New Zealand

DATABASE (383)

ARTICLES (695)

Co-founder of Vence

Industrial business entrepreneur Jasper Holdsworth comes from a multi-generational family of cattle ranchers. In 2013, he became a director of his family’s 100-year-old Paringahau Farm Company in New Zealand. He also co-founded a virtual fencing startup for livestock management, Vence Corp, with US-based investment banker Frank Wooten in 2016.After graduating in forestry engineering in 1995, Holdsworth obtained a master’s in engineering management at his alma mater University of Canterbury. In 1998, he completed a master’s in applied finance at Macquarie University and started his banking career at WestLB and Deutsche Bank in Sydney.He completed an entrepreneurship development program run by MIT’s Sloan School of Management in 2010. He has also undertaken an advanced management program run by Harvard Business School in 2012.Since 2004, he has been working as the CEO of New Zealand-based Pultron Composites Ltd, an industrial technology company focused on the development and manufacture of glass fiber-reinforced polymers.In 2019, he became the chairman and co-founder of Mateenbar Ltd to produce composite reinforcement for infrastructure building materials in New Zealand, North Carolina and Saudi Arabia.

Industrial business entrepreneur Jasper Holdsworth comes from a multi-generational family of cattle ranchers. In 2013, he became a director of his family’s 100-year-old Paringahau Farm Company in New Zealand. He also co-founded a virtual fencing startup for livestock management, Vence Corp, with US-based investment banker Frank Wooten in 2016.After graduating in forestry engineering in 1995, Holdsworth obtained a master’s in engineering management at his alma mater University of Canterbury. In 1998, he completed a master’s in applied finance at Macquarie University and started his banking career at WestLB and Deutsche Bank in Sydney.He completed an entrepreneurship development program run by MIT’s Sloan School of Management in 2010. He has also undertaken an advanced management program run by Harvard Business School in 2012.Since 2004, he has been working as the CEO of New Zealand-based Pultron Composites Ltd, an industrial technology company focused on the development and manufacture of glass fiber-reinforced polymers.In 2019, he became the chairman and co-founder of Mateenbar Ltd to produce composite reinforcement for infrastructure building materials in New Zealand, North Carolina and Saudi Arabia.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Vence’s animal collars create “virtual fences” to monitor livestock movements and provide health data, saving ranchers 30% in farming costs and boosting grassland management.

Vence’s animal collars create “virtual fences” to monitor livestock movements and provide health data, saving ranchers 30% in farming costs and boosting grassland management.

Co-founder and CEO of Karta

Andrew Tanner Setiawan is the co-founder and CEO of Karta, a motorcycle-mounted billboard startup. After spending his early years in New Zealand, Andrew returned to Indonesia to finish high school before attending Pasadena Community College and Loyola Marymount University in the US, graduating with a bachelor's in Business Administration. After returning to Indonesia after graduation, he worked at several companies and opened a restaurant and bar before eventually establishing Karta in 2016.

Andrew Tanner Setiawan is the co-founder and CEO of Karta, a motorcycle-mounted billboard startup. After spending his early years in New Zealand, Andrew returned to Indonesia to finish high school before attending Pasadena Community College and Loyola Marymount University in the US, graduating with a bachelor's in Business Administration. After returning to Indonesia after graduation, he worked at several companies and opened a restaurant and bar before eventually establishing Karta in 2016.

Co-Founder and CMO of Kitabisa

Vikra Ijas studied at University of Auckland, New Zealand. He earned a Bachelor of Commerce, Marketing & International Business and a Bachelor of Commerce, International Marketing, from 2009 to 2012. He was appointed Chief Marketing Officer at Kitabisa in 2014. He had previously worked at PT Mitra Usaha Sportindo in 2013 to manage projects for Manchester United Soccer Schools in Jakarta, Indonesia. Prior to that, he worked in various sales, marketing and operational roles at Gopher for about 17 months.

