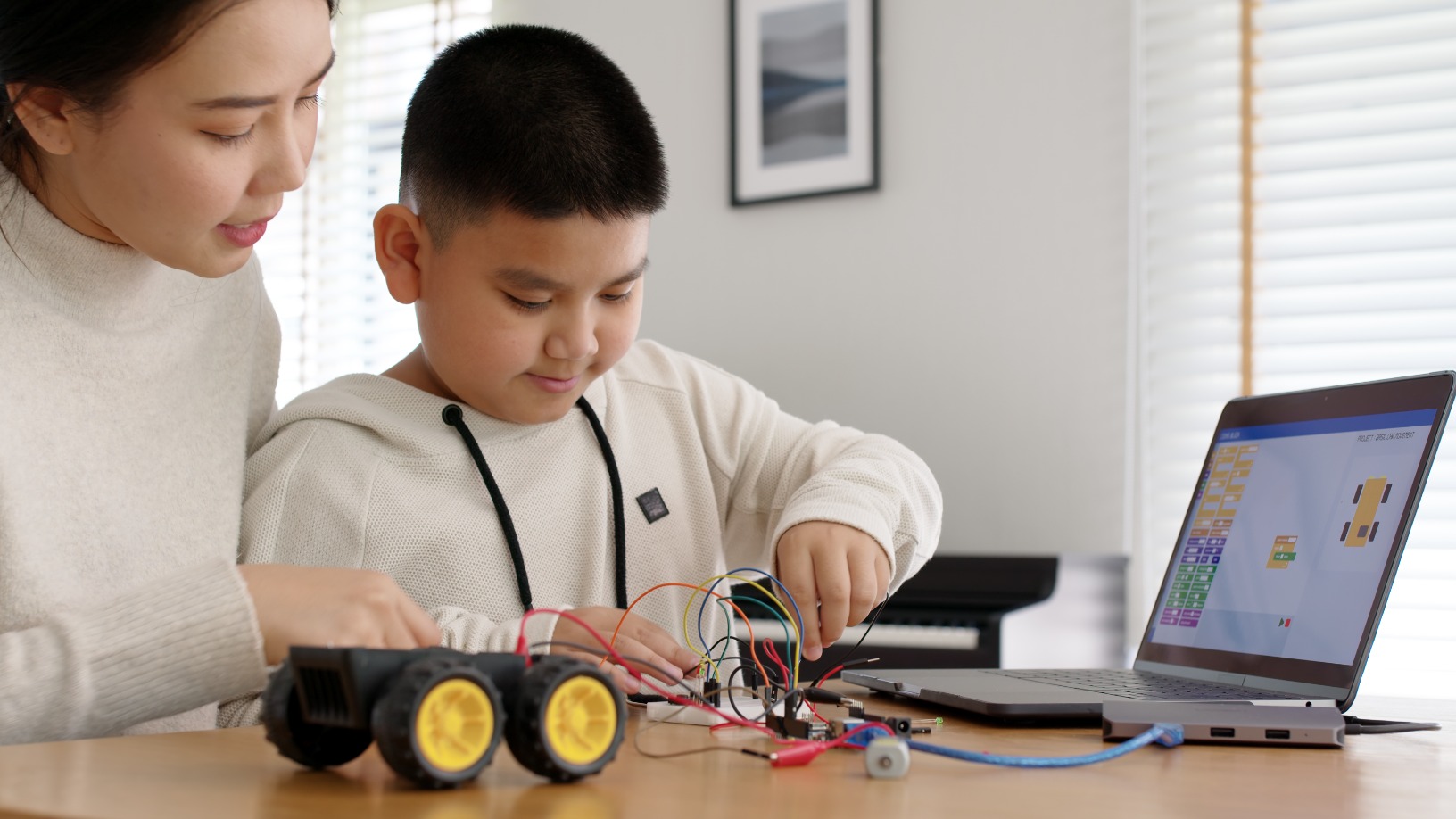

Squirrel AI: Edtech's AI-based personalized tutoring eases load for students and teachers

Used by more than 3m students, unicorn Squirrel AI tracks learning outcomes in real time and adapts teaching, proving more effective than traditional methods

Luo Yonghao: Maverick founder who gave Smartisan its allure, but couldn't build a winner

The Smartisan founder and internet celebrity is making a comeback with live commerce, after failing to sell enough smartphones at his own company

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Raw Data: Bringing new predictability to harvests

Spanish ML, big data startup helps farmers perfect wine and fruit production in a fast-growing precision agtech sector

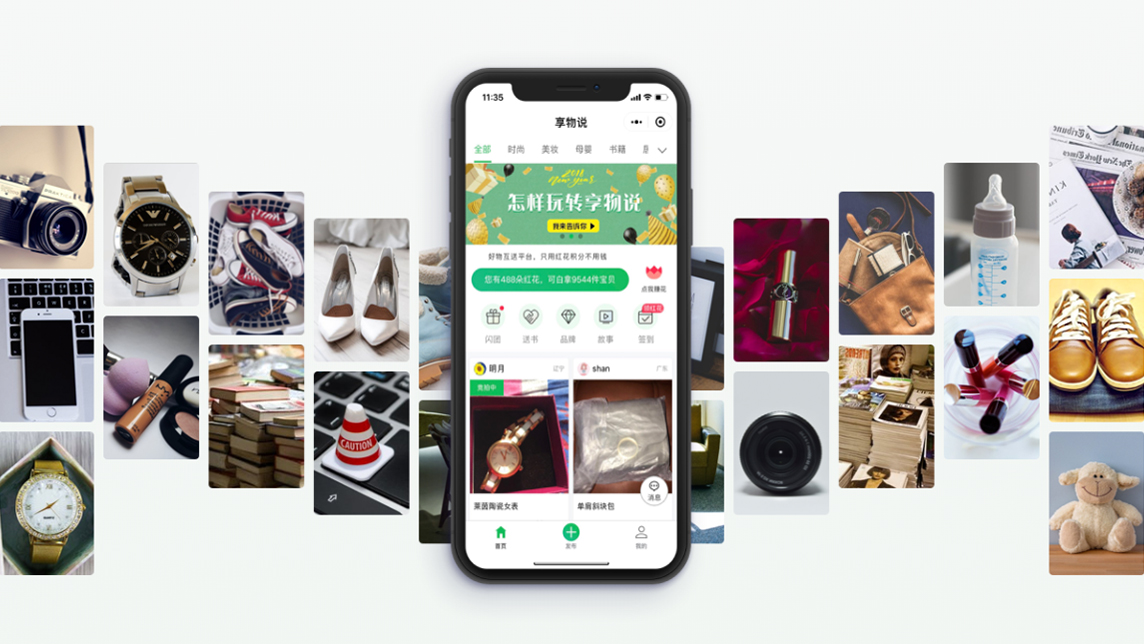

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Canika: A new app offering more budget-friendly weddings

Canika woos young couples with more flexible prices and options in Indonesia's $7bn wedding planning market

Sorry, we couldn’t find any matches for“New Oriental”.