New retail

-

DATABASE (453)

-

ARTICLES (711)

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Founder and CEO of Xiangwushuo

Founder and CEO of Xiangwushuo. Sun has ten years’ experience in the retail and internet industries in China and the US. In 2011, he received his MBA from Stanford University. After graduation, Sun worked as head of retail business at Asia Miles for three years, where he was in charge of virtual currency and data management as well as new market entry and P&L. His three years of experience with point redemption finance systems helped him start Xiangwushuo.

Founder and CEO of Xiangwushuo. Sun has ten years’ experience in the retail and internet industries in China and the US. In 2011, he received his MBA from Stanford University. After graduation, Sun worked as head of retail business at Asia Miles for three years, where he was in charge of virtual currency and data management as well as new market entry and P&L. His three years of experience with point redemption finance systems helped him start Xiangwushuo.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

Founded in 2017, Momentum Capital is focused on enterprise tech as well as new retail and consumption.

Founded in 2017, Momentum Capital is focused on enterprise tech as well as new retail and consumption.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Founder and CEO of Geoblink

Ex-McKinsey consultant and Amadeus engineer Jaime Laulhé lived in New York, Paris and Hong Kong before returning to his native Madrid to work at McKinsey, where he spent two years. He holds degrees in IT Engineering from Madrid Polytechnic University and in Telecommunications Engineering from ENSIMAG in France, and an MBA from the University of Chicago and a master's in Mathematics from Institut Fourier, France.In New York and Hong Kong, he spent several years working in High Frequency Trading tech at Société Générale. He is founder and CEO of Geoblink, developing location tech AI solutions for retail, real estate and FMCG sectors.

Ex-McKinsey consultant and Amadeus engineer Jaime Laulhé lived in New York, Paris and Hong Kong before returning to his native Madrid to work at McKinsey, where he spent two years. He holds degrees in IT Engineering from Madrid Polytechnic University and in Telecommunications Engineering from ENSIMAG in France, and an MBA from the University of Chicago and a master's in Mathematics from Institut Fourier, France.In New York and Hong Kong, he spent several years working in High Frequency Trading tech at Société Générale. He is founder and CEO of Geoblink, developing location tech AI solutions for retail, real estate and FMCG sectors.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Co-founder and CEO of Kopi Kenangan

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

Exovite: Revolutionary treatment for broken bones and assisted surgery

Medtech startup Exovite combines 3D printing technology and remote treatment to improve rehabilitation of broken bones, and employs mixed reality to assist surgery

Loones' cooperative e-marketplace connects farmers directly with agrifood businesses

Loones, Spain's first cooperative-based e-marketplace for bulk produce, helps traditional agricultural producers go digital

“From a record year to a tragic year” – Investor Eneko Knorr on Spain’s 2020 startup funding

Startups should focus on profitability but for investors with leeway, there are still great opportunities, says Spanish angel investor Eneko Knorr. He shares his outlook, top picks and advice on riding out the Covid-19 crisis

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

BioMind: AI medical diagnostics with over 90% accuracy for 100 diseases

BioMind helps doctors save lives by providing more accurate diagnosis of life-threatening diseases like Covid-19 and brain tumors

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Zhang Yiming: The man who said no to Baidu, Alibaba and Tencent

Rejecting offers from BAT to grow ByteDance, Zhang Yiming has quickly built up a social media content empire that includes TikTok and Toutiao, challenging the incumbents

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Xuebacoming: Promising edtech had compliance issues from day one

Other hefty mistakes also contributed to Xuebacoming's demise – proof that investor and media support, and a booming market, won't guarantee success

