New Zealand

-

DATABASE (383)

-

ARTICLES (695)

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

CEO and founder of Swan Daojia (formerly 58 Daojia)

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Established in July 2009, GP Capital was co-funded by Shanghai International Group, Jiangsu Shagang Group, Huatai Securities and Hengdian Group. It specializes in establishing and managing industrial investment funds and private equity funds. GP Capital manages the RMB 20 billion Shanghai Financial Development Investment Fund. The Fund was sponsored by the Shanghai Municipal People’s Government with approval from the State Council and National Development and Reform Commission. Half of GP Capital's investment has gone to financial firms. It also invests in sectors such as consumer products, healthcare, new energy, culture, etc.

Established in July 2009, GP Capital was co-funded by Shanghai International Group, Jiangsu Shagang Group, Huatai Securities and Hengdian Group. It specializes in establishing and managing industrial investment funds and private equity funds. GP Capital manages the RMB 20 billion Shanghai Financial Development Investment Fund. The Fund was sponsored by the Shanghai Municipal People’s Government with approval from the State Council and National Development and Reform Commission. Half of GP Capital's investment has gone to financial firms. It also invests in sectors such as consumer products, healthcare, new energy, culture, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

GP Bullhound is a financial advisory and investment firm founded in 1999 with offices in London, San Francisco, Stockholm, Berlin, Manchester, Paris, Hong Kong, Madrid and New York. To date, the firm has undertaken over 530 investments worldwide, with its latest fund raising €65 million in 2018. GP Bullhound's 18 exits to date include successful companies like Spotify and Avito. It has invested in renowned companies like Slack and Wallapop. Its recent investments include a Series A round in customer service platform Nivo and a Series D round in productivity software, Partnerize.

GP Bullhound is a financial advisory and investment firm founded in 1999 with offices in London, San Francisco, Stockholm, Berlin, Manchester, Paris, Hong Kong, Madrid and New York. To date, the firm has undertaken over 530 investments worldwide, with its latest fund raising €65 million in 2018. GP Bullhound's 18 exits to date include successful companies like Spotify and Avito. It has invested in renowned companies like Slack and Wallapop. Its recent investments include a Series A round in customer service platform Nivo and a Series D round in productivity software, Partnerize.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Tiger Brokers, a Chinese online brokerage for trading foreign stocks, announces US IPO

The Jim Rogers-backed fintech startup wants to raise US$150 million as it sees growing demand from younger Chinese investors

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Raw Data: Bringing new predictability to harvests

Spanish ML, big data startup helps farmers perfect wine and fruit production in a fast-growing precision agtech sector

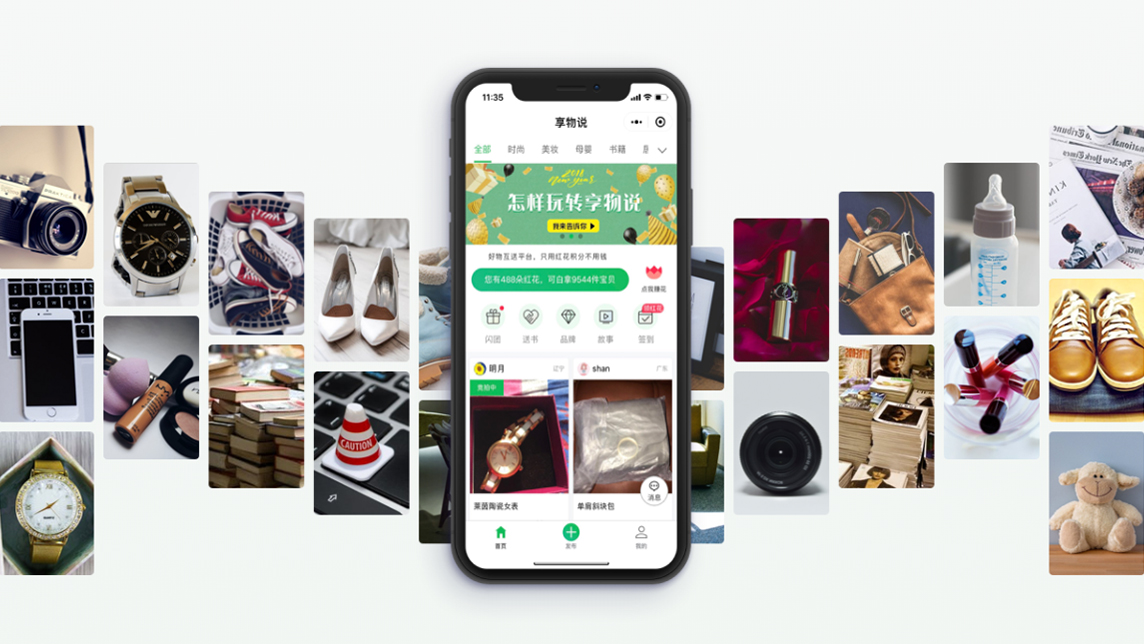

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Sorry, we couldn’t find any matches for“New Zealand”.