New Zealand

-

DATABASE (383)

-

ARTICLES (695)

Co-founder of Ecertic

Leopoldo Chamarro Puga has spent most of his career in management, marketing and communications. He is the co-founder, and for the past 11 years, managing director of Promoland Media, a Madrid-based marketing and communications agency. Puga was previously an aircraft avionics technician before completing a marketing degree at the CENP (Spanish Center for New Professions). He was Spanair's marketing director for eight years before founding Promoland Media. Puga also sits on the board of startups Waynabox and Ecertic, a digital identity company of which he is a co-founder.

Leopoldo Chamarro Puga has spent most of his career in management, marketing and communications. He is the co-founder, and for the past 11 years, managing director of Promoland Media, a Madrid-based marketing and communications agency. Puga was previously an aircraft avionics technician before completing a marketing degree at the CENP (Spanish Center for New Professions). He was Spanair's marketing director for eight years before founding Promoland Media. Puga also sits on the board of startups Waynabox and Ecertic, a digital identity company of which he is a co-founder.

COO and co-founder of Capaball

Jose Luis Vega de Seoane graduated in 2012 as a software engineer from the Complutense University of Madrid. He has also completed a global management program at IESE Business School.In 2013, he co-founded video games developer Upplication as CEO. The mobile app maker was sold in 2017 to Mobusi, a leading digital marketing company. He left Upplication in 2018 and became a digital strategy advisor at the Spanish Institute for Foreign Trade (ICEX).In 2018, he co-founded Capaball as COO. He is also a mentor at Conector Startup accelerator and a board member of IBECOSOL. In 2020, the serial entrepreneur has founded two new startups: Heris, a platform to cure patients affected by aphasia and a digital marketing agency Trevol.

Jose Luis Vega de Seoane graduated in 2012 as a software engineer from the Complutense University of Madrid. He has also completed a global management program at IESE Business School.In 2013, he co-founded video games developer Upplication as CEO. The mobile app maker was sold in 2017 to Mobusi, a leading digital marketing company. He left Upplication in 2018 and became a digital strategy advisor at the Spanish Institute for Foreign Trade (ICEX).In 2018, he co-founded Capaball as COO. He is also a mentor at Conector Startup accelerator and a board member of IBECOSOL. In 2020, the serial entrepreneur has founded two new startups: Heris, a platform to cure patients affected by aphasia and a digital marketing agency Trevol.

With partnerships already secured with Google, Microsoft and Amazon, Acuilae is poised to introduce ethical decision-making in a big way to the AI community.

With partnerships already secured with Google, Microsoft and Amazon, Acuilae is poised to introduce ethical decision-making in a big way to the AI community.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Founded in 2017 by Li Li, a former partner at K2VC, Next Capital invests mainly in early-stage startups. Next Capital manages around RMB 400 million. Investments range in value from RMB 3-30 million. In just its first year, Next Capital invested in more than 10 startups. It finances mainly Chinese internet innovations, especially in Fintech and new retail.

Founded in 2017 by Li Li, a former partner at K2VC, Next Capital invests mainly in early-stage startups. Next Capital manages around RMB 400 million. Investments range in value from RMB 3-30 million. In just its first year, Next Capital invested in more than 10 startups. It finances mainly Chinese internet innovations, especially in Fintech and new retail.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in July 2013, Liangjiang Capital directly manages a total asset of around RMB 5 billion. Liangjiang Capital mainly invests in the fields including telecommunication, new media, medical instrument, bio-engineering, clean technology, information technology, robotics, and artificial intelligence. Liangjiang Capital provides invested companies with both funding support and services of financial, legal and management consulting.

Founded in July 2013, Liangjiang Capital directly manages a total asset of around RMB 5 billion. Liangjiang Capital mainly invests in the fields including telecommunication, new media, medical instrument, bio-engineering, clean technology, information technology, robotics, and artificial intelligence. Liangjiang Capital provides invested companies with both funding support and services of financial, legal and management consulting.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Possibly Europe's most famous e-commerce investor, Rocket Internet is known for replicating the business models of successes like Amazon, Alibaba and Uber in new markets. Rocket is based in Berlin and was founded in 2007 by brothers Oliver, Alexander and Marc Samwer. It went public in 2014.

Possibly Europe's most famous e-commerce investor, Rocket Internet is known for replicating the business models of successes like Amazon, Alibaba and Uber in new markets. Rocket is based in Berlin and was founded in 2007 by brothers Oliver, Alexander and Marc Samwer. It went public in 2014.