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

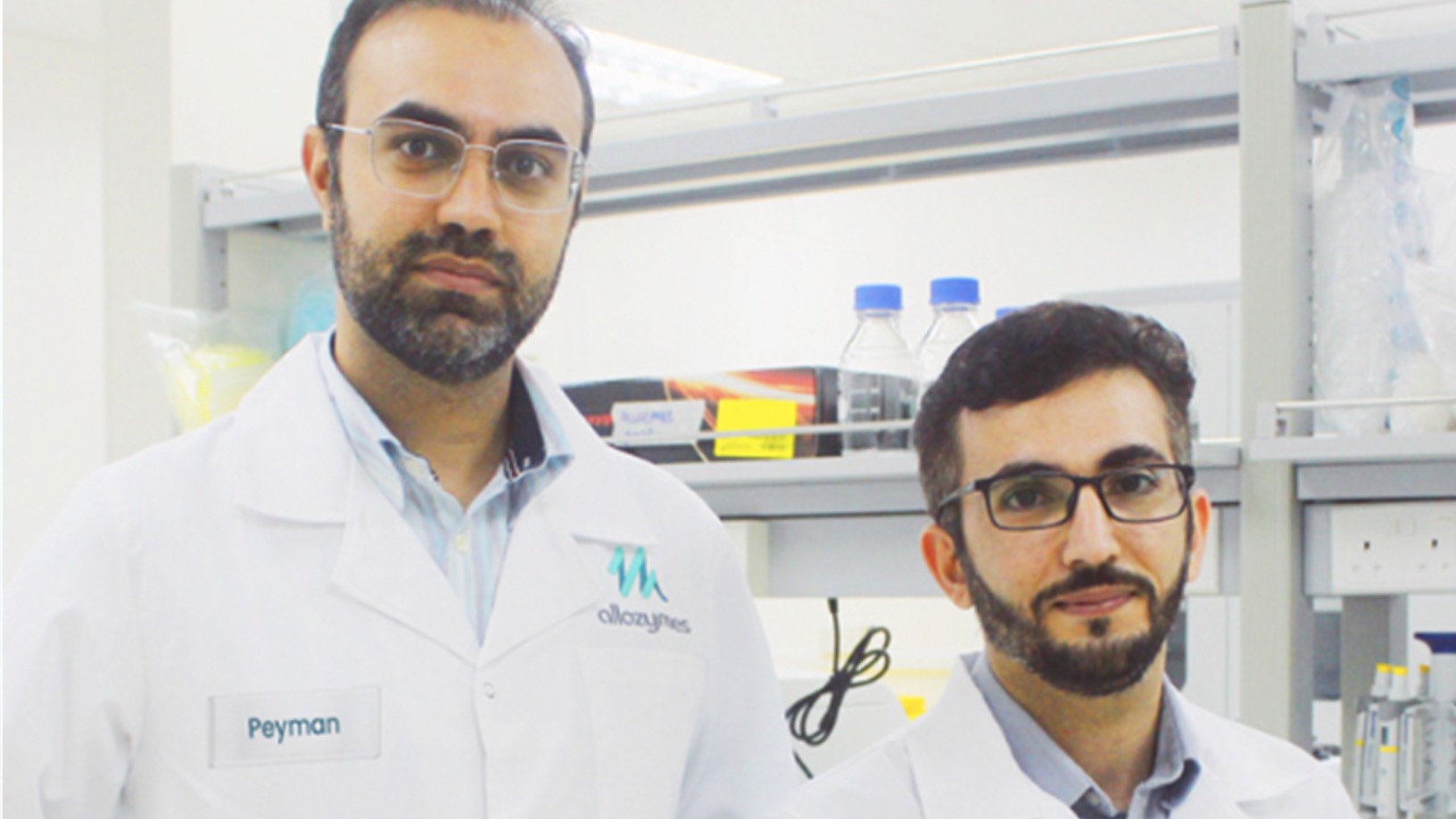

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

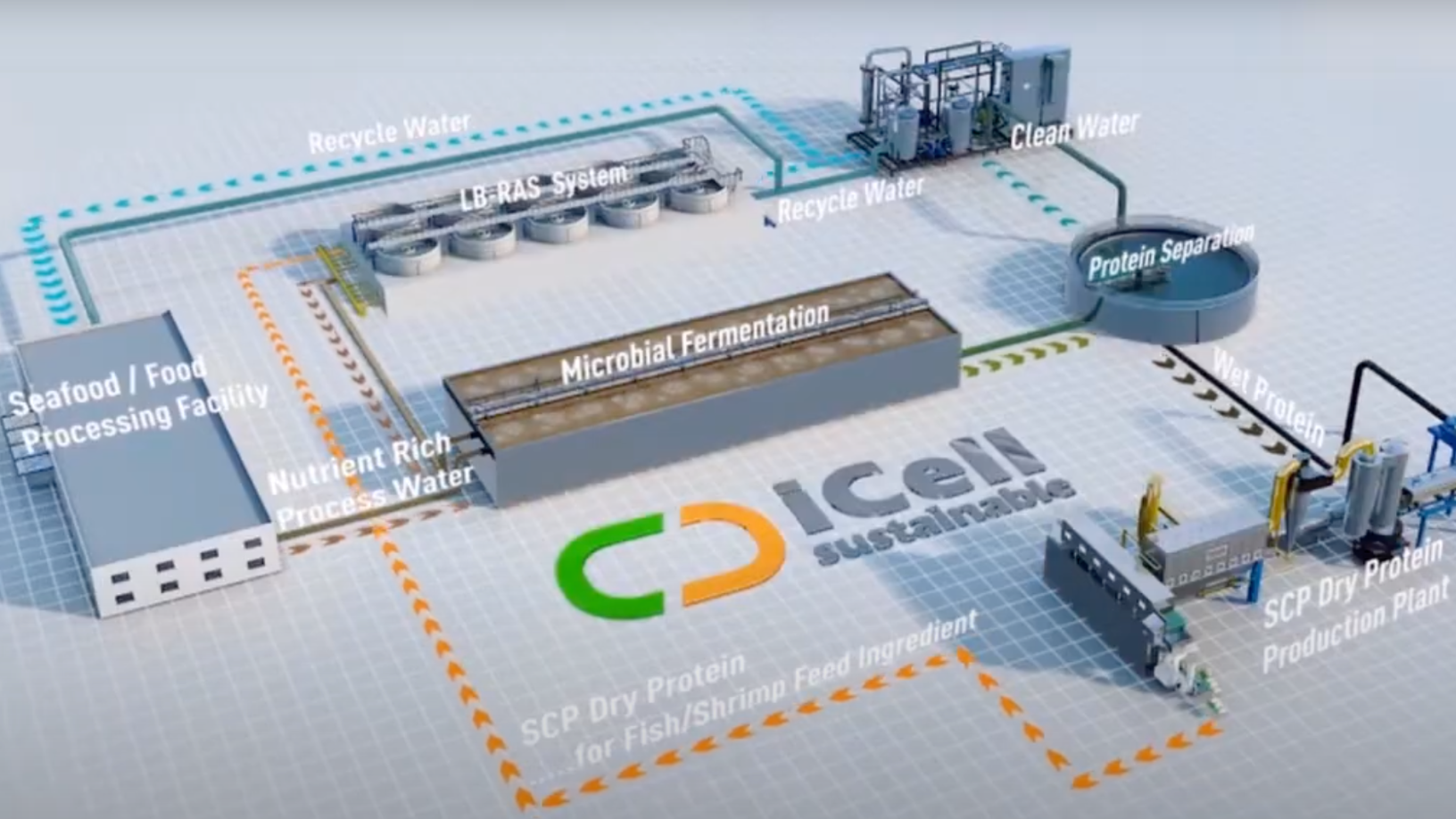

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“New retail”.