New Zealand

-

DATABASE (383)

-

ARTICLES (695)

Kim Jung is a South Korean businessman and the man behind Nexon, Korea's largest gaming company. He is Chairman and CEO of NXC Corporation, Nexon’s holding company. NXC diversified into cryptocurrency and holds 83% of Korbit, a Seoul-based exchange.In 2016, Kim was accused of bribery, having favoured a prosecutor who was his university friend. Although he was found not guilty due to lack of evidence, Kim resigned as a director of Nexon.Kim is also partner at Collaborative Fund, a New York-based VC firm.

Kim Jung is a South Korean businessman and the man behind Nexon, Korea's largest gaming company. He is Chairman and CEO of NXC Corporation, Nexon’s holding company. NXC diversified into cryptocurrency and holds 83% of Korbit, a Seoul-based exchange.In 2016, Kim was accused of bribery, having favoured a prosecutor who was his university friend. Although he was found not guilty due to lack of evidence, Kim resigned as a director of Nexon.Kim is also partner at Collaborative Fund, a New York-based VC firm.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

China Literature was founded in March 2015 by merging Tencent Literature and Shanda Literature. It went public on the Stock Exchange of Hong Kong in November 2017. It owns online reading brand Qidian.com and acquired film and television production company New Classic Media in August 2018. It focuses on building a premium e-reading platform at home and abroad while seeking business opportunities in the adaptation of its copyrighted literary works into film and television productions, comics and animation and video games. As at late June 2019, there are over 11.7m pieces of literary works in its online library.

China Literature was founded in March 2015 by merging Tencent Literature and Shanda Literature. It went public on the Stock Exchange of Hong Kong in November 2017. It owns online reading brand Qidian.com and acquired film and television production company New Classic Media in August 2018. It focuses on building a premium e-reading platform at home and abroad while seeking business opportunities in the adaptation of its copyrighted literary works into film and television productions, comics and animation and video games. As at late June 2019, there are over 11.7m pieces of literary works in its online library.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Ontario Teachers' Pension Plan

Founded by the Ontario government and Ontario Teachers' Federation in 1990, Ontario Teachers' Pension Plan is Canada's largest single-profession pension plan. Headquartered in Toronto, Ontario Teachers' also has investment offices in London, Singapore and Hong Kong. With C$204.7bn worth of assets under its management, Ontario Teachers' is responsible for the pensions of 329,000 working and retired teachers in Ontario. Its diverse global portfolio of assets generates a total-fund net return of 9.5% annually. A new investment department, Teachers’ Innovation Platform, was set up in 2019 to invest in late-stage ventures that deliver disruptive technologies.

Founded by the Ontario government and Ontario Teachers' Federation in 1990, Ontario Teachers' Pension Plan is Canada's largest single-profession pension plan. Headquartered in Toronto, Ontario Teachers' also has investment offices in London, Singapore and Hong Kong. With C$204.7bn worth of assets under its management, Ontario Teachers' is responsible for the pensions of 329,000 working and retired teachers in Ontario. Its diverse global portfolio of assets generates a total-fund net return of 9.5% annually. A new investment department, Teachers’ Innovation Platform, was set up in 2019 to invest in late-stage ventures that deliver disruptive technologies.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Co-founder of NPAW

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

COO and co-founder of OLIO

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Tiger Brokers, a Chinese online brokerage for trading foreign stocks, announces US IPO

The Jim Rogers-backed fintech startup wants to raise US$150 million as it sees growing demand from younger Chinese investors

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Raw Data: Bringing new predictability to harvests

Spanish ML, big data startup helps farmers perfect wine and fruit production in a fast-growing precision agtech sector

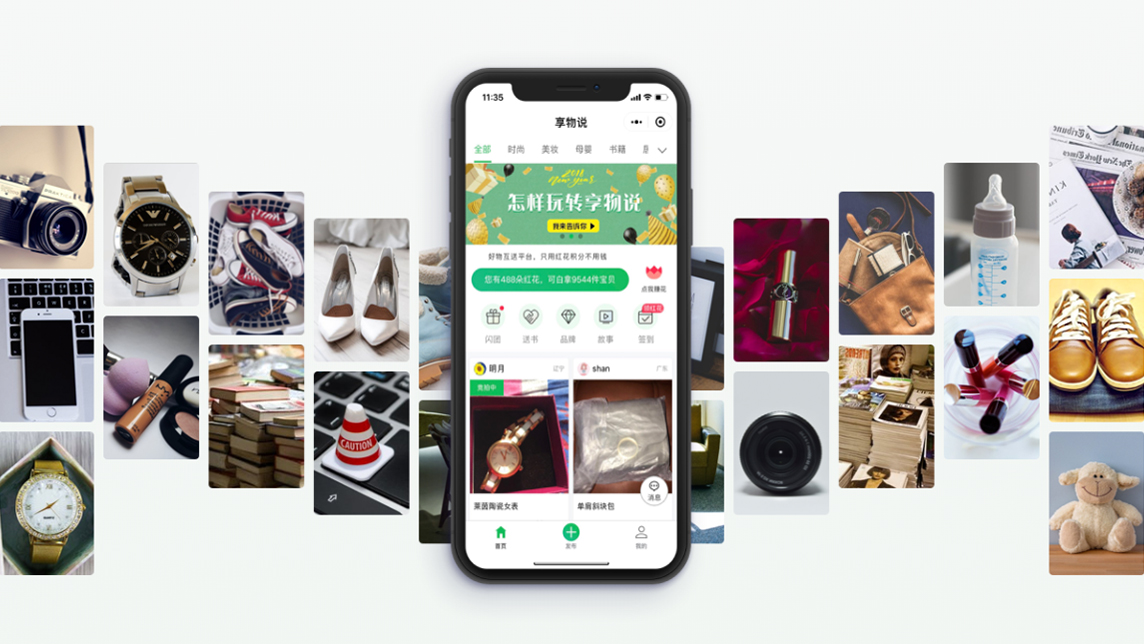

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Sorry, we couldn’t find any matches for“New Zealand”.