CEO and Co-founder of WOOM

Belgian-born Laurence Fontinoy graduated in Commercial Engineering at Belgium’s Louvain Catholic University in 1994 and went on an exchange program for one year at New York’s Stern Graduate Business School. She worked for almost four years at Belgacom Mobile in Belgium, where she supervised the launch of its first prepaid card. In 1999, she moved to the Netherlands to join Dutch telecoms provider Ben as a customer development manager. After completing an MBA in 2002 at IESE University of Navarra, the mother-of-three joined eBay Spain as head of category and seller development. In 2005, she was promoted to marketing and communications director but left in 2008 to join Google as the regional country marketing manager for Spain and Portugal. In 2015, she left to become the CEO and co-founder of WOOM with former eBay colleague Clelia Morales.

Belgian-born Laurence Fontinoy graduated in Commercial Engineering at Belgium’s Louvain Catholic University in 1994 and went on an exchange program for one year at New York’s Stern Graduate Business School. She worked for almost four years at Belgacom Mobile in Belgium, where she supervised the launch of its first prepaid card. In 1999, she moved to the Netherlands to join Dutch telecoms provider Ben as a customer development manager. After completing an MBA in 2002 at IESE University of Navarra, the mother-of-three joined eBay Spain as head of category and seller development. In 2005, she was promoted to marketing and communications director but left in 2008 to join Google as the regional country marketing manager for Spain and Portugal. In 2015, she left to become the CEO and co-founder of WOOM with former eBay colleague Clelia Morales.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

EDB Investments (EDBI) is an investment arm of Singapore's Economic Development Board. It has invested in emerging technologies since 1991, with particular focus on healthcare and information/communication tech. EDBI seeks companies with the potential to support Singapore's economy through existing economic pillars or the development of new industry sectors, as well as companies that can potentially go global through Singapore.

EDB Investments (EDBI) is an investment arm of Singapore's Economic Development Board. It has invested in emerging technologies since 1991, with particular focus on healthcare and information/communication tech. EDBI seeks companies with the potential to support Singapore's economy through existing economic pillars or the development of new industry sectors, as well as companies that can potentially go global through Singapore.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Tiger Brokers, a Chinese online brokerage for trading foreign stocks, announces US IPO

The Jim Rogers-backed fintech startup wants to raise US$150 million as it sees growing demand from younger Chinese investors

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Raw Data: Bringing new predictability to harvests

Spanish ML, big data startup helps farmers perfect wine and fruit production in a fast-growing precision agtech sector

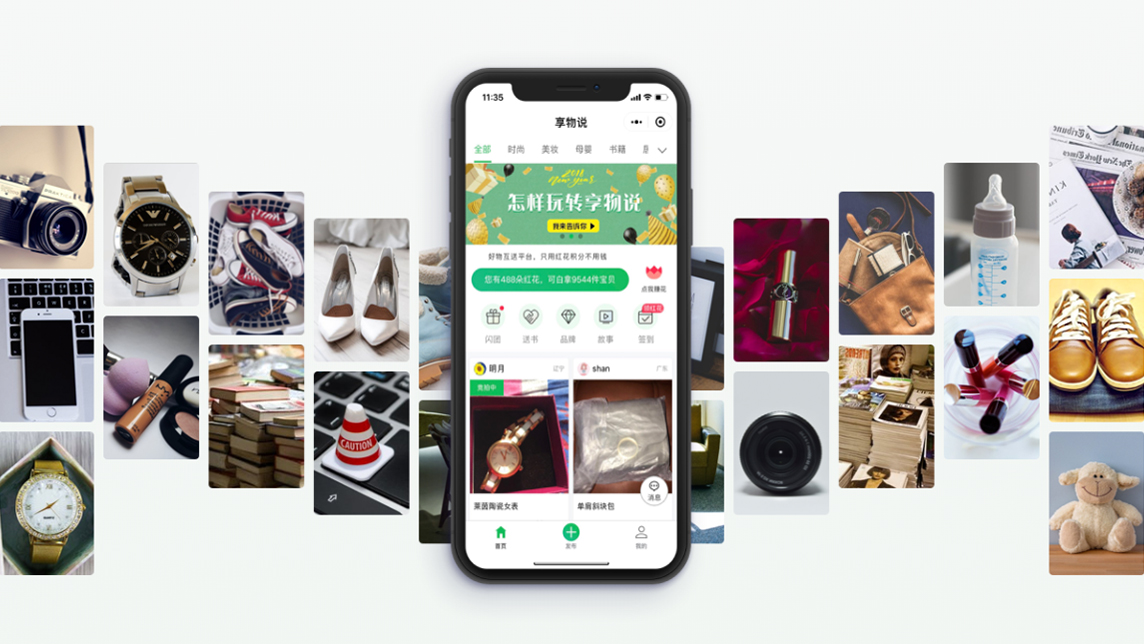

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Sorry, we couldn’t find any matches for“New Zealand”.