Vikra Ijas studied at University of Auckland, New Zealand. He earned a Bachelor of Commerce, Marketing & International Business and a Bachelor of Commerce, International Marketing, from 2009 to 2012. He was appointed Chief Marketing Officer at Kitabisa in 2014. He had previously worked at PT Mitra Usaha Sportindo in 2013 to manage projects for Manchester United Soccer Schools in Jakarta, Indonesia. Prior to that, he worked in various sales, marketing and operational roles at Gopher for about 17 months.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

CEO and co-founder of Vence

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Co-founder of Vence

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

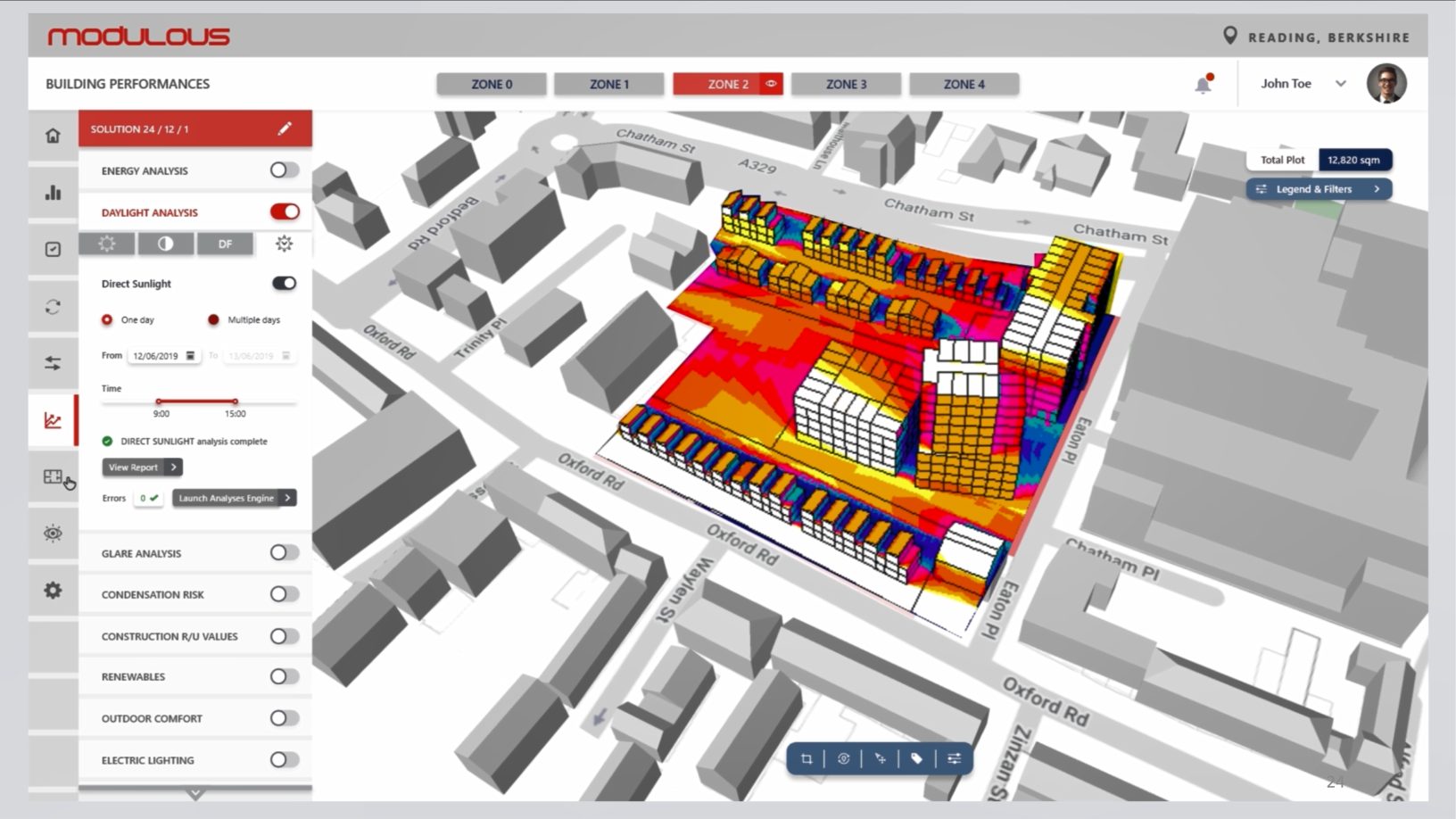

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Choose from over 10,000 mental health therapists at Yidianling

Startup's 24/7 services will include AI-powered chatbots to help more Chinese cope with mental health issues, amid lack of therapists

IONIC AI: Human-centric technology that enhances mobile phone performance

Giving new life to old mobile phones and upgrading cheaper ones, IONIC AI's tech also keeps gamers' phones cool for longer usage

Sorry, we couldn’t find any matches for“New Zealand”.